The Rise of AI in Crypto Investing

The cryptocurrency market is awash with opportunities, but also with noise. Identifying truly promising projects from the vast sea of tokens demands a robust research process. Fortunately, artificial intelligence, particularly tools like ChatGPT, is revolutionizing the way traders and investors approach market analysis. This technology can sift through mountains of data, offering insights that were previously inaccessible, or required countless hours of manual research. This guide explores how to harness the power of ChatGPT to find hidden gems in the crypto space, turning the tide from luck-based investing to data-driven strategies.

Decoding Market Sentiment with AI

One of the key advantages of using ChatGPT lies in its ability to analyze market sentiment. A coin may boast strong fundamentals, but if it lacks community interest, its potential remains unrealized. ChatGPT can synthesize information from various sources, including news headlines and social media chatter, to gauge the overall market mood. By feeding the AI information, you can then generate a summary indicating whether the sentiment is neutral, bullish or negative. This method can help you determine the market’s overall emotional state, and helps you identify early narratives before others.

Unveiling Technical and On-Chain Insights

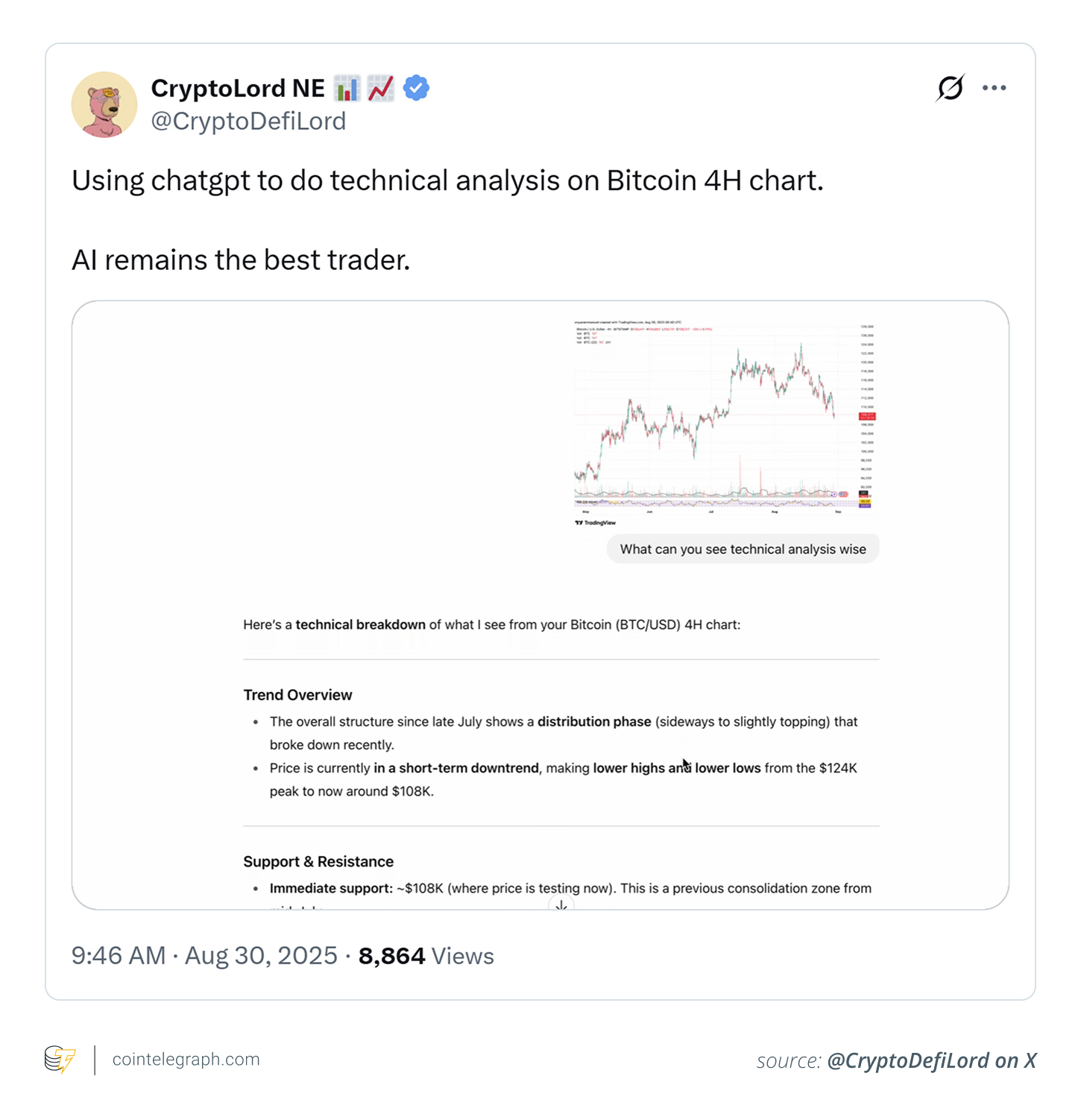

Beyond sentiment analysis, ChatGPT excels at dissecting technical and on-chain data. For technical analysis, traders can feed raw data from charting platforms, such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) values. Using this data, ChatGPT can highlight bullish or bearish signals and potential upcoming price movements. This helps to determine the optimal time to enter or exit a position.

On-chain analysis takes this a step further. By providing transaction data from block explorers, you can instruct ChatGPT to identify patterns of accumulation or distribution by ‘smart money’ – large-volume transactions from wallets with a history of successful trades. This insight can potentially reveal early signs of a price move before it’s apparent to the wider market. This process involves using a variety of sources and tools to make informed investment decisions.

Leveraging ChatGPT‘s Customization: GPTs

ChatGPT‘s true potential in crypto lies in its customizability through GPTs (Generative Pre-trained Transformers). These are tailored versions of ChatGPT designed for specific crypto use cases. One can find and leverage GPTs built for smart contract analysis, blockchain research summarization, or structured market data analysis. Using multiple GPTs in a workflow lets traders cross-reference metrics, sentiment, and contract safety for more informed decisions, further streamlining the research process.

Building Your Own AI-Driven Scanner

For those seeking a more automated approach, building a data-driven scanner is within reach. This involves creating embeddings from project white papers, social media posts, and GitHub commits. Combining those vectors helps surface outliers worth further investigation. Layering in tokenomics risk scores, liquidity metrics, and anomaly detection can flag unusual activity in real-time. A data-driven approach to finding value in the crypto market, when used correctly, can deliver powerful results.

By integrating AI into your crypto analysis workflow, you can significantly enhance your ability to identify promising projects, reduce the time spent on research, and potentially improve your investment outcomes. Remember, AI tools are designed to augment your own knowledge, not replace it. Thorough research and risk management remain essential for success in the dynamic world of cryptocurrency.