XRP Futures Open Interest Spikes: Bullish or Bearish?

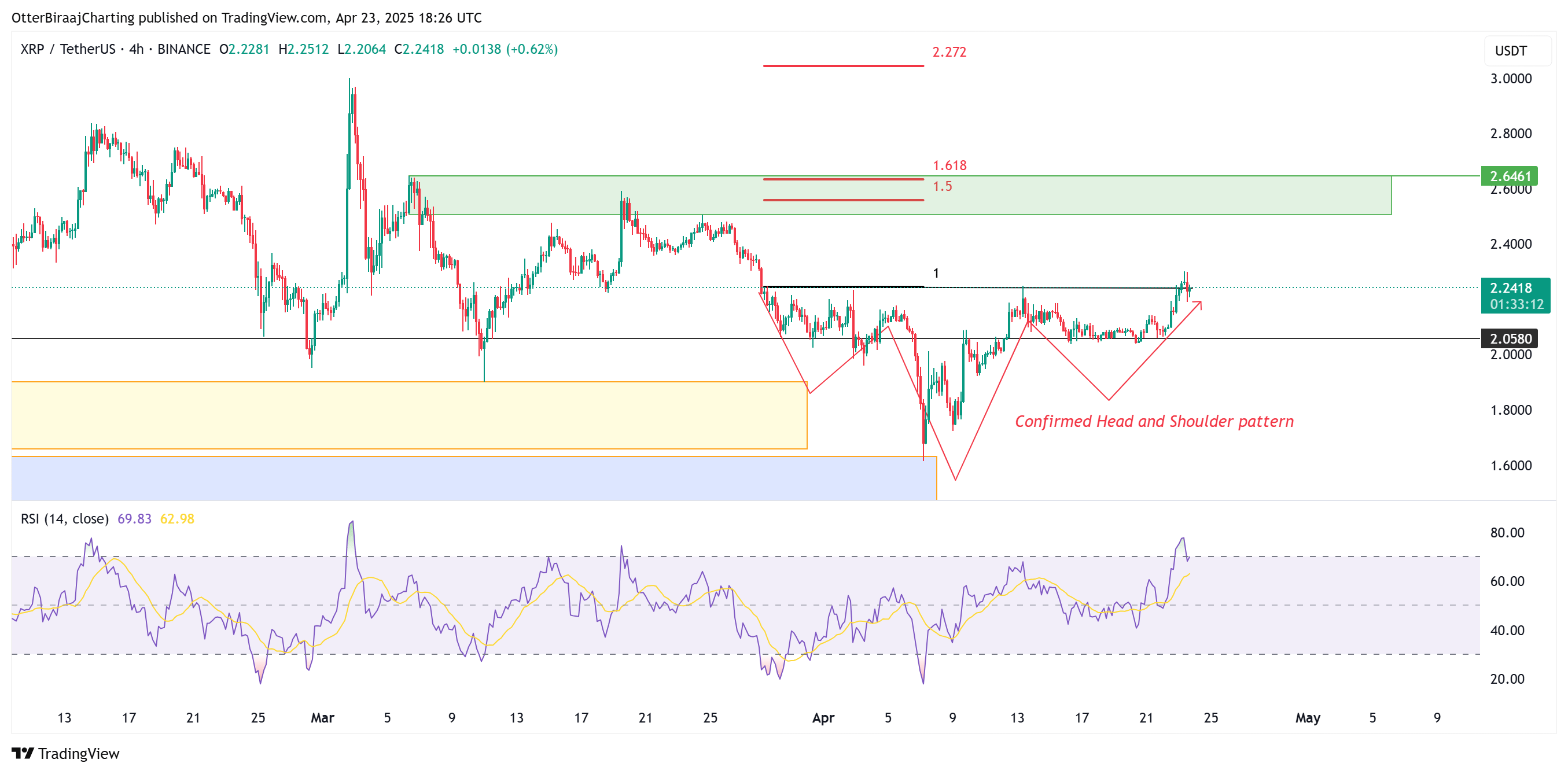

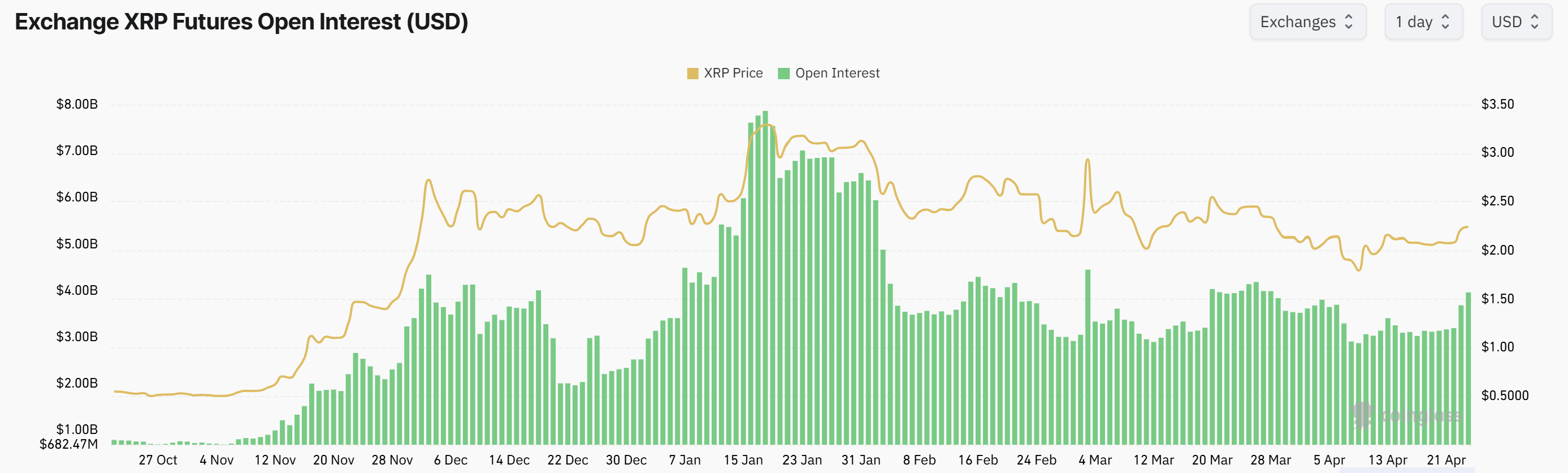

The cryptocurrency market has been on a roller coaster ride in recent weeks, with XRP (XRP) being no exception. After plunging to a year-to-date low of $1.61 on April 7, XRP experienced a remarkable 25% rebound over the past two weeks, mirroring a broader market recovery. However, the rise in price has been accompanied by a significant increase in futures open interest, leading to questions about the true sentiment of traders.

Open interest represents the total number of outstanding contracts in the futures market. A surge in open interest typically signals increased trader activity and can be seen as a bullish indicator. In the case of XRP, open interest jumped by 32% from $3.14 billion to $4.13 billion between April 21 and 23, indicating a resurgence of derivatives trading.

A Tale of Two Markets: Spot vs. Futures

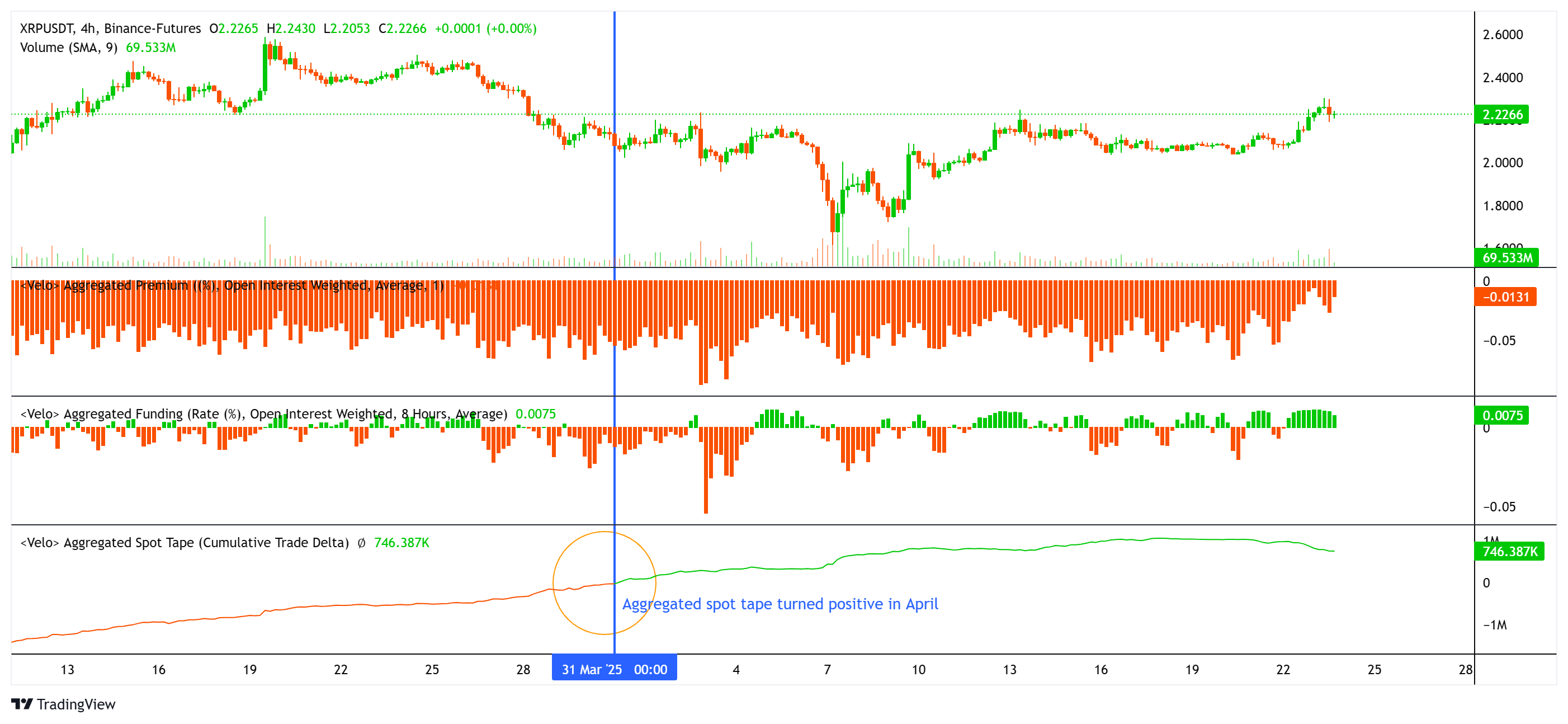

While the increase in futures open interest could suggest a bullish sentiment, other indicators paint a different picture. The funding rate, a measure of the cost of holding a futures contract, remained near 0, implying a neutral stance between bulls and bears. This suggests that despite the rising interest in XRP futures, there is still uncertainty among traders about the future direction of the price.

Adding to the complexity is the behavior of the spot market, where XRP has seen a significant influx of buying pressure. The aggregated spot tape cumulative volume delta, an indicator measuring the net difference between aggressive buy and sell trades, turned positive in April, indicating an increase in buying pressure. This suggests a bullish sentiment among spot traders, but the neutral futures funding rate raises questions about the sustainability of this bullish momentum.

Double-Digit Price Targets, But Market Cap Concerns

Despite the market uncertainties, some analysts remain optimistic about XRP‘s future. Sistine Research, a crypto investment community, has predicted a long-term target of $33 to $50 for XRP, based on a higher time frame (HTF) symmetrical triangle pattern. This prediction, if realized, could drive XRP‘s market cap to over $2 trillion, surpassing Bitcoin’s current market capitalization.

While such optimistic predictions are intriguing, they also raise concerns about the market’s ability to absorb such a substantial price increase. The current market cap of XRP is around $131 billion, and a 1,400% jump to $2 trillion would be a significant shift, potentially leading to volatility and market adjustments.

Cautious Optimism and Navigating the Uncertainties

The current situation surrounding XRP presents a mixed bag for traders. While the bullish spot market activity is encouraging, the neutral funding rate and the potential market capitalization challenges highlight the uncertainties surrounding the future of XRP. As with all investments, it’s crucial to conduct thorough research, manage risk, and exercise caution before making any trading decisions.