The 2025 Ether Whale Report: Who Controls the ETH?

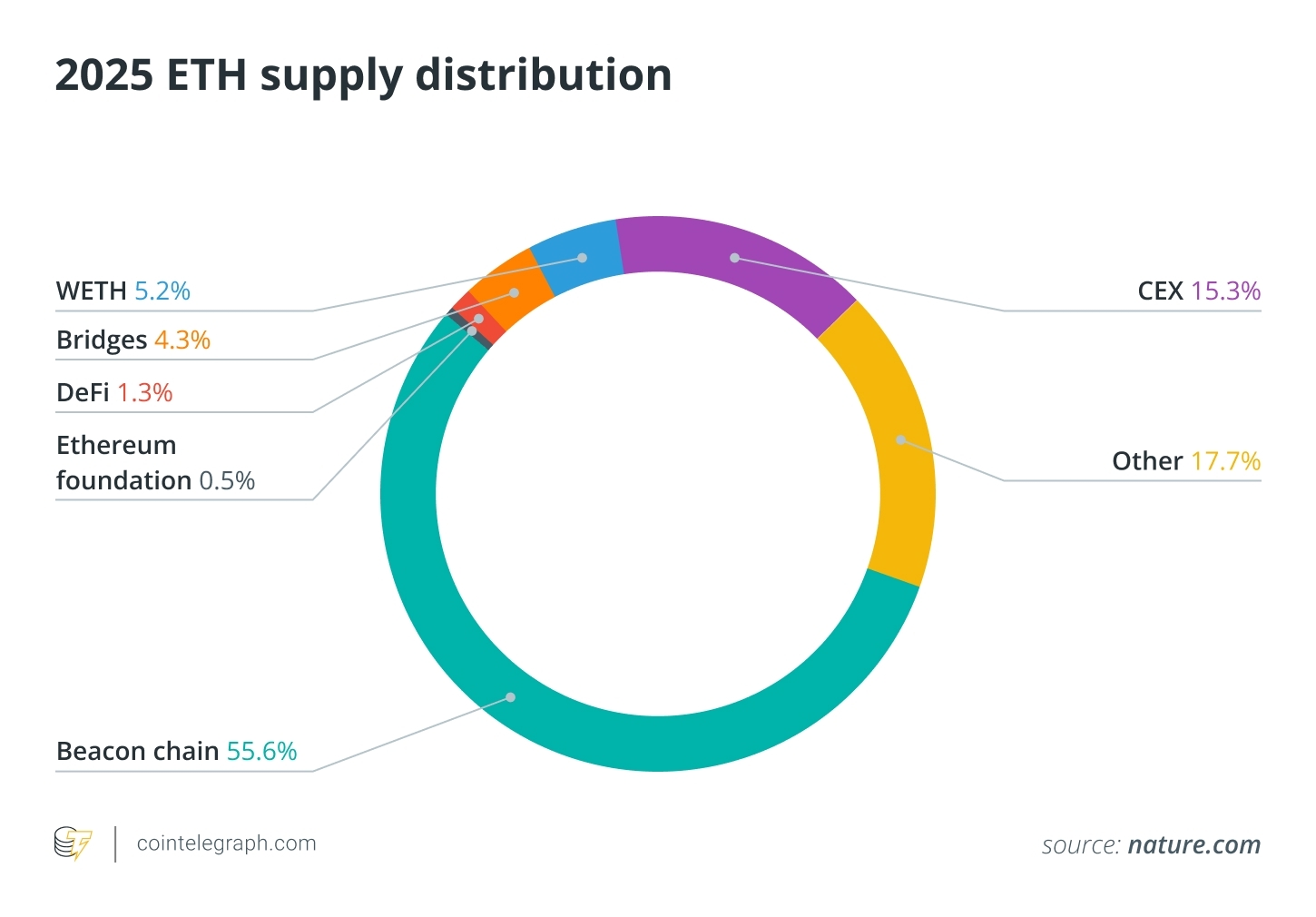

The Ethereum network, by mid-2025, has matured into a bustling ecosystem. With over 120 million ETH in circulation, a pressing question surfaces: who truly controls the asset? This isn’t just about individual wealth anymore; it’s about institutional adoption, staking protocols, and the very infrastructure that powers DeFi and Web3.

The Beacon Contract: The Biggest Whale

The data paints a clear picture: a significant portion of ETH isn’t held by individuals, but by the network itself. The Beacon Deposit Contract, essential for Ethereum’s proof-of-stake mechanism, holds approximately 56% of the total circulating supply. This isn’t a single entity but the collective participation of validators. While some critics raise concerns about centralization risks, this contract remains pivotal to the network’s security and stability.

Exchanges and Institutional Adoption: A New Guard

Major exchanges, like Coinbase and Binance, hold considerable ETH reserves, used to facilitate trading and power staking derivatives. Their active role contrasts with inactive Bitcoin whales, highlighting ETH‘s utility. Simultaneously, institutional adoption has reshaped the landscape. BlackRock’s iShares Ethereum Trust (ETHA), for example, has amassed millions of ETH, becoming a prominent player. Fidelity and Bitwise are also growing their holdings, demonstrating the increasing integration of ETH into traditional financial systems.

Corporate Treasuries Enter the Fray

Following in Bitcoin’s footsteps, some publicly listed companies have strategically added ETH to their balance sheets. Companies like Bitmine Immersion Technologies and SharpLink Gaming have acquired substantial ETH holdings, showcasing their belief in Ethereum‘s long-term potential. They are actively staking their ETH, generating yield, and treating it as a treasury asset. This trend underscores ETH’s evolution from a speculative asset to a strategic component of corporate financial planning.

Notable Individuals: The Ethereum Pioneers

Despite the dominance of smart contracts and institutions, some key individuals still hold significant ETH. Vitalik Buterin, Ethereum’s co-founder, retains a substantial portion of ETH, as does Joseph Lubin, another co-founder. While their precise holdings are estimates, they are still a reflection of the early days and continued influence of the network’s founders. These individuals represent the enduring spirit of Ethereum’s inception and vision.

Tracking the Ether Rich List: Tools and Insights

Understanding ETH ownership relies on on-chain analytics platforms like Nansen, Dune Analytics, and Etherscan. These tools analyze wallet behavior, categorize holdings, and provide valuable insights into the distribution of ETH. However, these tools have limitations. While offering a window into the digital asset landscape, it’s essential to understand that the true picture is multifaceted. There are challenges, from identifying the entities behind specific wallets, to accounting for complex and emerging privacy techniques. The pursuit of clarity continues, driven by a community passionate about transparency and the evolution of the Ethereum network.

- Note: This analysis is based on publicly available on-chain data and does not constitute financial advice.