Babylon Labs Unveils Bitcoin-Backed Lending on Ethereum

The burgeoning world of decentralized finance (DeFi) is constantly seeking ways to incorporate Bitcoin, the original and largest cryptocurrency, into its ecosystem. Babylon Labs, a Bitcoin infrastructure company, recently announced a significant step in this direction, claiming to have developed a system allowing native Bitcoin (BTC) to be used as trustless collateral for borrowing on the Ethereum blockchain. This represents a potential breakthrough, offering a novel approach to leverage the value of Bitcoin within the DeFi space, but with important caveats.

How It Works: The Trustless Vault System

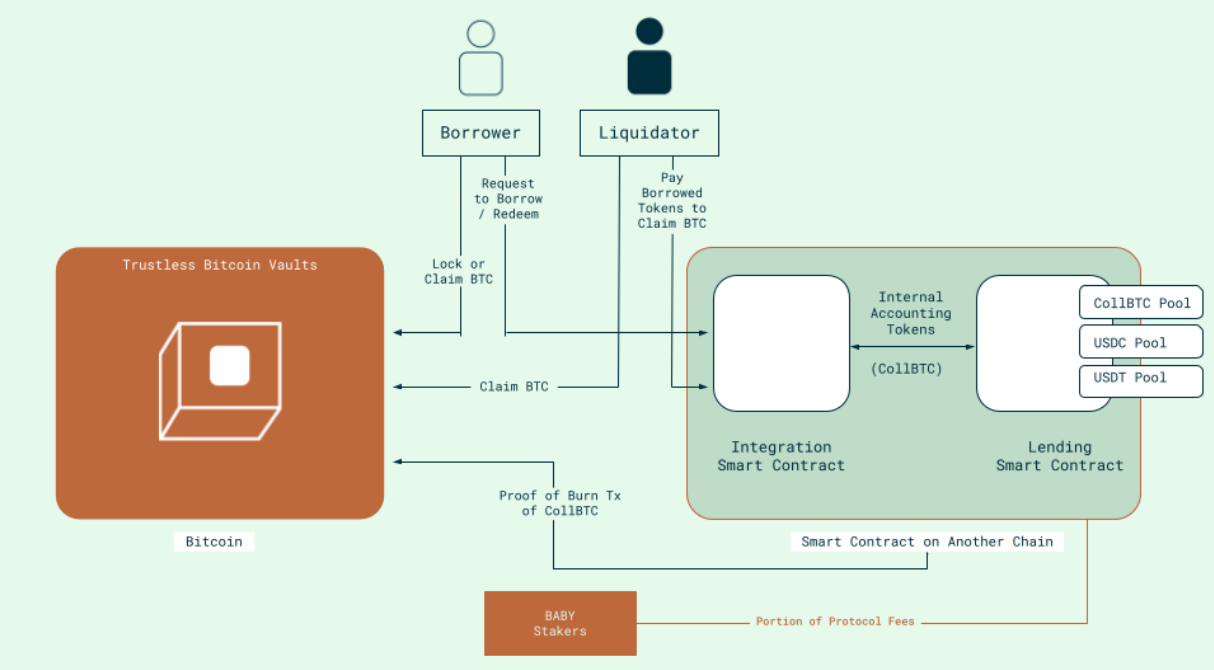

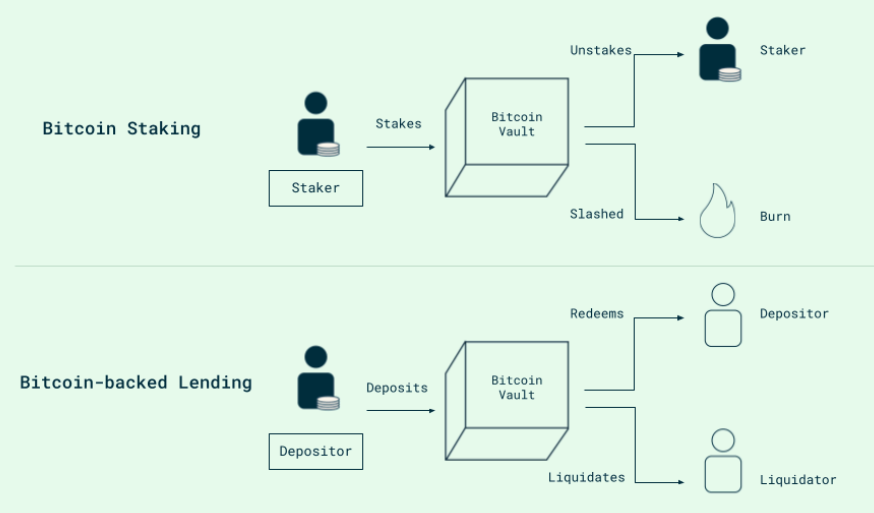

The core innovation, as outlined by Babylon Labs, lies in its Bitcoin trustless vault system. This system utilizes BitVM3, a Bitcoin smart contract verification system, to lock BTC within per-user vaults. The withdrawals, whether for redemption or liquidation, are governed by cryptographic proofs that verify the state of external smart contracts on Bitcoin. This clever mechanism enables users to lock their Bitcoin and move it to Ethereum without the need for a centralized custodian or bridge, eliminating a significant point of vulnerability and trust that plagues other wrapped Bitcoin solutions.

On the Ethereum side, a smart contract verifies the Bitcoin vault via a Bitcoin light client before accounting for the collateral. The resulting token, VaultBTC, is already accessible on the on-chain lending protocol Morpho, although it’s currently in an experimental phase. This token acts as an intermediary, facilitating interaction between the vault, Morpho, and users who deposit or liquidate assets.

The “Trustless” Aspect: Examining the Fine Print

While the system offers a largely trustless mechanism for locking and transferring Bitcoin, some non-trustless elements remain. Specifically, the white paper acknowledges that Babylon’s Bitcoin vault liquidations currently rely on whitelisted liquidators to monitor the price and the vault‘s state. This introduces a trust assumption, as the system depends on the proper behavior of these liquidators. Even with safeguards like co-signing designed to mitigate censorship, the model assumes a sufficient number of liquidators will act honestly. Furthermore, liquidations are dependent on price oracles, introducing risks related to oracle accuracy, timeliness, and censorship resistance.

“Trustless vaults eliminate all such trust assumptions. Bob and Larry jointly pre-sign a set of Bitcoin transactions defining conditional spending rights,” the white paper states.

Implications and Future Outlook

The potential implications of this development are significant. By enabling native Bitcoin to be used as collateral, Babylon Labs could unlock new avenues for Bitcoin holders to participate in DeFi activities, such as borrowing stablecoins and generating yield. The ability to do so without relying on custodians or centralized bridges reduces counterparty risk and enhances the overall security of the system. However, the system’s reliance on whitelisted liquidators and oracles warrants careful consideration. As the project evolves, the team must address these trust assumptions to realize the full potential of a truly trustless Bitcoin-based DeFi system.

The integration with Morpho and the launch of VaultBTC represents a crucial test for the technology, and its performance will be closely watched by the crypto community. While the current market liquidity is modest, successful implementation could pave the way for wider adoption and deeper integration of Bitcoin within the broader DeFi ecosystem.