Maple Finance’s Strategic Move to Base

Onchain asset manager Maple Finance is making a significant move, deploying its yield-bearing stablecoin, syrupUSDC, onto Coinbase‘s Base network. This strategic decision aims to inject institutional-grade credit rails into the rapidly evolving Ethereum layer-2 ecosystem. The integration promises to provide Maple with enhanced access to Coinbase‘s extensive user base and product offerings, whilst also broadening the reach of institutional-grade yield to a wider spectrum of onchain participants, diverging from the confines of the Ethereum mainnet. This maneuver could signal a pivotal shift in how institutional capital interacts with DeFi, driving forward its maturation.

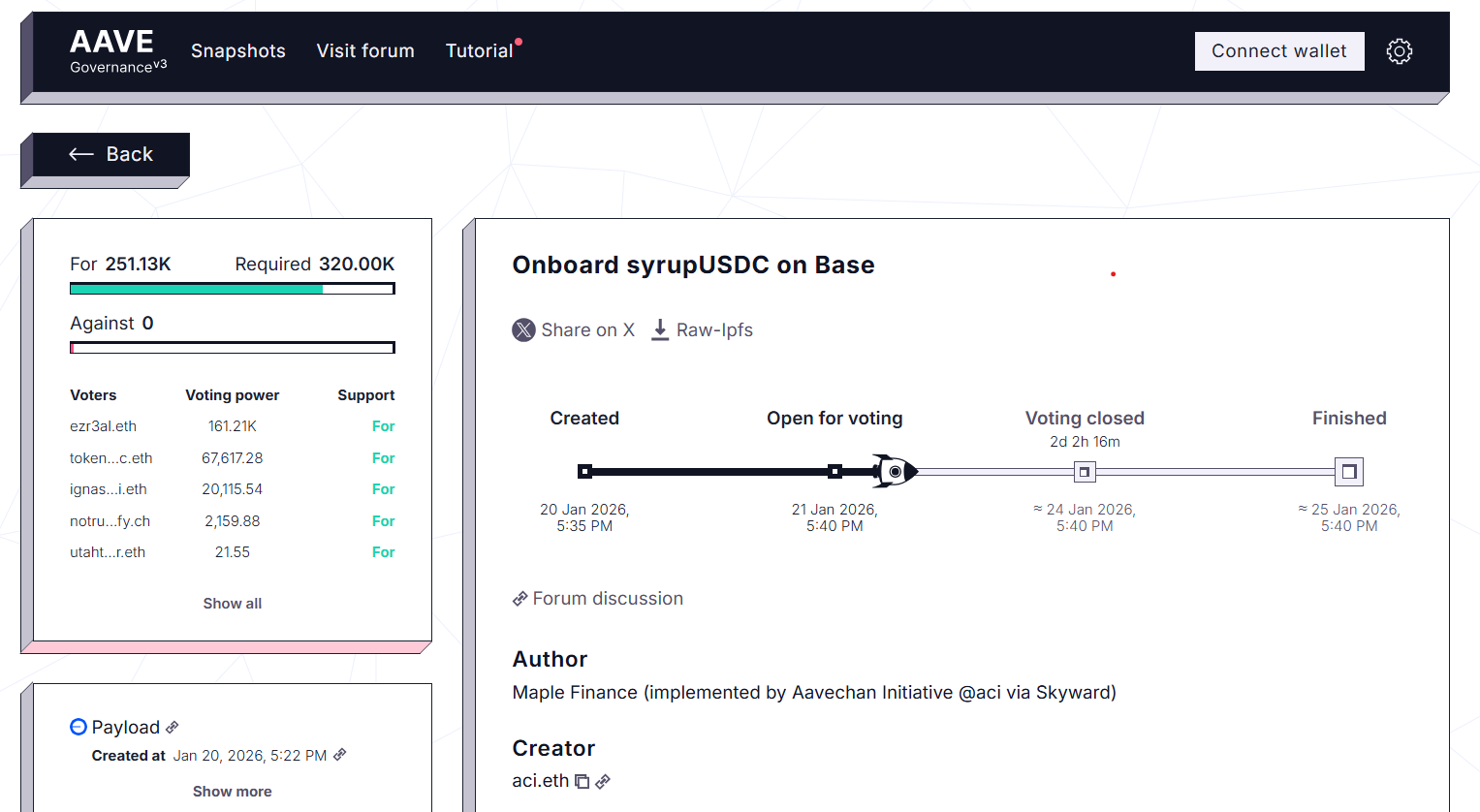

Aave V3 Listing: Amplifying Accessibility

Simultaneously, Maple is actively pursuing a listing of syrupUSDC as collateral on Aave V3’s Base instance. This is contingent on a successful governance proposal. If approved, the listing would amplify the utility of syrupUSDC within the Base ecosystem, opening it up to lending and borrowing activities, thereby augmenting its composability within the DeFi landscape. Maple is leveraging Chainlink’s infrastructure to ensure seamless interoperability between Ethereum and Base, crucial for syrupUSDC to function effectively as collateral in a variety of DeFi strategies such as lending and leveraged trading.

Overcollateralization and Institutional Guardrails

Sid Powell, Maple‘s CEO and co-founder, highlighted the emphasis on overcollateralized loans backing syrupUSDC. This approach provides robust downside protection and underscores the commitment to sustainable yields as the stablecoin scales within the Base ecosystem. The platform enforces stringent guardrails to manage leverage, incorporating real-time collateral monitoring, defined margin calls, and liquidation thresholds to mitigate risks. This framework, coupled with Aave‘s loan-to-value limitations, further reinforces Maple‘s commitment to offering an institutional-grade product. These measures are designed to instill confidence in institutional lenders, paving the way for wider adoption.

Base Network: A Catalyst for DeFi Innovation

Powell characterizes Base as a “key next step” for Maple, emphasizing its distribution power and accelerated DeFi growth. The Base network is viewed as an ideal environment for syrupUSDC to thrive, where it can provide a composable yield asset benefiting both institutional and retail investors. This strategy aligns perfectly with the evolving vision of DeFi, which prioritizes scalability and trustworthy, stable yield products. The integration of Maple’s infrastructure strengthens Base‘s DeFi stack, offering crucial financial primitives to boost the onchain economy.

Implications and Future Outlook

This initiative from Maple signifies a growing trend: the convergence of institutional finance and decentralized protocols. The success of syrupUSDC on Base and its potential integration with Aave V3 could serve as a blueprint for other asset managers seeking to bridge the gap between traditional finance and DeFi. The increased availability of institutional-grade yield on Base could attract significant capital inflows, fueling further innovation and expansion of the network’s DeFi ecosystem. The success of this strategy hinges on the ongoing development and adoption of Base and the ability of Maple to navigate the regulatory environment surrounding stablecoins and onchain lending. The coming months will be crucial in assessing the full impact of Maple‘s strategic moves on the Base network.