LetsBonk Takes the Lead: Shifting Sands in the Solana Memecoin Arena

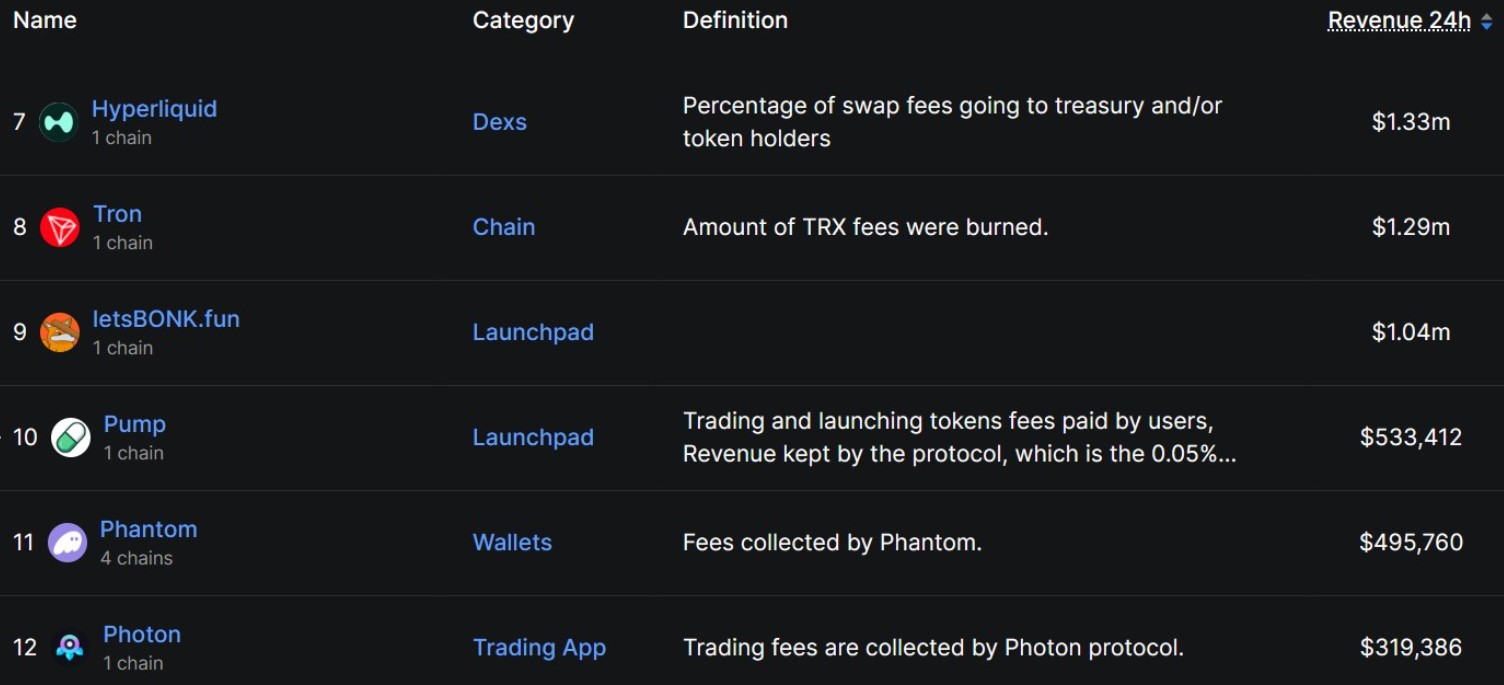

The Solana memecoin landscape has witnessed a significant shakeup. LetsBonk, a memecoin launchpad backed by the BONK community, has unexpectedly surpassed Pump.fun in daily protocol revenue, according to DefiLlama data. This represents a major shift in the dominance of the Solana ecosystem, where Pump.fun has held a firm grip on the top spot since its inception. LetsBonk‘s emergence reflects the dynamic and unpredictable nature of the memecoin market, driven by community enthusiasm and rapid adoption.

On a single day, LetsBonk generated an impressive $1.04 million in revenue, more than double Pump.fun‘s $533,412. This spike, while notable, needs to be considered within the context of the broader market trends. Though LetsBonk showed impressive daily performance, Pump.fun continues to dominate the monthly revenue charts, illustrating its established position. Furthermore, the success of LetsBonk seems to have directly impacted the price of the BONK token itself, which has seen an increase of nearly 52% since the launchpad’s release. BONK’s substantial market capitalization ($1.8 billion) and its large following on social media underscores its significance within the Solana memecoin sphere.

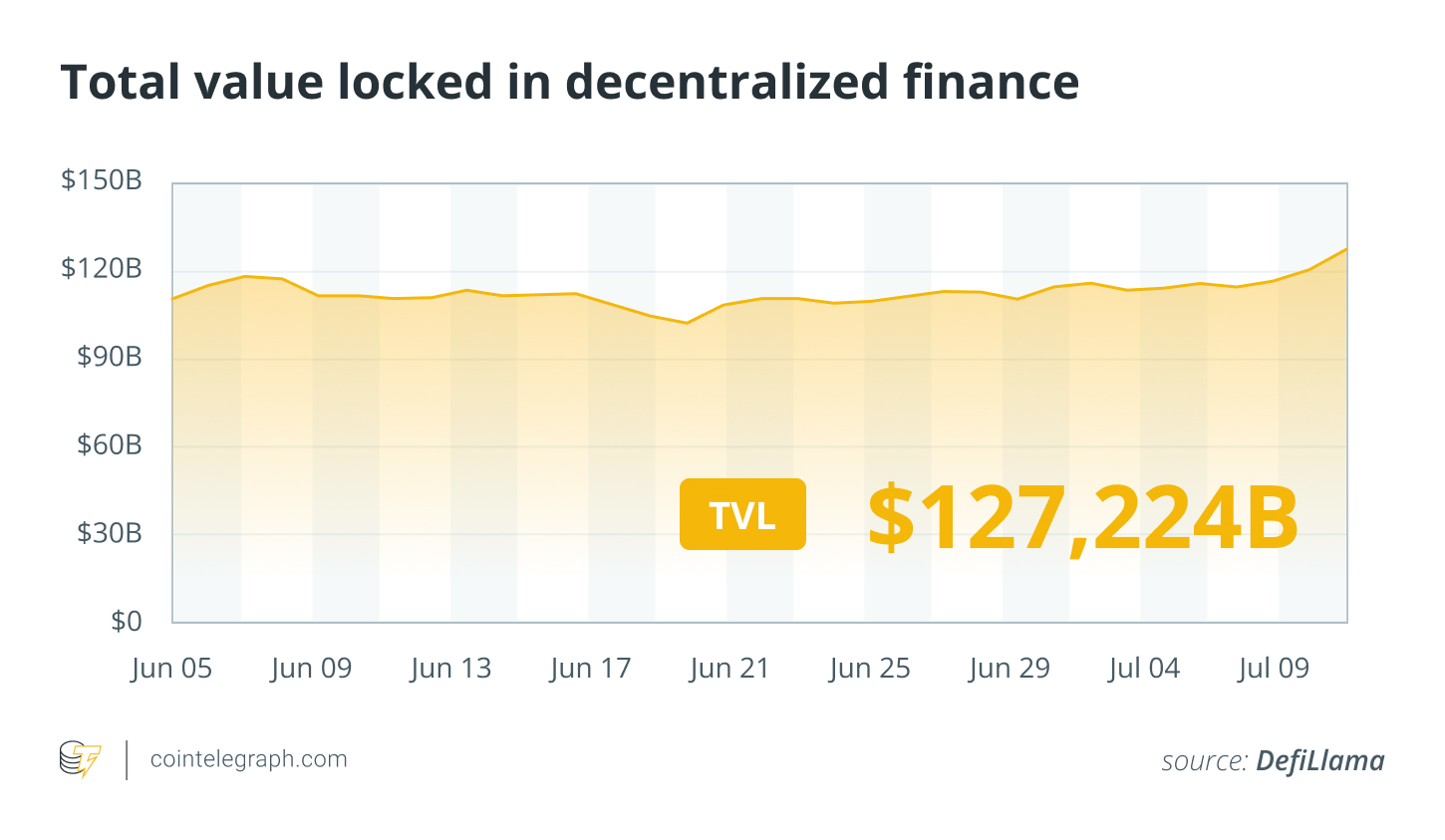

DeFi and TradFi: A Convergence on the Horizon?

Beyond the memecoin frenzy, the potential for convergence between Decentralized Finance (DeFi) and Traditional Finance (TradFi) is gaining traction. Nelli Zaltsman, a key executive at JPMorgan’s Kinexys, forecasts this integration could occur within the next few years. JPMorgan’s focus is on integrating on-chain assets with institutional-grade payments infrastructure. This could signal a massive shift in how finance functions. The focus is “asset agnostic,” meaning they want to offer multichain access to clients, which, if successful, will drastically change how TradFi services are delivered. This collaboration is being further catalyzed by the willingness of both sectors to work together.

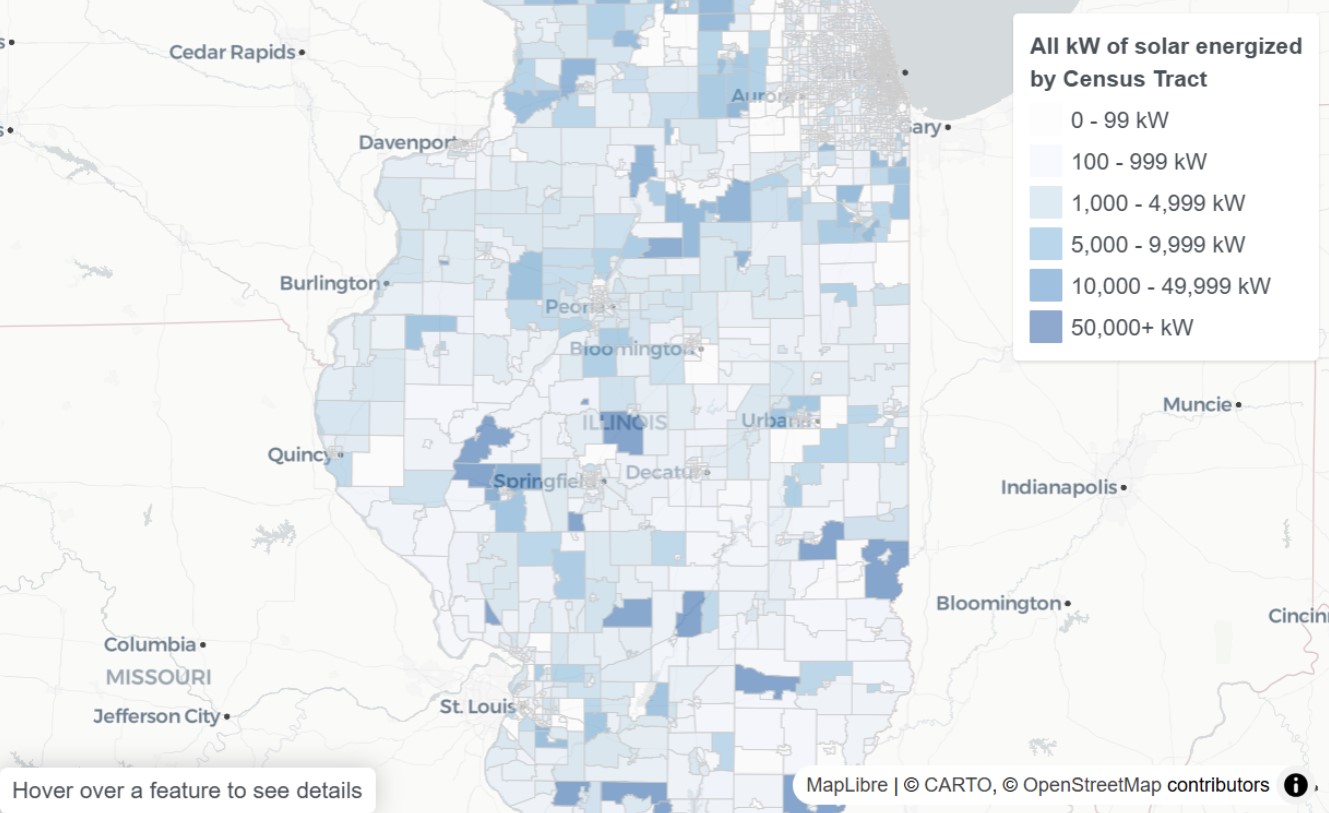

Real-World Assets and the Future of On-Chain Finance

The Real-World Asset (RWA) space is also gaining momentum. Projective Finance, an RWA financing platform, is leading the way by opening a $7 million lending pool for solar energy projects in Illinois. This platform allows DeFi investors to participate in government-backed projects with the transparency of blockchain technology. This signals the growing importance of real-world applications of blockchain and the potential for DeFi to fund sustainable projects. This marks an exciting juncture where sustainability and innovation intersect within the blockchain space.

OpenSea‘s Expansion: Beyond NFTs

The non-fungible token (NFT) platform, OpenSea, is strategically expanding its horizons. The acquisition of Rally, a mobile and token-focused company, demonstrates OpenSea‘s aspiration to go beyond the traditional NFT space and establish a comprehensive mobile trading platform for crypto. This strategic move is a sign that the platform is aiming to be an “onchain everything app” which signals the evolution of the on-chain economy. This move demonstrates a commitment to broadening its reach and catering to the evolving needs of the crypto community.

Security First: Protecting the DeFi Ecosystem

In a critical win for DeFi security, researchers thwarted a $10 million DeFi backdoor that threatened thousands of smart contracts. The exploit targeted uninitialized ERC-1967 proxy contracts, potentially allowing malicious actors to compromise the contracts. This crucial discovery and remediation underscore the importance of security in DeFi and the ongoing efforts to safeguard user funds.