Spark’s Diversification Strategy

In a significant move that underscores the evolving landscape of decentralized finance (DeFi), the lending protocol Spark has allocated a substantial $100 million of its stablecoin reserves into Superstate‘s Crypto Carry Fund (USCC). This marks a pivotal shift away from traditional US government bonds and towards crypto-native yield strategies, signifying a growing trend among DeFi protocols seeking uncorrelated returns.

The USCC’s Appeal

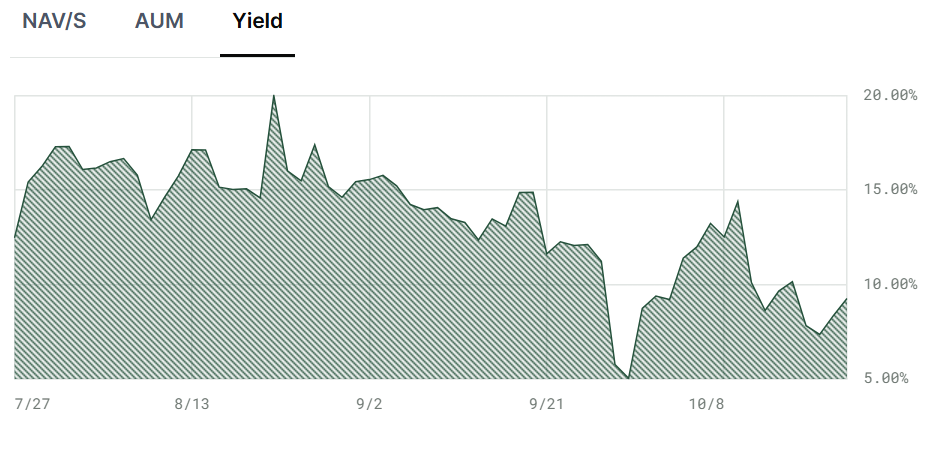

Superstate‘s USCC is a regulated basis-trading fund designed to generate yield from price differentials between spot and futures markets across major digital assets. This market-neutral approach offers DeFi protocols an avenue to earn yield, independent of the broader interest rate environment and Federal Reserve policies. The fund currently boasts a 30-day yield of 9.26%, attracting protocols like Spark that aim for robust returns in a potentially volatile market.

Why the Shift?

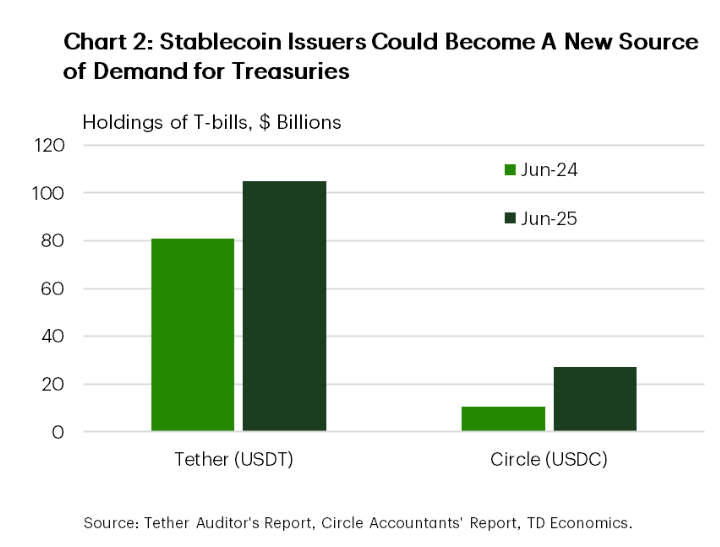

The decision by Spark to diversify its holdings stems from a confluence of factors. The compression of US Treasury yields, coupled with the anticipation of potential rate cuts by the Federal Reserve, is prompting DeFi players to seek alternative sources of returns. The move also highlights a risk management strategy, as protocols look to insulate themselves from the potential impact of fluctuating Treasury yields on their stablecoin reserves. This contrasts with more established players, like Tether and Circle, who still have significant holdings in US Treasuries.

The Growing Sophistication of Onchain Yield

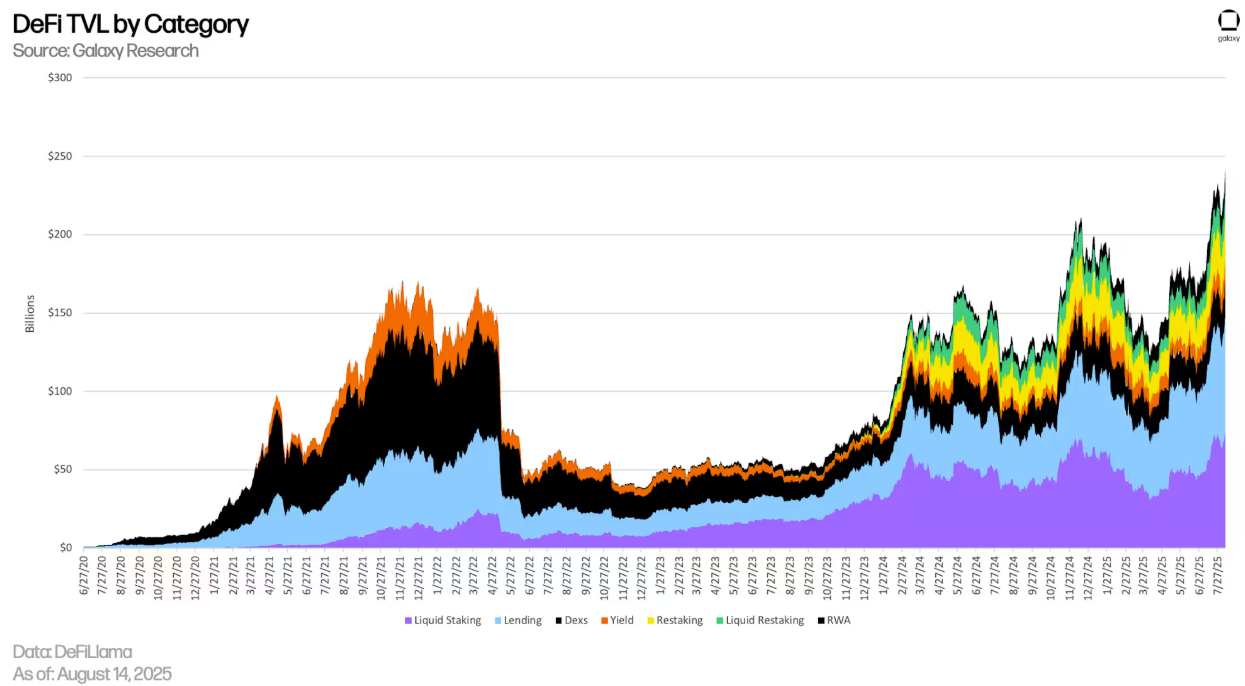

Onchain yield generation has rapidly evolved beyond simple lending and staking mechanisms. DeFi is now witnessing the rise of sophisticated strategies, including basis trading, validator rewards, and restaking, which offer the potential for higher returns while mitigating risk. Research from Galaxy Digital emphasizes that successful onchain yield strategies now require a careful balance of liquidity, complexity, and risk management.

Implications for the Stablecoin Market

This development is particularly relevant for the stablecoin market. The two largest stablecoin issuers, Tether and Circle, collectively hold billions in US government debt. As these entities navigate the shifting yield landscape, their strategies will play a crucial role in shaping the future of DeFi. Spark’s diversification could be a precursor to a broader trend, influencing other protocols to explore crypto-native yield sources.

Looking Ahead

While US Treasury yields continue to serve as a benchmark for many onchain yield strategies, the increasing emphasis on uncorrelated returns suggests a maturing DeFi ecosystem. Protocols are actively seeking new ways to generate yield beyond the traditional fixed-income market. Spark’s move to allocate funds to Superstate’s Crypto Carry Fund is a testament to the innovation and evolution occurring in the DeFi space.

This evolving landscape presents both challenges and opportunities for DeFi participants.