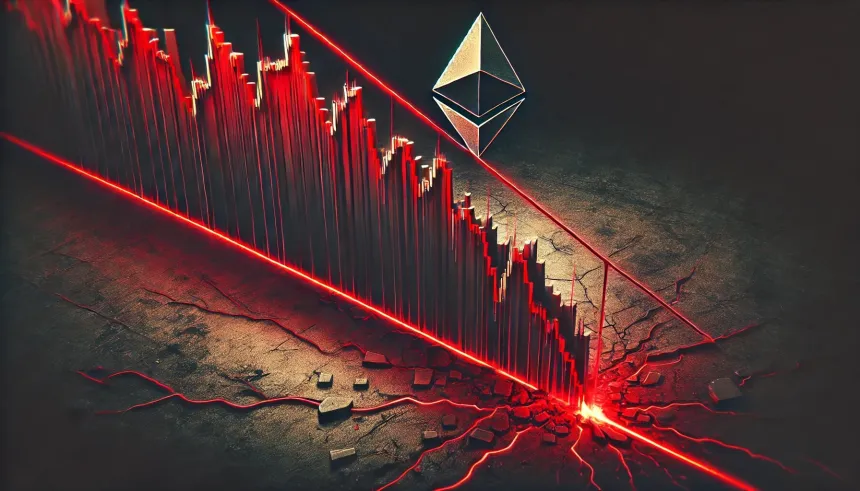

Ethereum (ETH) is facing intense selling pressure after breaking below a key parallel channel pattern, raising fears of a possible collapse toward $1,250. The second-largest cryptocurrency by market cap has struggled to maintain its bullish momentum, leaving investors uncertain about its next move.

Ethereum’s Technical Breakdown

Ethereum had been trading within a parallel channel — a bullish pattern indicating consistent price movement between two trendlines. However, ETH recently broke below the lower support line of the channel, signaling a bearish reversal.

If the breakdown holds, analysts warn that Ethereum could plunge toward the $1,250 support zone — a key level last seen during the 2022 bear market.

Why Is ETH Dropping?

Several factors are contributing to Ethereum’s price decline:

- Profit-Taking: Investors are cashing out after ETH’s recent rally above $3,000.

- Bitcoin Correlation: Bitcoin’s recent downturn has dragged the entire crypto market lower.

- Regulatory Uncertainty: Ongoing regulatory pressure in the U.S. continues to weigh on investor sentiment.

Will Ethereum Recover?

Despite the bearish outlook, some analysts believe the correction could be temporary. ETH still holds long-term bullish fundamentals, especially with the rise of Layer 2 solutions and Ethereum’s deflationary supply model following the Merge upgrade.

Key support levels to watch:

- $2,000 – Psychological support

- $1,850 – Major horizontal support

- $1,250 – Worst-case scenario if bearish momentum continues

Conclusion

Ethereum’s break below the parallel channel could signal further downside if selling pressure continues. However, long-term investors may see this dip as a buying opportunity ahead of future network upgrades and institutional adoption.

Will ETH bounce back, or is a deeper correction on the horizon? Time will tell.