Crypto Market in Focus: Bitcoin at a Crossroads

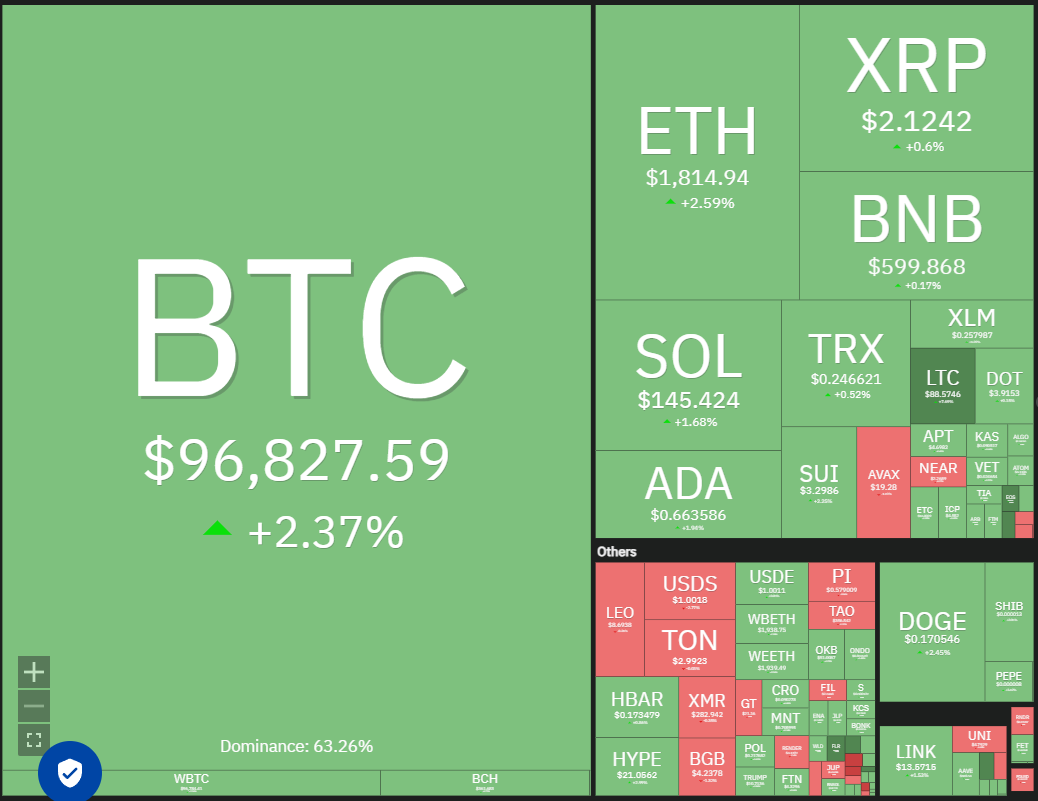

The crypto market is holding its breath, with Bitcoin hovering near the crucial $97,000 level as traders anxiously await the release of the FOMC minutes. Bitcoin’s recent rebound off the 20-day exponential moving average (EMA) suggests bullish sentiment, and a successful break above the $97,895 resistance could pave the way for a rally towards the coveted $100,000 milestone. However, bears are lurking, and a slip below the $95,000 support could trigger a deeper correction. Meanwhile, select altcoins are showing encouraging signs, hinting at potential short-term rallies.

Bitcoin: On the Brink of a Breakthrough?

Bitcoin bulls are pushing hard, seeking to conquer the immediate resistance at $97,895. If they prevail, the next target is the psychological $100,000 level, a barrier that could propel BTC/USDT to $107,000. However, sellers remain vigilant, and a sustained dip below the 20-day EMA could send Bitcoin tumbling towards the 50-day simple moving average (SMA) at $87,441.

Ethereum: Bulls Fight for Control

Ethereum is facing a tug-of-war between buyers and sellers. The bears are struggling to push ETH below the moving averages, indicating a lack of selling pressure at lower levels. Bulls are aiming to capitalize on this weakness and drive the price above the $1,873 resistance, setting the stage for a rally towards $2,111. However, sellers remain a threat, and a break below the moving averages could lead to a decline to $1,537, with the vital support at $1,368 serving as the next line of defense.

XRP: Caught in a Range

XRP is currently trapped in a tight range, with flattish moving averages and the RSI near the midpoint suggesting a stalemate between bulls and bears. A decisive break above the resistance line could signal a trend change, propelling XRP/USDT towards $3. Conversely, a break below the $2 support would open the gates for a drop to the $1.72 to $1.61 support zone.

BNB: Bulls Show Resilience

BNB has demonstrated resilience, with bulls holding their ground against bearish pressure. The failure of the bears to sustain BNB below the moving averages indicates strong demand at lower levels. To continue the upward momentum, bulls need to overcome the $620 barrier, clearing the path for a rally towards the overhead resistance at $644. A break below the $576 support would invalidate this bullish view and could lead to a decline to $520, where buyers are expected to defend the critical support zone.

Solana: Finding Support

Solana is finding support at the moving averages, signaling a positive sentiment as dips are being bought. Bulls are striving to strengthen their position by pushing SOL/USDT above the $153 resistance, which could open the door for a climb to $180 and potentially $200. However, sellers will aim to drag the price below the 20-day EMA to prevent this upside move, potentially sending the pair towards the 50-day SMA at $133.

Dogecoin: Balanced Forces

Dogecoin is locked in a delicate balance between buyers and sellers, with the price clinging to the moving averages. A close below the moving averages could trigger a bearish move towards the range support at $0.14. Bulls will attempt to defend this level, while a break above $0.21 would indicate a short-term trend change, potentially leading to a rally towards $0.25 and the pattern target of $0.28.

Cardano: A Battle for Dominance

Cardano is witnessing a fierce battle between buyers and sellers near the moving averages. The flattish moving averages and the RSI near the midpoint do not provide a clear advantage to either side. A break above $0.75 could propel ADA/USDT towards $0.83, while a break below the $0.58 support could result in a decline to the $0.54 to $0.50 support zone.

Sui: Bullish Rebound

Sui rebounded off the 20-day EMA on May 6, suggesting buyers are active at lower levels. A break above the $3.50 resistance could drive SUI/USDT towards $3.90 and eventually to $5. However, a break below the 20-day EMA could indicate a loss of bullish momentum and lead to a drop to the $2.86 support and the 50-day SMA at $2.61.

Chainlink: Bears Remain in Control

Chainlink is finding support at the 50-day SMA, but the lack of a strong rebound suggests bears are still in control. A break below the 50-day SMA could lead to a decline to $11.68. Buyers will attempt to defend this level, but any relief rally is likely to face selling at the moving averages. On the other hand, a break above the 20-day EMA could signal a shift in momentum and lead to a rally towards the resistance line.

Avalanche: Range-Bound Action

Avalanche has slipped below the 50-day SMA, indicating range-bound action may continue for a few days. A break below $18.50 could send AVAX/USDT towards the range support at $15.27, with a break below this level potentially resuming the downtrend. A bounce off the current level suggests bulls are trying to maintain the pair within the upper half of the range. A break above $23.50 could lead to an uptrend towards $28.78 and the pattern target of $31.73.

**Disclaimer:** This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research before making a decision.