Peso Plummets: Argentina‘s Economic Turmoil Deepens

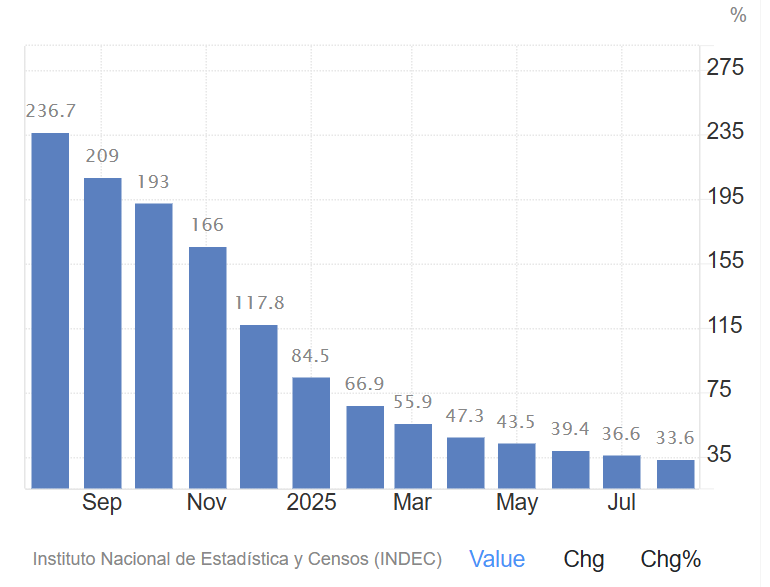

Argentina‘s economic woes have intensified, with the peso enduring a significant decline, sparking both investor concern and the skepticism of Bitcoin proponents. The nation’s struggle with rampant inflation and political uncertainty has led to a critical juncture, with the United States stepping in to offer a financial lifeline. However, the long-term efficacy of this intervention is being hotly debated within the crypto community, especially among those advocating for Bitcoin as a viable alternative to traditional fiat currencies.

US Intervention: A Temporary Reprieve?

The US government’s offer of assistance includes potential measures such as swap lines, direct currency purchases, and the utilization of the Treasury’s Exchange Stabilization Fund to acquire Argentine government debt. While this announcement briefly buoyed investor confidence, as evidenced by a temporary surge in the Merval stock index, underlying concerns remain. The country’s dwindling foreign reserves, coupled with questions about President Javier Milei‘s ability to enact crucial fiscal and structural reforms, have kept markets on edge. The political climate, complicated by a corruption investigation involving a family member of Milei, further exacerbates the uncertainty.

Bitcoin‘s Growing Appeal in Times of Crisis

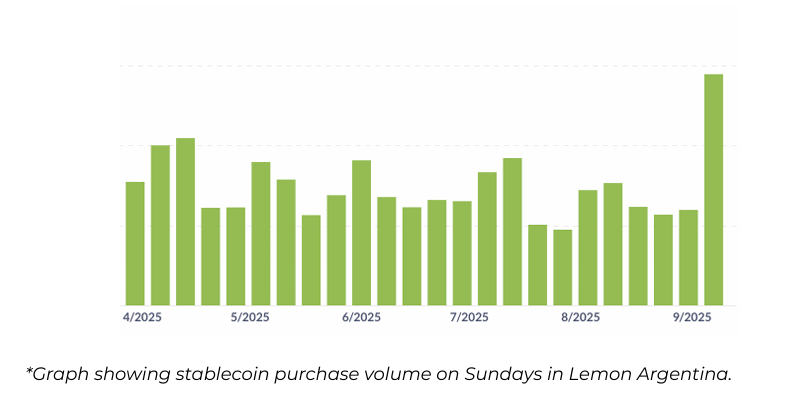

The unfolding crisis has underscored the growing interest in alternative financial instruments, particularly within the cryptocurrency space. Stablecoins, pegged to the US dollar, have seen a surge in popularity as Argentines seek refuge from the peso‘s volatility. Data from crypto trading platforms reveals a significant increase in stablecoin purchases, indicating a clear trend of individuals seeking to protect their wealth from currency devaluation. Bitcoin, too, has gained traction as a store of value, becoming a compelling alternative to both the peso and even the US dollar, in some instances.

The Bitcoin Skepticism and Economic Realities

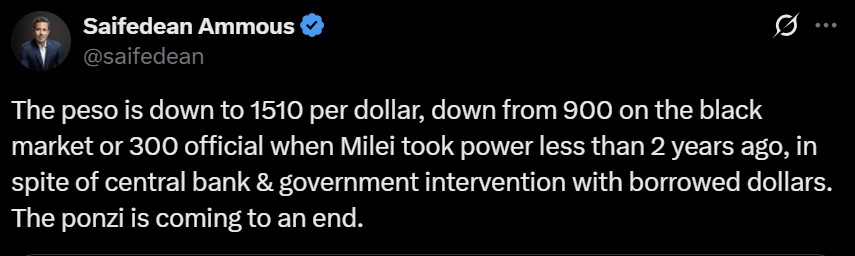

Bitcoin advocates are expressing doubts about the long-term effectiveness of the US intervention. They argue that the underlying economic issues, such as unsustainable debt levels and inflationary pressures, may not be adequately addressed by short-term financial assistance. Economist Saifedean Ammous, author of *The Bitcoin Standard*, has voiced criticism of the current administration’s approach, pointing to what he perceives as a continuation of problematic economic policies. The ongoing crisis, and the subsequent adoption of cryptocurrencies, demonstrate the growing need for alternative stores of value as the economic environment worsens.

Stablecoins and the Future of Argentine Finance

The increasing use of stablecoins is reshaping the financial landscape in Argentina. Beyond their function as a hedge against currency debasement, stablecoins facilitate international payments, remittances, and access to decentralized finance (DeFi). The combination of economic instability and the appeal of digital assets is creating a perfect storm for cryptocurrency adoption. As the government navigates its fiscal reforms and the peso continues its downward trajectory, the role of Bitcoin and stablecoins in Argentina‘s financial future is bound to increase.