Bitcoin Gears Up for a Volatile Week

The cryptocurrency market is entering a crucial period, with Bitcoin (BTC) traders keenly watching the horizon. The US Federal Reserve‘s upcoming interest rate decision is the primary focus, promising to inject significant volatility into the market. Bitcoin currently faces a key resistance level, and analysts are offering varying perspectives on potential price movements. The backdrop to this market anticipation involves a confluence of factors, including institutional demand, macroeconomic data, and technical analysis.

The Federal Reserve‘s Influence

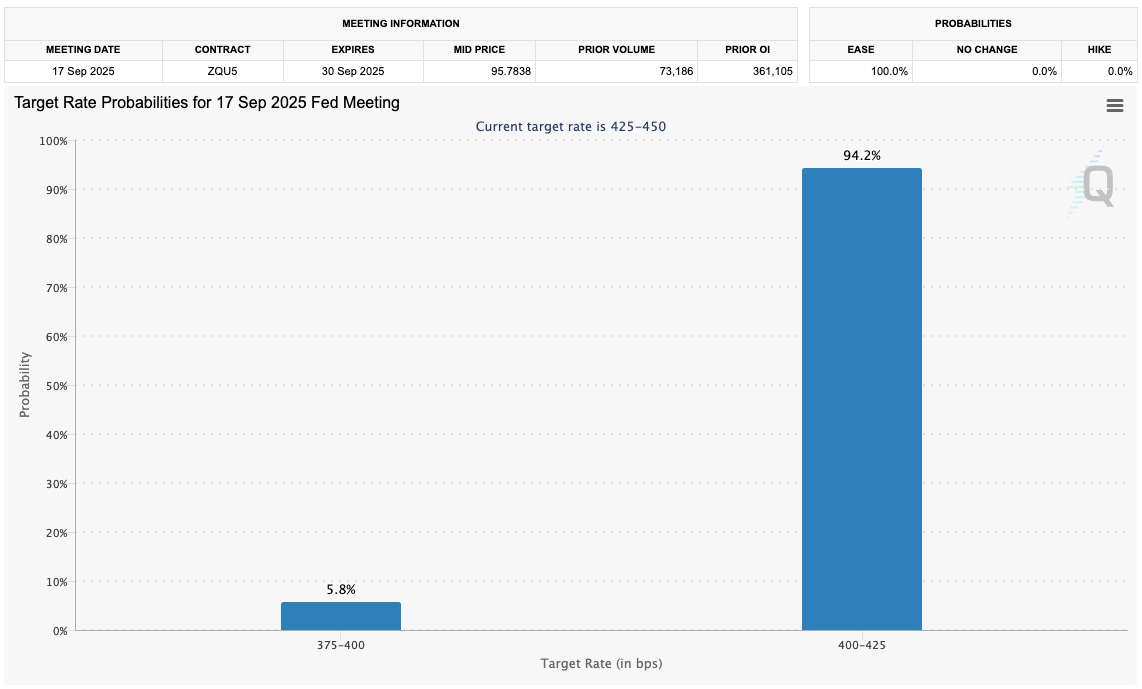

The consensus expectation is a rate cut from the Federal Reserve, possibly as early as Wednesday. While the magnitude of the cut remains uncertain, the anticipation itself is driving market sentiment. Historically, rate cuts have often coincided with positive developments for risk assets, including Bitcoin. However, some analysts point out that the circumstances surrounding this potential cut are unusual. The possibility of the rate cut occurring while stock markets are near all-time highs has historically created heightened volatility. The potential implications of the Fed’s decisions are far-reaching, influencing not only the short-term price action of Bitcoin but also the longer-term trajectory of the market.

Resistance, Support, and Potential Price Targets

Bitcoin currently encounters a significant resistance point at $117,000. Breaching this level is seen as crucial for the continuation of the upward trend. Several analysts suggest that a failure to maintain above this level could trigger a correction, with potential support levels identified at $113,500 or even lower. Conversely, breaking through this resistance could pave the way for a new all-time high.

Institutional Demand and Supply Dynamics

A significant driver of Bitcoin‘s recent price action has been the surge in institutional demand. Data indicates that last week’s institutional buys were several times the amount of newly mined Bitcoin supply. This dynamic creates a supply squeeze, potentially pushing the price higher. The active buying on major exchanges like Binance also signals a bullish sentiment among large investors. Exchange-Traded Funds (ETFs) continue to see large inflows, further supporting the demand-side pressure.

Looking Ahead: Forecasting and Analysis

Various forecasting tools and market indicators are being used to gauge Bitcoin‘s future. Some analysts are using historical models to predict the potential top of the current bull market, some anticipating a potential peak in the coming weeks, with price targets ranging from $140,000 and even higher. Technical indicators, such as the moving average convergence/divergence (MACD), are also being analyzed, with some suggesting aggressive targets. The interplay between these indicators, institutional interest, and the Federal Reserve‘s actions will be pivotal in determining the direction of Bitcoin in the near future.