Bitcoin‘s Price in the Balance: Navigating Pre-FOMC Uncertainty

Bitcoin, the leading cryptocurrency, finds itself at a crossroads as traders and investors alike brace for the upcoming Federal Open Market Committee (FOMC) meeting. The market‘s current consensus leans heavily towards the Federal Reserve maintaining existing interest rates, a situation that has created a climate of cautious optimism. However, the anticipated inaction belies a complex interplay of factors, leaving Bitcoin‘s immediate price direction uncertain.

The Rate Decision and Market Expectations

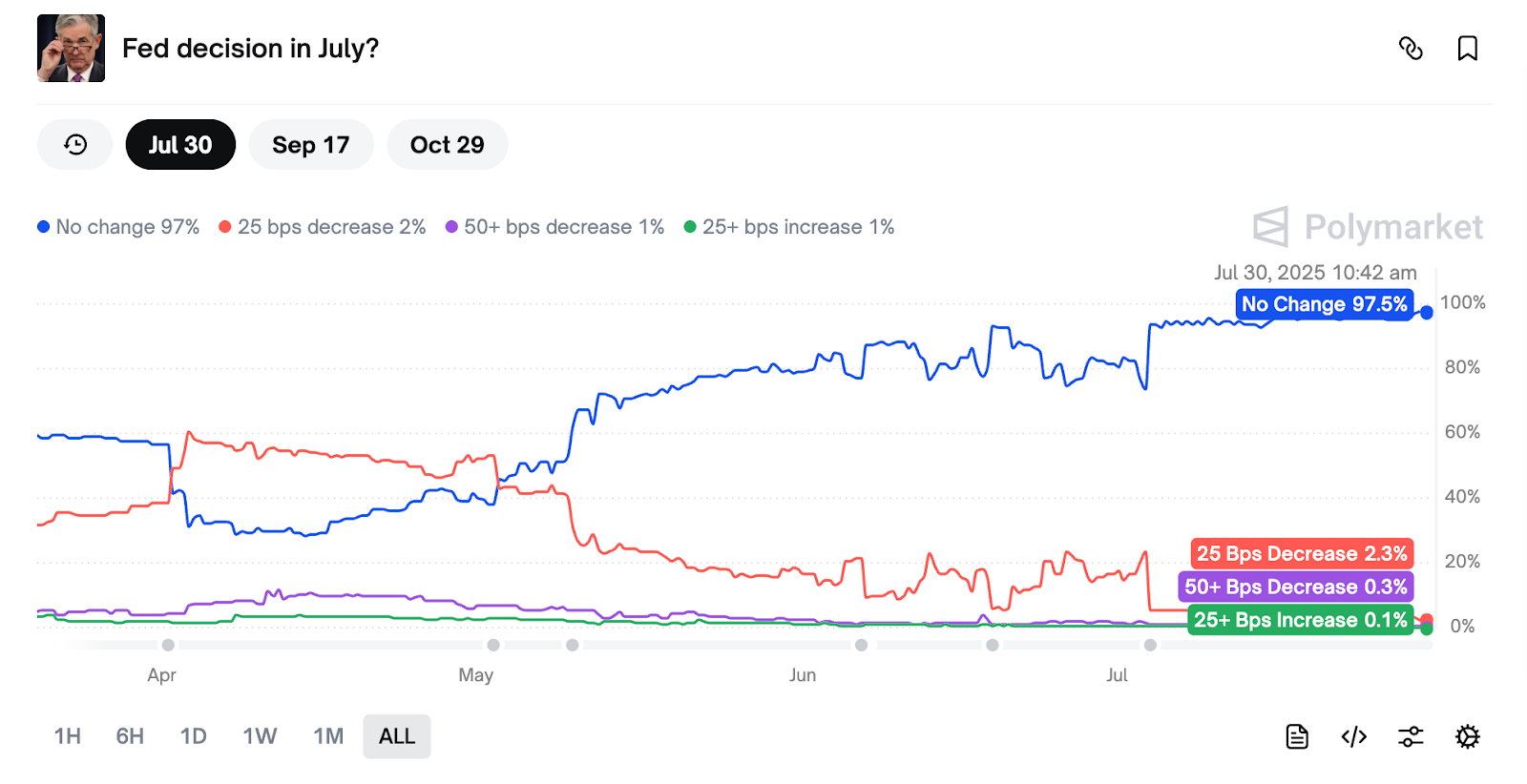

The primary focus of the market centers on the Federal Reserve’s interest rate decision. Current predictions, according to platforms like Polymarket, assign an exceptionally low probability to any rate cuts this week. This widespread expectation, while seemingly straightforward, doesn’t necessarily translate to market tranquility. Historical precedent suggests that while the rate decision itself may be largely priced in, the accompanying statements from Fed Chair Jerome Powell hold significant sway.

Powell’s Words: The Real Market Mover?

While the interest rate decision is a critical piece of the puzzle, the prevailing sentiment is that Powell’s comments during the subsequent news conference could be more influential. His tone, his projections for future monetary policy, and any hints of shifting economic perspectives will be scrutinized. A “dovish” stance, suggesting a willingness to consider future rate cuts or a more relaxed approach to inflation, could trigger a bullish reaction in the crypto market, while a hawkish tone could dampen investor enthusiasm.

Key Price Levels and Potential Volatility

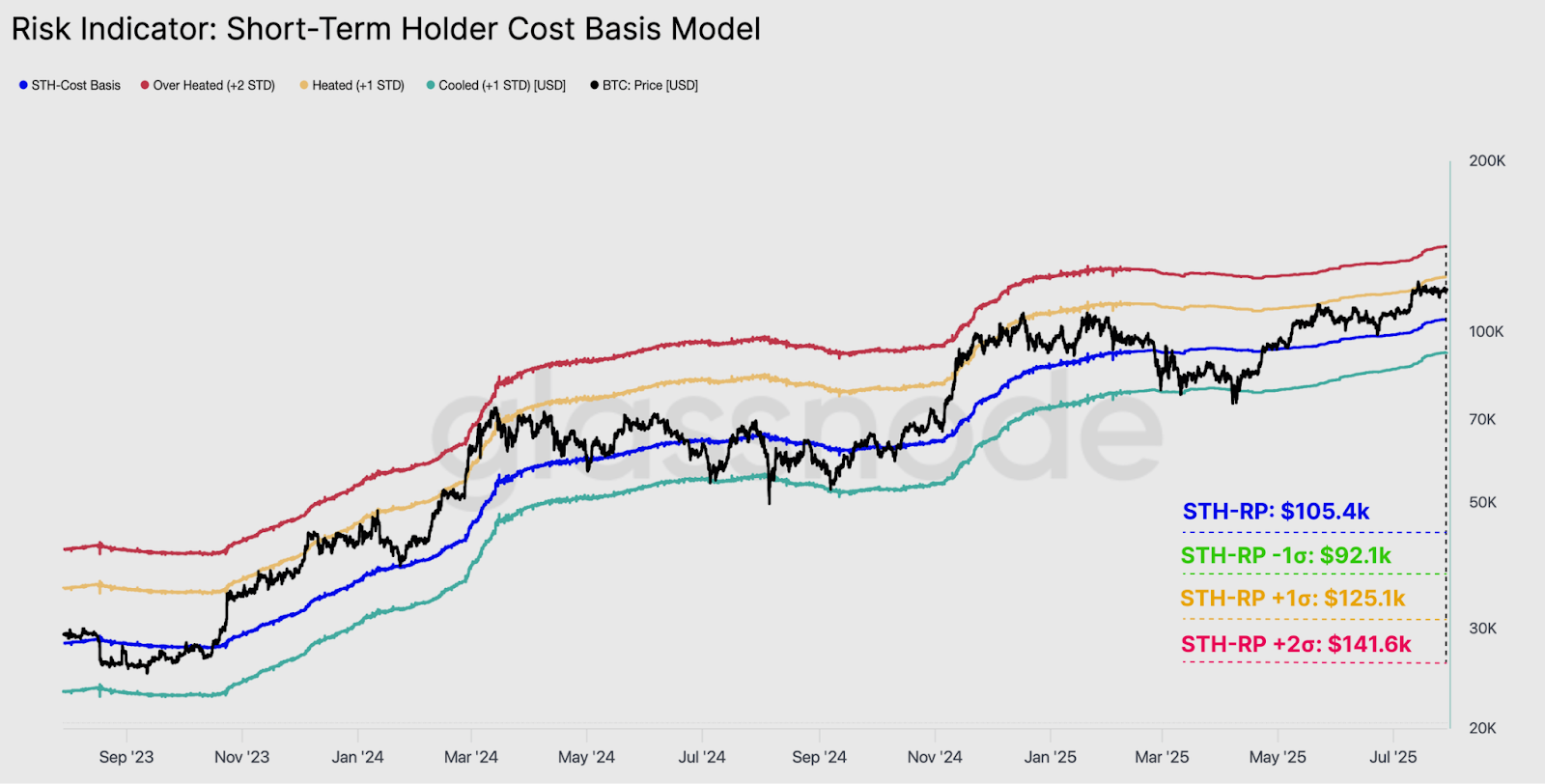

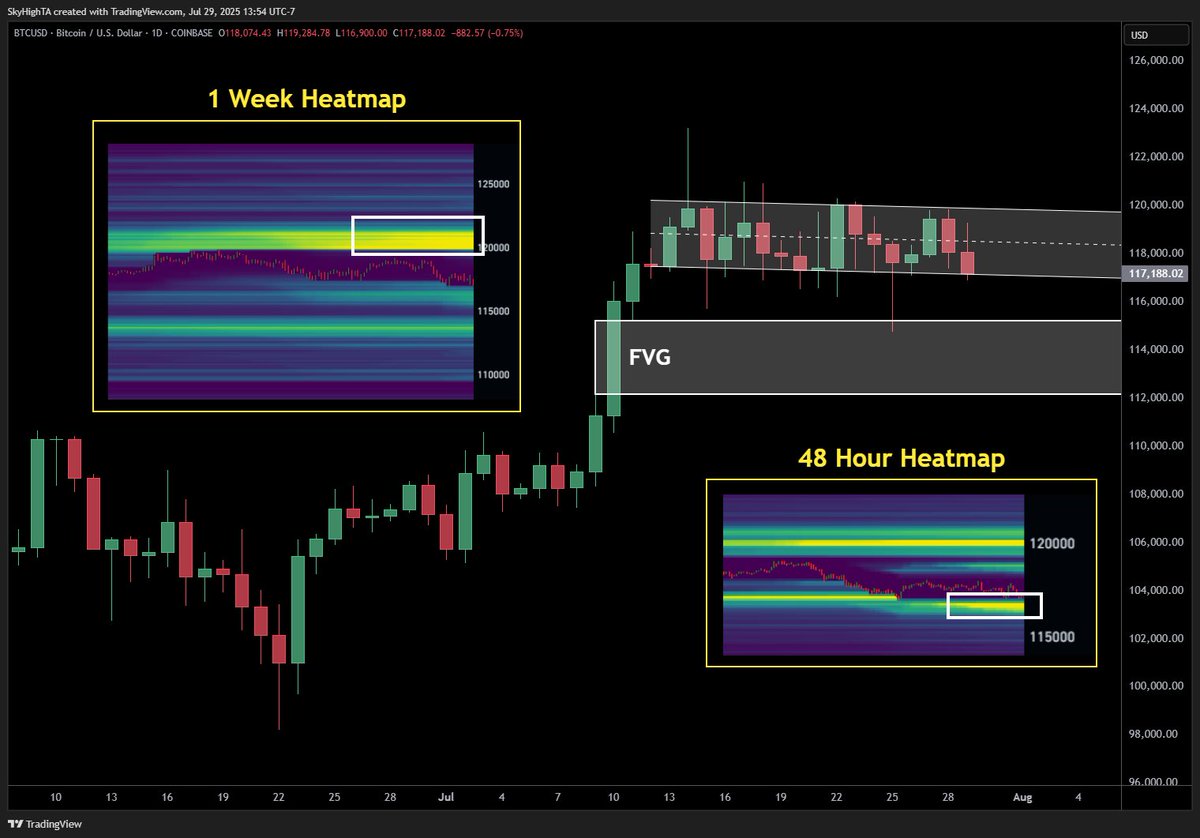

Market analysts are meticulously charting key support and resistance levels for Bitcoin. Breaking through established resistance around $120,000 could propel Bitcoin toward fresh all-time highs, potentially targeting the $141,000 region. Conversely, a break below key support levels, potentially as low as $112,000, could signal a deeper correction. Several analysts are emphasizing specific price zones and potential “fair gap” fills. These are areas where the price may experience increased trading activity or volatility.

Anticipating the Fallout: Analysts Weigh In

Various analysts are offering their perspectives on Bitcoin‘s potential trajectory. One analyst anticipates a sweep downwards, followed by a “squeeze higher.” Another observes that Bitcoin could remain range-bound until the conclusion of Powell’s address. These differing viewpoints highlight the uncertainty inherent in the market, particularly in the run-up to a significant event like the FOMC meeting. In addition to the FOMC, traders are also watching for the US nonfarm payrolls report for further indications.

Conclusion: A Wait-and-See Approach

The overall market sentiment appears to be one of cautious anticipation. While the interest rate decision may be a foregone conclusion, the potential for market-moving commentary from Chair Powell suggests that volatility is likely. The prudent approach for investors is to monitor the situation closely, paying attention to key price levels and the evolving macroeconomic landscape. The next few days could prove decisive in shaping Bitcoin‘s short-term price action.