Bitcoin ETFs: A Promising Start to 2026

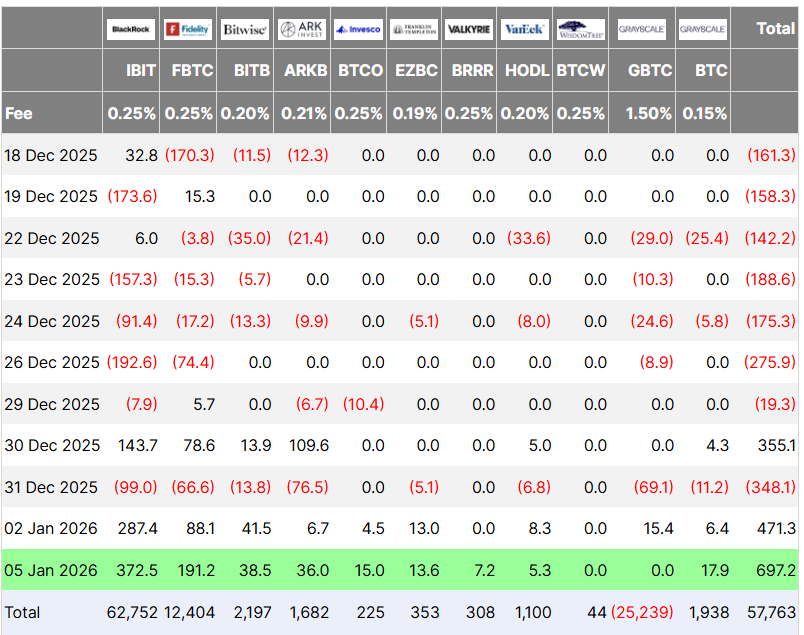

The cryptocurrency market has kicked off 2026 with a bang, as spot Bitcoin exchange-traded funds (ETFs) witnessed a significant influx of capital. In the first two trading days, these ETFs collectively attracted over $1.1 billion, with a substantial $697 million pouring in on the second day alone. This robust start comes after a challenging period, and analysts are pointing to a potential “clean-slate effect” driving renewed interest in digital assets.

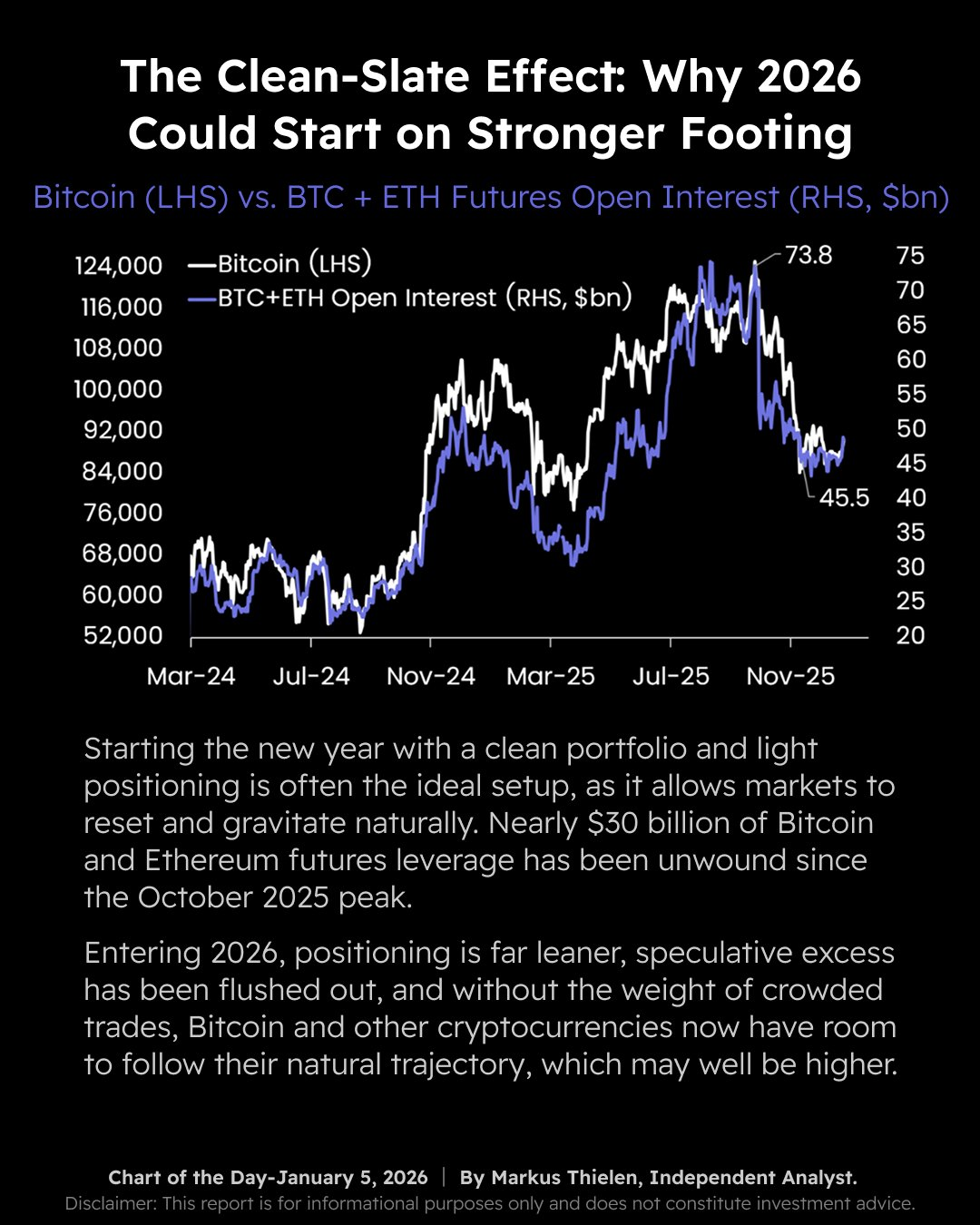

The Clean-Slate Effect and Market Sentiment

The “clean-slate effect” is a term used to describe the fresh start that the new year often brings to financial markets. According to Matrixport analysts, this phenomenon allows markets to reset, potentially erasing the impact of past volatility and positioning. In the context of Bitcoin, this could mean a shift away from the bearish sentiment that prevailed in late 2025.

ETF Inflows and Bitcoin‘s Momentum

The recent inflows into spot Bitcoin ETFs are particularly noteworthy given the context of previous outflows. Data from Sosovalue indicates that Bitcoin ETFs experienced significant outflows in both November and December 2025. This makes the current positive trend a welcome development for Bitcoin holders. Geoff Kendrick, Standard Chartered’s global head of digital assets research, has previously highlighted the importance of ETF inflows in driving Bitcoin’s price momentum.

Beyond Bitcoin: The Broader Crypto Landscape

While Bitcoin ETFs are leading the charge, other crypto funds are also benefiting from renewed investor interest. Spot Ether (ETH) ETFs saw $168 million in inflows on Monday, marking a second consecutive day of gains. Spot Solana (SOL) ETFs recorded $16.8 million in investments, reflecting 20 consecutive days of inflows. This broader trend suggests a positive outlook for the entire crypto market, not just Bitcoin.

Expert Perspectives and Market Outlook

Lacie Zhang, a research analyst at Bitget Wallet, notes that the ETF inflows reflect a “rebalancing phase” driven by geopolitical risks and liquidity positioning. She anticipates that institutional buyers are absorbing supply, which could lead to a near-term rebound in Bitcoin and Ethereum. Zhang suggests that Bitcoin may push towards $105,000, while Ethereum could test $3,600.

Smart Money vs. Market Trends

Interestingly, while ETFs and overall market sentiment point towards a bullish outlook, not all players are on the same page. Nansen’s data, tracking “smart money” traders, reveals a net short position on Bitcoin, suggesting expectations of a price decline. However, these same traders are net long on Ethereum and XRP, hinting at potential upside for those coins. This divergence underscores the complexities of the crypto market and the need to consider multiple perspectives when analyzing trends.

Conclusion: A Bullish Start, but Proceed with Caution

The strong performance of Bitcoin ETFs in the opening days of 2026 is undoubtedly encouraging. However, the market’s volatile nature warrants a cautious approach. Investors should consider various factors, including the “clean-slate effect,” institutional interest, and conflicting views of market participants, before making investment decisions. The coming weeks will be crucial in determining whether this initial surge in ETF inflows translates into sustained growth for Bitcoin and the broader crypto ecosystem.