Bitcoin ETFs Dominate, Ethereum Follows: A Bullish Signal

The cryptocurrency market is experiencing a surge of renewed interest from institutional investors, as evidenced by the robust performance of spot Bitcoin and Ether exchange-traded funds (ETFs). Recent data indicates substantial inflows across these investment vehicles, painting a picture of rising confidence and a strengthening market position for both leading cryptocurrencies.

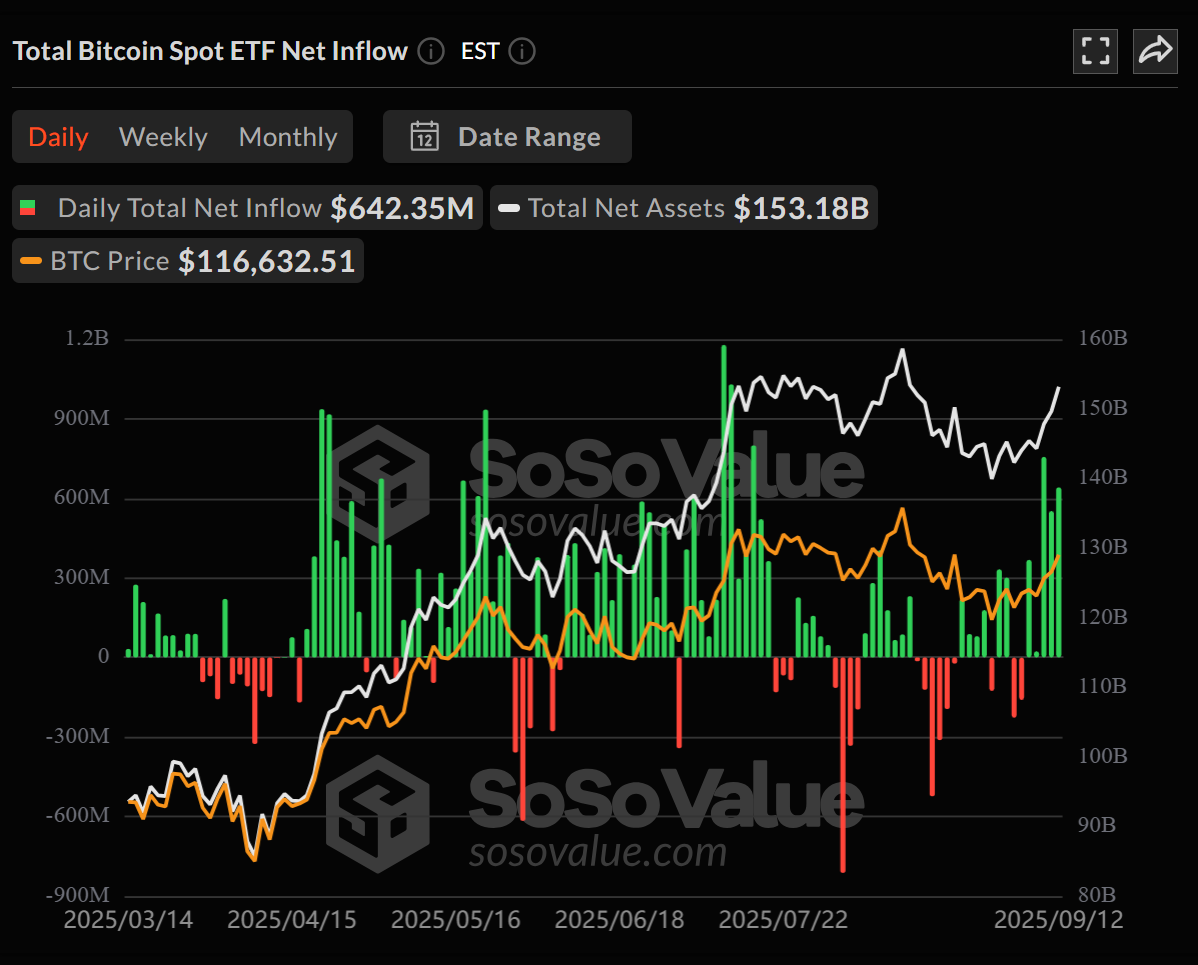

Bitcoin ETFs Continue to Attract Capital

Spot Bitcoin ETFs have been particularly successful in attracting fresh capital. Data from SoSoValue reveals substantial net inflows, marking a consistent pattern of gains over several days. This influx of capital has pushed the cumulative net inflows into the billions, with assets under management (AUM) growing rapidly. These figures underscore the increasing acceptance of Bitcoin as a mainstream investment asset, a trend that has been accelerated by the availability of these ETFs.

Leading the charge are industry titans such as Fidelity and BlackRock, whose Bitcoin ETFs have recorded significant daily gains and trading volumes. The strong performance of these ETFs highlights the growing demand for Bitcoin exposure among institutional investors, suggesting a shift in sentiment as the market matures and macro-economic conditions stabilize.

Ethereum ETFs Experience a Parallel Boost

Ethereum ETFs are also experiencing significant growth, albeit on a smaller scale than their Bitcoin counterparts. The positive momentum has resulted in a consistent flow of capital into these products, increasing their total net assets. This parallel rise underscores the growing institutional interest in the Ethereum ecosystem, which is often seen as a vital component of the broader blockchain revolution.

Similar to Bitcoin, BlackRock and Fidelity are at the forefront of Ethereum ETF adoption, with their respective funds attracting substantial inflows. The high trading volumes associated with these ETFs point to considerable market activity and the increasing integration of Ethereum-based products into the portfolios of institutional investors.

BlackRock‘s Strategic Move: ETF Tokenization

Adding further intrigue to the narrative, BlackRock is reportedly exploring the tokenization of its ETFs, leveraging blockchain technology to enhance functionality. This strategic move could offer several advantages, including 24/7 trading capabilities and seamless integration with decentralized finance (DeFi) ecosystems. The move, while promising, presents regulatory hurdles that will need to be addressed before widespread implementation can be achieved.

“Bitcoin and Ethereum spot ETFs keep seeing strong inflows, showing rising institutional confidence,” Vincent Liu, chief investment officer of Kronos Research, told Cointelegraph.

This development signals a potential evolution in the traditional financial landscape, with blockchain technology poised to disrupt the status quo. The move could signify a broader trend toward increased efficiency, transparency, and accessibility within the investment world. As institutions like BlackRock continue to adopt and experiment with blockchain-based solutions, the future of finance seems increasingly intertwined with cryptocurrencies and decentralized technologies.