Bitcoin‘s Short-Term Outlook: Bearish Signals Emerge

The cryptocurrency market is currently navigating a period of increased uncertainty, with Bitcoin (BTC) showing signs of potential weakness. Technical indicators are flashing warning signals, and a brewing conflict between MicroStrategy (MSTR), a major corporate Bitcoin holder, and global index provider MSCI is adding to the pressure. This combination of factors has analysts watching closely for a potential price decline.

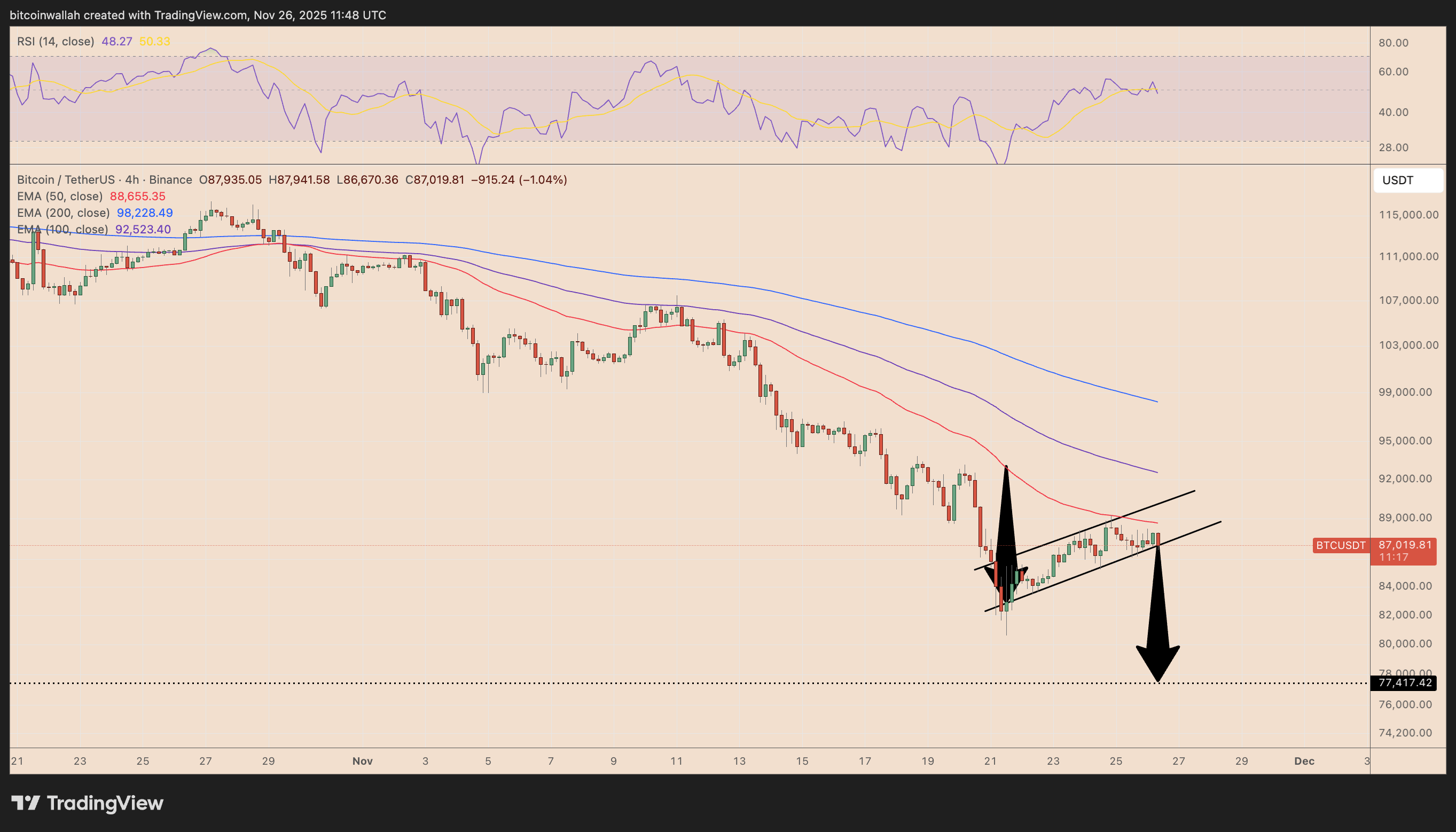

The Bear Flag Formation and Key Support Levels

Bitcoin‘s recent price action has formed a “bear flag” pattern, a technical formation typically indicating a continuation of a downtrend. A decisive break below the flag’s lower trendline could trigger a significant sell-off, with analysts pointing towards a potential target of around $77,400. This level represents a crucial support zone, and a breach could lead to further losses. Conversely, if Bitcoin manages to break above the 50-4H Exponential Moving Average (EMA) and the flag’s upper trendline, the bearish outlook would be invalidated, offering a glimmer of hope for bulls.

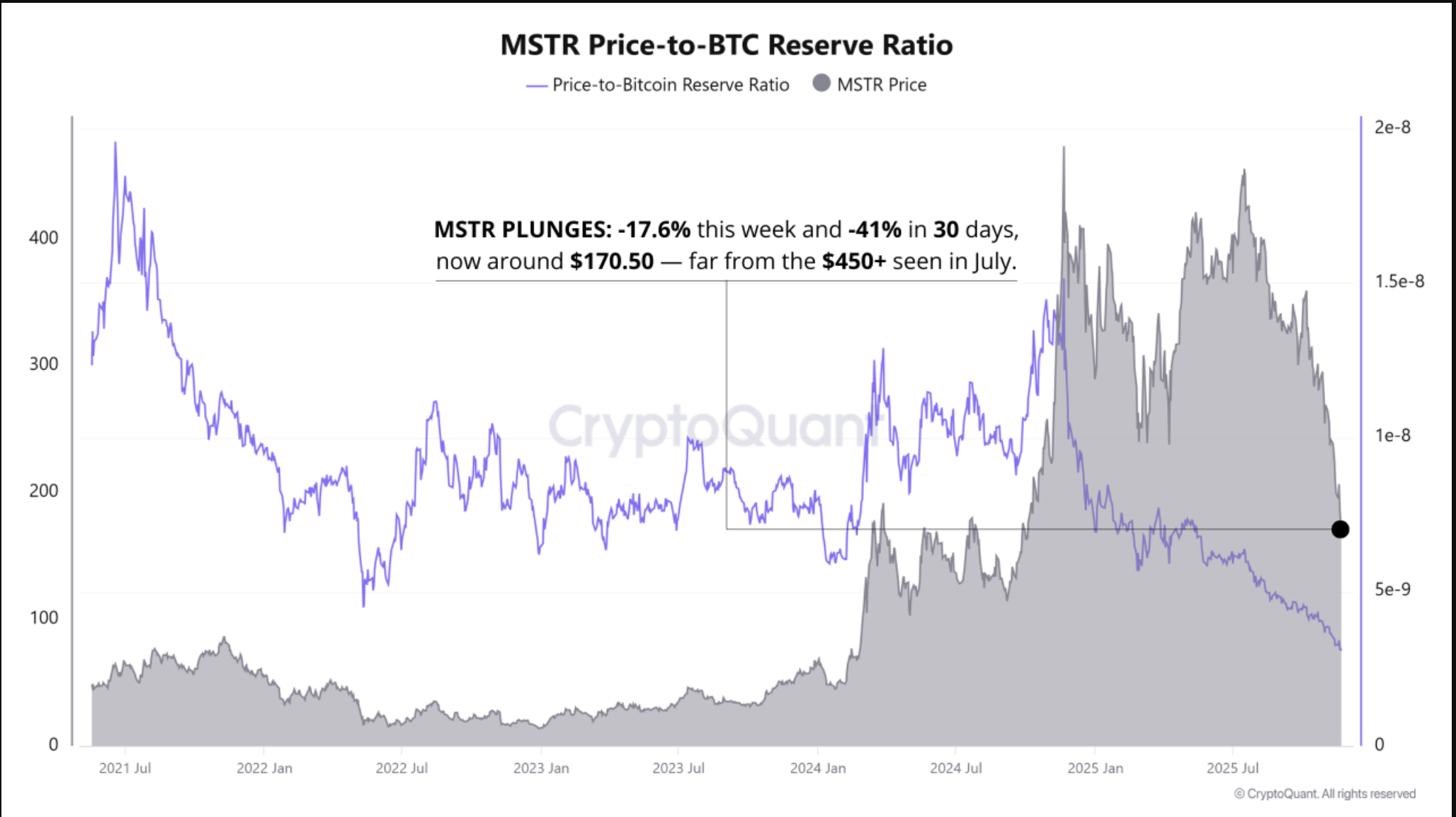

MicroStrategy and MSCI: A Clash of Interests?

Adding fuel to the fire, concerns surrounding MicroStrategy are intensifying. MSCI is currently reviewing its stance on companies whose digital assets constitute a significant portion of their balance sheets. The index provider is expected to make a decision by January 15, 2026, which could have major implications for MicroStrategy‘s inclusion in key indexes. The potential exclusion from indexes could force passive funds tracking those benchmarks to sell off shares, putting downward pressure on the markets.

Institutional Risk and Market Sentiment

The situation has raised questions about potential institutional influence and market manipulation. Some analysts have accused certain financial institutions of orchestrating a “hit job” on MicroStrategy to benefit from their own leveraged Bitcoin-focused products. These allegations, combined with the technical analysis and MSCI‘s review, are creating a fragile market environment. It’s a classic case of uncertainty being the enemy of any bull run.

MicroStrategy‘s Reassurance and the Road Ahead

In response to the growing concerns, MicroStrategy has issued a statement to reassure investors. The company stated it maintains a strong asset coverage even in the event of a significant Bitcoin price drop. Despite these assurances, the broader market remains cautious. The interplay between technical indicators, institutional pressures, and regulatory uncertainties will likely determine Bitcoin‘s near-term trajectory. Investors should conduct thorough research and consider the inherent risks associated with such volatility.