Bitcoin‘s Bullish Trifecta: A Path Beyond $122K?

The cryptocurrency world is buzzing, and the focal point remains firmly fixed on Bitcoin. With the digital gold currently trading near the $120,000 mark, whispers of a new all-time high are gaining traction. But what’s driving this optimism? And what are the key elements that could propel Bitcoin well beyond its current valuation?

Global Money Supply: A Macro Tailwind

One significant factor bolstering Bitcoin‘s prospects is the relentless expansion of the global money supply. The M2 global money supply across the 21 largest central banks has surged to a record $55.5 trillion. This monetary influx, coupled with mounting fiscal debt, provides fertile ground for Bitcoin‘s growth. As traditional fiat currencies face devaluation pressures, Bitcoin‘s scarcity becomes increasingly attractive, acting as a hedge against inflation. This macroeconomic backdrop acts as a strong tailwind, potentially fueling Bitcoin‘s continued ascent.

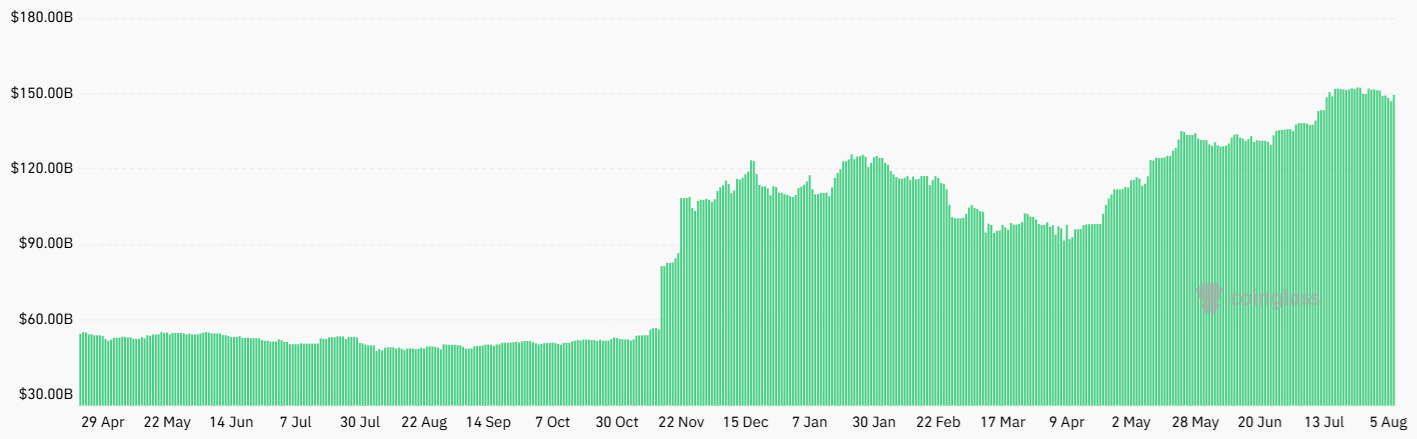

ETFs and Institutional Adoption: Cementing Reserve Asset Status

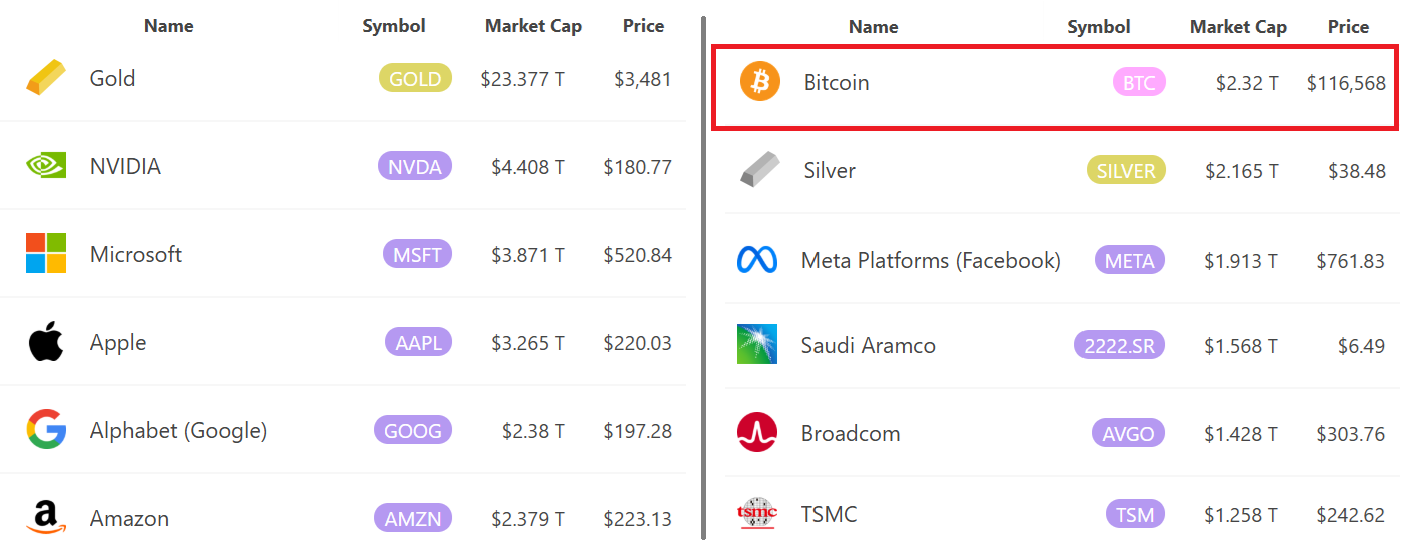

Another crucial element is the evolution of Bitcoin‘s reserve asset status. The rise of Spot Bitcoin ETFs has been remarkable. These investment vehicles are rapidly accumulating significant assets, and some analysts predict they could soon surpass gold’s equivalent holdings. This milestone would mark a pivotal shift, solidifying Bitcoin‘s position as a recognized store of value and attracting even greater institutional investment. Increased institutional participation, from public companies to sovereign wealth funds, would undoubtedly act as a major catalyst for future price appreciation.

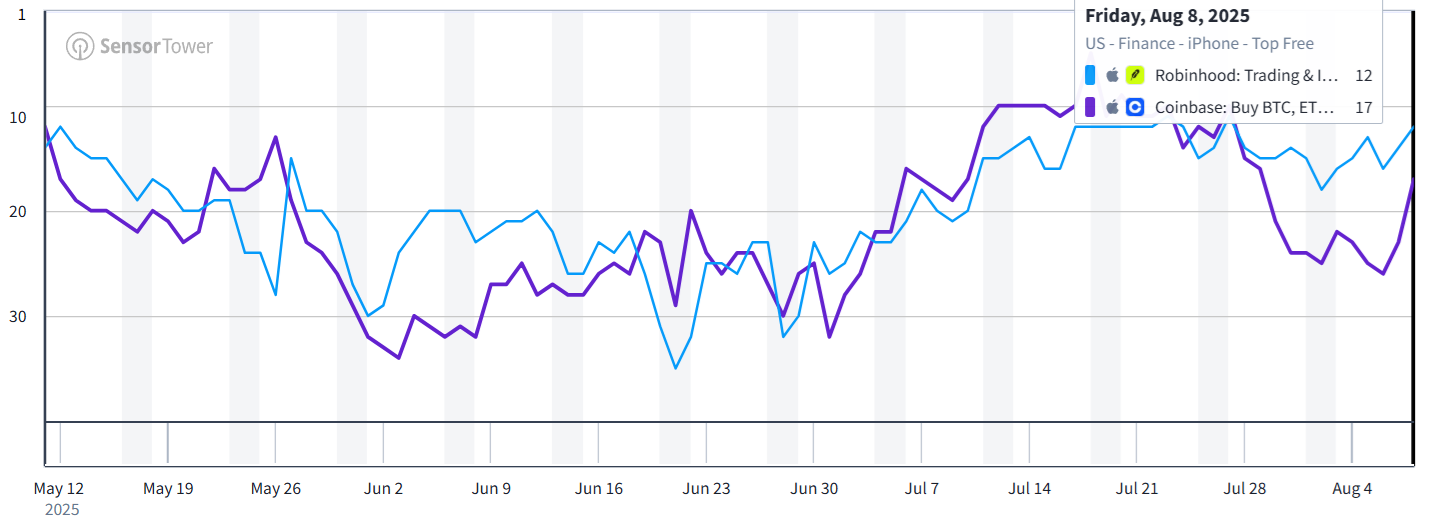

Retail Awakening: The Missing Piece of the Puzzle

Despite the positive developments, retail investor participation remains relatively muted. While Bitcoin has delivered impressive gains over the past year, the recent rally has yet to ignite widespread retail enthusiasm. However, this presents an exciting opportunity. The potential for a retail-driven rally in 2025 is substantial, particularly as mainstream adoption accelerates. The gap in returns compared to the broader market, coupled with increasing media attention and regulatory acceptance, could act as a powerful magnet, drawing in new capital from individual investors. A renewed influx of retail funds could provide the necessary fuel for Bitcoin to surge beyond the $122,000 barrier and establish new price frontiers.

Risks and Considerations

While the outlook appears optimistic, certain risks warrant attention. The correlation between Bitcoin and tech stocks remains a factor, meaning market volatility could influence Bitcoin‘s short-term performance. Furthermore, factors like the sustainability of AI-driven valuations and overall global economic uncertainty could pose challenges. However, with the combined strength of the global money supply, growing institutional interest, and the potential for a retail resurgence, Bitcoin‘s trajectory towards a new all-time high remains firmly set. The future looks bright for the digital gold, but investors should stay informed and remain vigilant in this dynamic market.