Bitcoin Trading at a Discount: Institutional Buying Fuels ETF-Driven Rally

The crypto market is abuzz with activity as Bitcoin (BTC) experiences a surge in price, fueled by a confluence of factors, including institutional interest and potential price predictions.

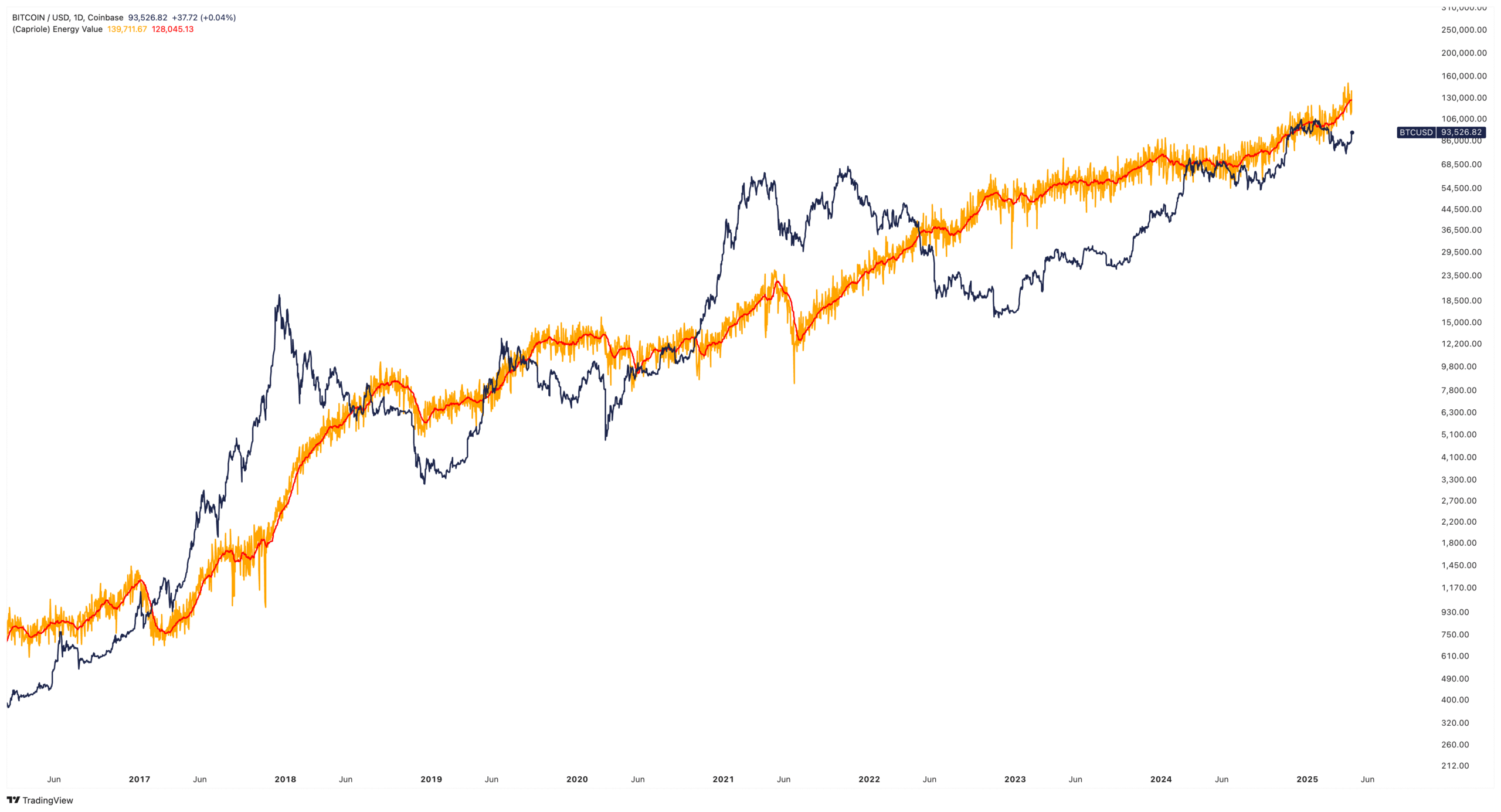

According to Capriole Investments founder Charles Edwards, Bitcoin is currently trading at a 40% discount to its intrinsic value. Edwards, referencing Bitcoin’s energy value based on mining costs and energy consumption, estimates that the true value of Bitcoin could be as high as $130,000.

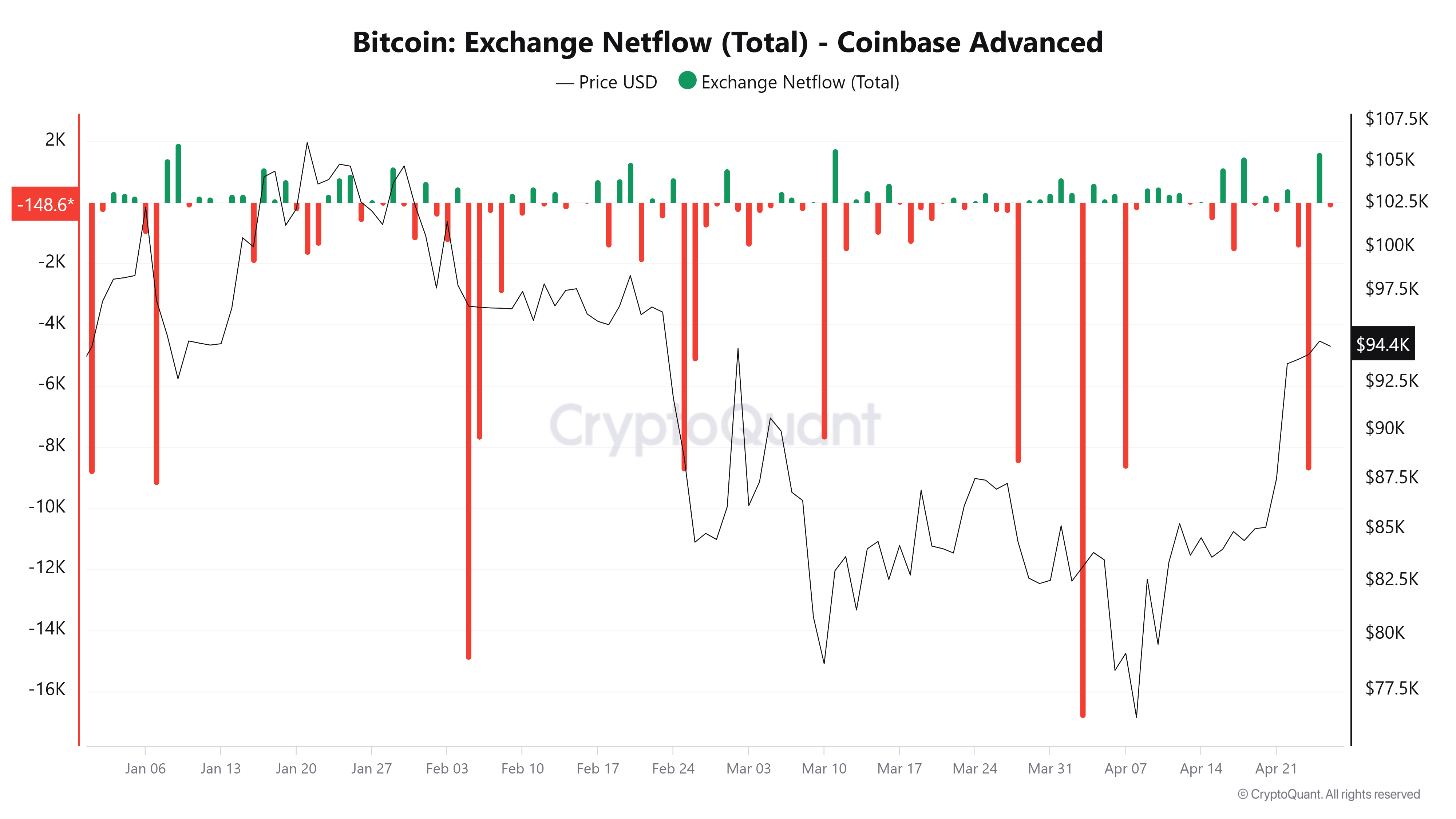

This assessment comes at a time when institutional buying has reached a fever pitch, spurred by the recent approvals of spot Bitcoin ETFs. Data from CryptoQuant reveals substantial outflows from leading crypto exchanges, indicating a significant shift in institutional appetite.

Massive Outflows: Coinbase and Binance Witness Institutional Demand

On April 24th, over 8,756 BTC (roughly $830 million) were withdrawn from Coinbase, a trend that continued on April 25th with Binance experiencing a record-breaking outflow of 27,750 BTC.

While these outflows suggest strong institutional demand, analysts emphasize the need for caution. Alphractal founder Joao Wedson highlights that historical patterns don’t guarantee continued price rallies.

“In 2021, massive outflows didn’t prevent the dump triggered by China’s crypto ban (April–May). On the other hand, continuous outflows over several days, like during the FTX collapse, signaled a bottom and recovery.”

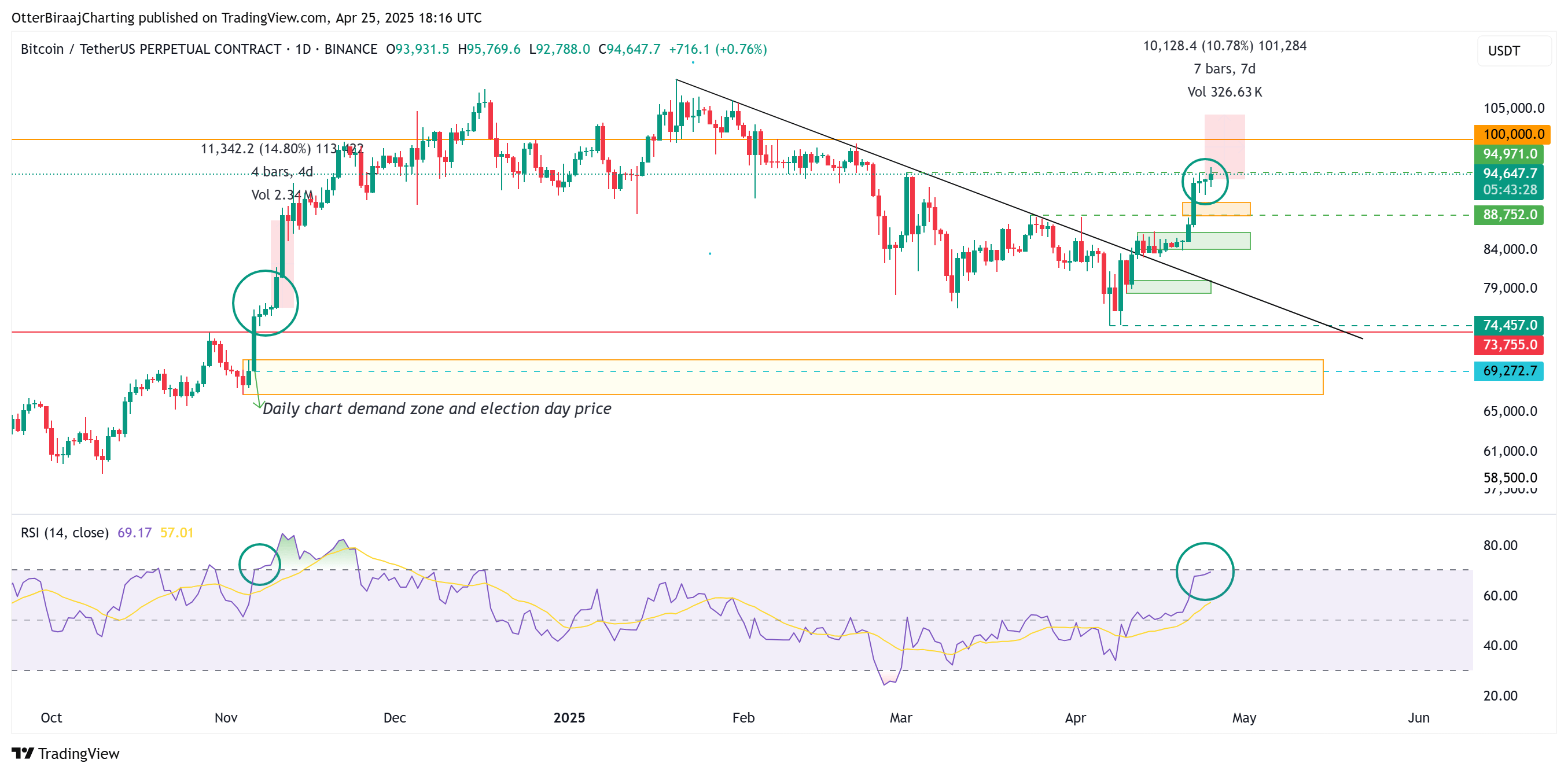

Fractals Point Towards $100,000?

Adding fuel to the bullish fire, Bitcoin‘s recent price action echoes a similar fractal pattern observed in Q4 of 2024. This pattern, characterized by a breakout followed by consolidation at a higher range, suggests a potential for Bitcoin to surpass the $100,000 mark.

However, analysts remain cautious, noting the presence of overhead resistance at $96,100 that could potentially impede a sustained breakout.

The current bullish sentiment in the market is palpable, with Bitcoin’s recent performance marking its highest return in 2025. While the potential for Bitcoin to reach $100,000 remains a tantalizing prospect, investors should remain vigilant and conduct their own due diligence before making any investment decisions.

This article is for informational purposes only and should not be considered investment advice.