Bitcoin‘s Price Surge: A Perfect Storm Brewing?

Bitcoin is making headlines again, not just for its steady climb but for the potential for a dramatic price explosion. Traders are keenly observing the market, with eyes locked on a possible move towards $120,000. This optimism is fueled by several factors, including the recent price action that has pushed Bitcoin to new August highs and the anticipation of a significant short squeeze.

The Short Squeeze Scenario: A $18 Billion Liquidation Event?

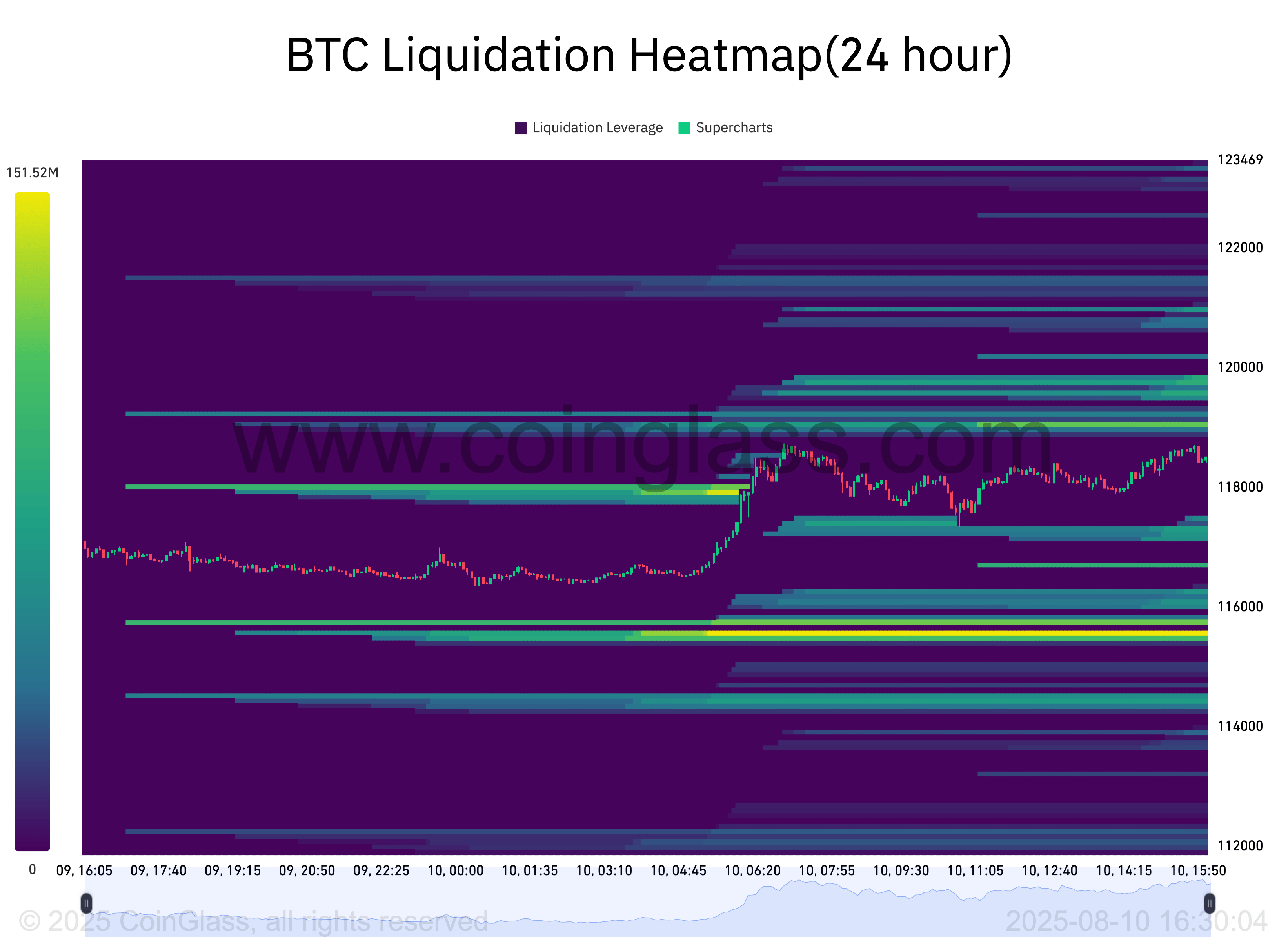

The current market structure sets the stage for an intriguing scenario. According to some analysts, a mere 10% upward move in Bitcoin’s price could trigger a massive short squeeze, potentially liquidating over $18 billion in short positions. This potential cascade effect could further accelerate the price increase, creating a self-fulfilling prophecy as bears are forced to cover their positions.

Analyzing the Technical Indicators: CME Gaps and Retracements

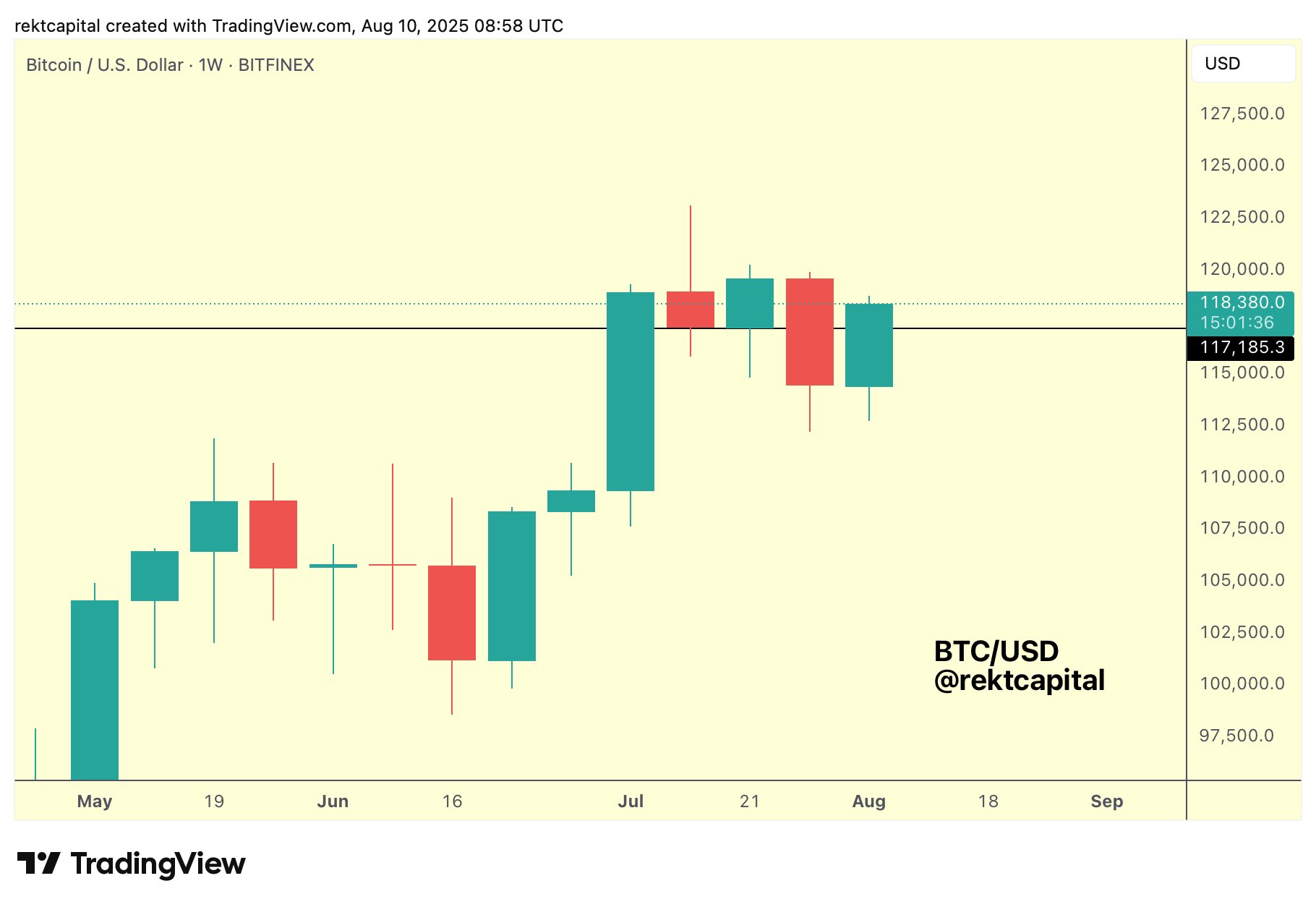

Beyond the potential for a short squeeze, technical indicators are also playing a role in market expectations. One key area of interest is the CME Group’s Bitcoin futures market. Several analysts are watching for the filling of a CME gap around $116,500, suggesting this could be a potential support level. The market has historically shown a tendency to retrace and fill these gaps, making it a crucial area to watch for potential price reversals. Additionally, the possibility of a temporary bearish retracement before further upward movement is on the radar.

Expert Opinions and Market Sentiment

Several prominent figures in the crypto space are weighing in on the situation. Traders like Rekt Capital and BitBull are providing insights on potential market moves. BitBull, for instance, believes a move above $120,000 is possible after a period of retracement. Another trader, Merlijn, is also targeting $120,000, emphasizing the significant liquidity pool that may be available above the current price.

The Bigger Picture: Bitcoin‘s Bullish Trajectory

Despite the short-term volatility and potential for retracements, the overarching sentiment remains bullish. Many analysts believe that Bitcoin is poised to continue its upward trajectory. This sentiment is supported by comparing the current price action to previous bull market cycles. While the market remains choppy, the potential for significant gains is undeniable.

Disclaimer

This article is not financial advice. Cryptocurrency investments carry significant risks. Always conduct your own research before making any investment decisions.