Bitcoin‘s Bullish Indicators: A $330,000 Target?

The cryptocurrency world is abuzz with predictions, and Bitcoin, the market’s bellwether, is no exception. Recent analyses, coupled with shifts in institutional behavior, paint a compelling picture: a potential surge to $330,000 before the end of the current cycle. This forecast hinges on several key factors, primarily the historical performance of the AVIV Ratio and the accumulation patterns observed among large-scale investors.

Decoding the AVIV Ratio

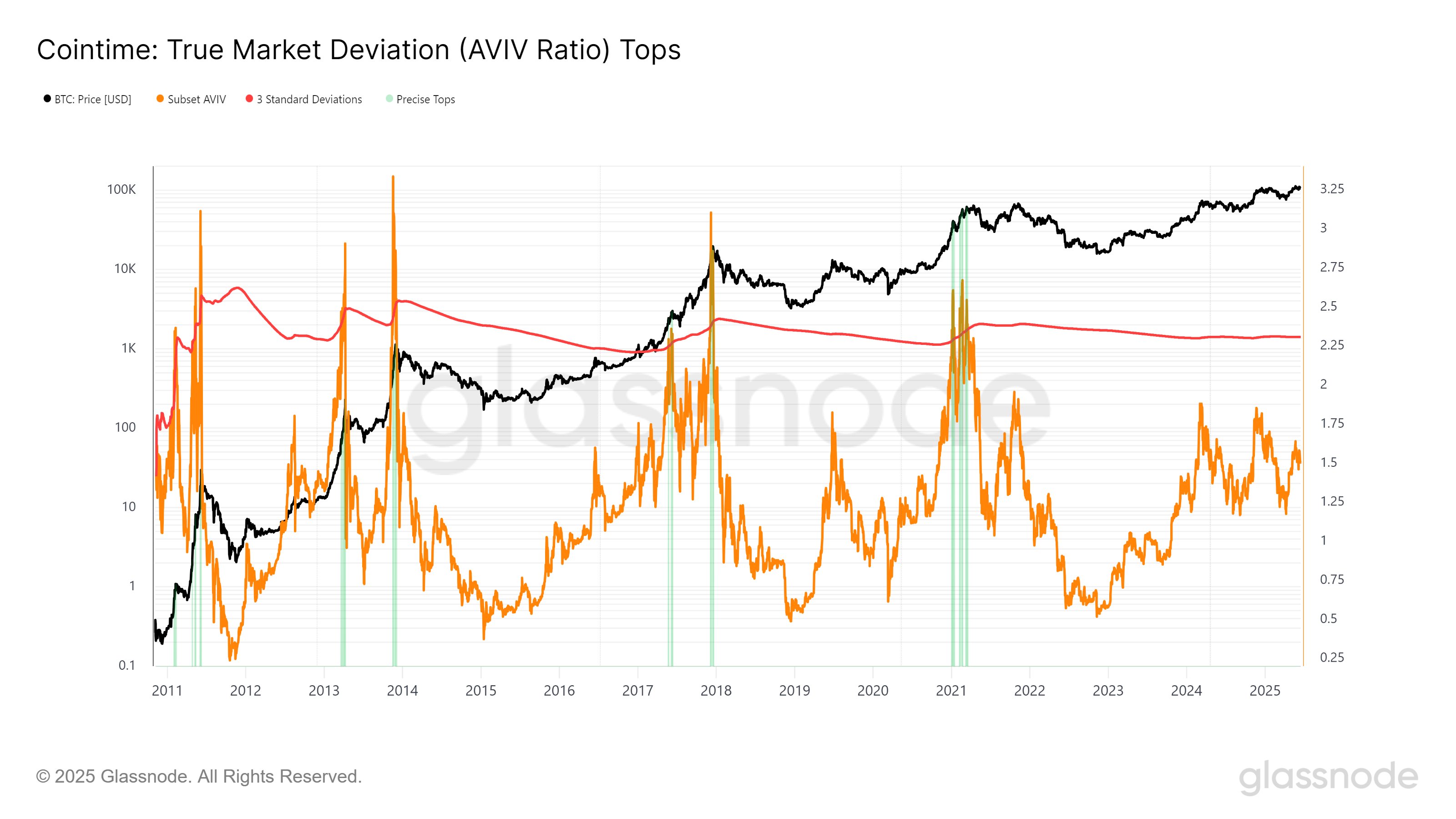

Technical analyst Gert van Lagen’s research centers on the AVIV Ratio, a metric that compares Bitcoin‘s active capitalization with its total invested capitalization. Historically, when this ratio surpasses a certain threshold, it has accurately predicted cycle tops. The data suggests that the current AVIV Ratio level remains below the peaks seen in previous bull runs, implying that Bitcoin has considerable room to grow before reaching a cycle peak.

Institutional Accumulation: A Strategic Shift

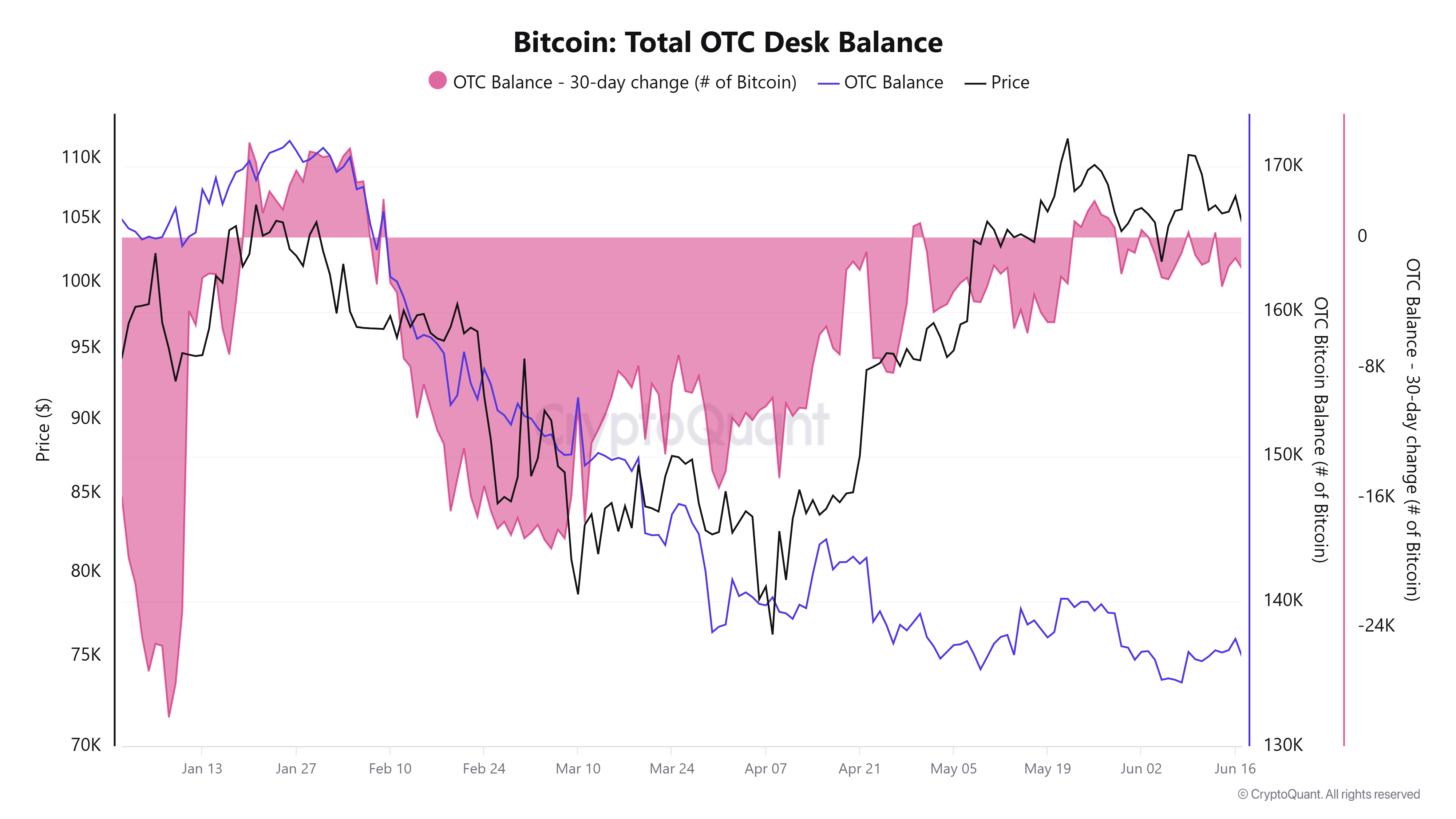

Adding to the bullish narrative is a visible trend in institutional behavior. Data indicates a notable decline in Bitcoin holdings on over-the-counter (OTC) desks. This decrease, from 166,500 to 137,400, suggests strategic accumulation by large players. Firms like Strategy, Metaplanet, and BlackRock are reportedly adding to their Bitcoin stashes. BlackRock’s current Bitcoin holdings, for example, are valued at over $70 billion, with recent additions of $250 million further signaling their commitment.

Other Key Indicators and Predictions

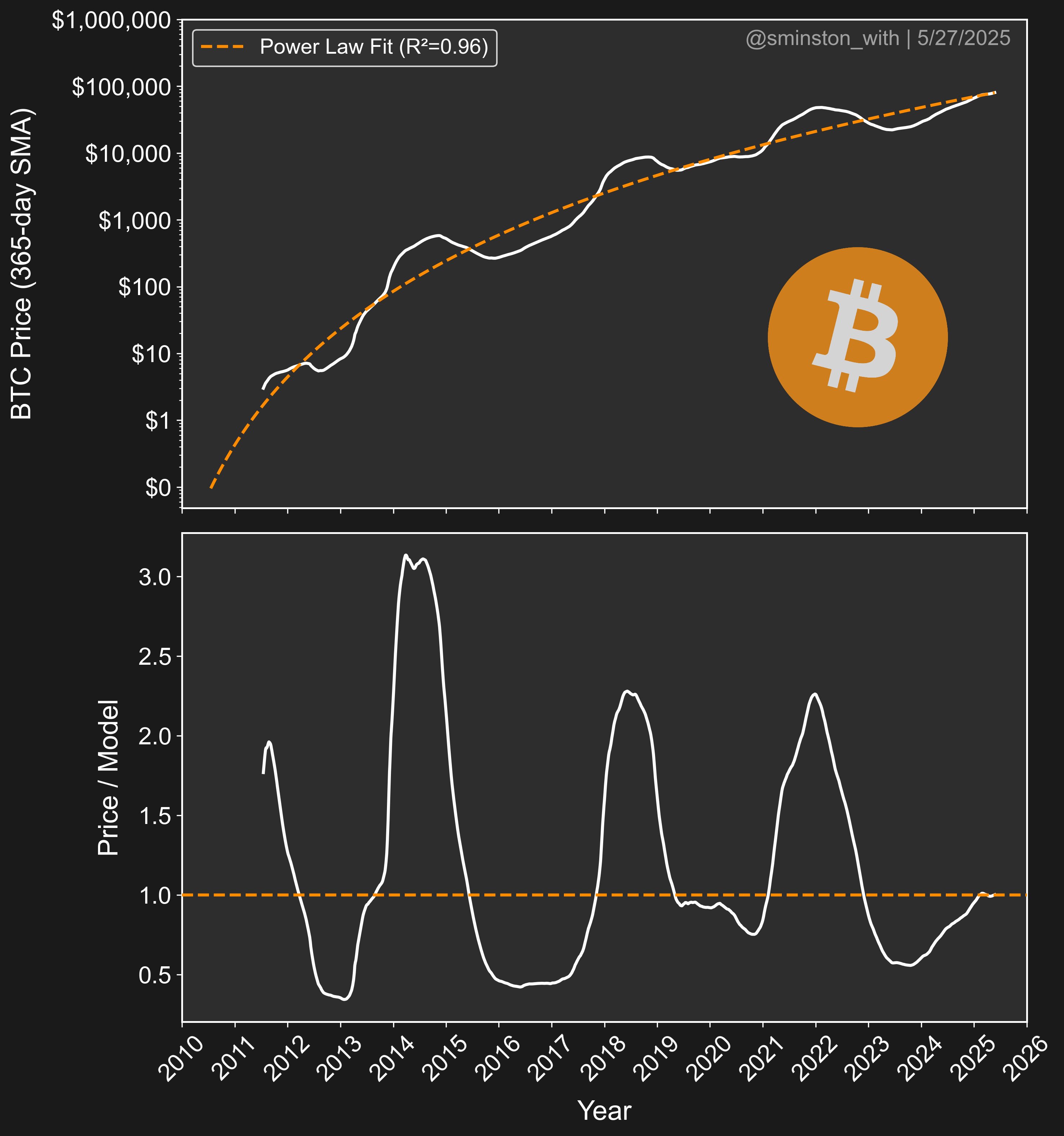

- Similar to van Lagen’s $330,000 prediction, another analysis suggests a range of $220,000 to $330,000, based on a 365-day simple moving average.

- CoinGlass data highlights that despite Bitcoin‘s recent climb, many bull market peak indicators are still not signaling a top.

Market Dynamics and Cautionary Notes

The AVIV Ratio provides a unique perspective on market dynamics, reflecting the balance between investor activity and long-term value. However, it’s crucial to acknowledge the inherent volatility of the crypto market. Past performance is not a guarantee of future results, and several factors could influence Bitcoin‘s trajectory. These include overall market sentiment, regulatory developments, and the emergence of new technologies.

“This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.”

Conclusion: A Bullish Outlook with Caveats

The confluence of the AVIV Ratio‘s historical context and the shift towards institutional accumulation strongly suggests a bullish outlook for Bitcoin. However, the crypto market‘s volatile nature warrants caution. Investors should conduct their research and consider the associated risks before making any investment decisions. The potential for a $330,000 Bitcoin remains a compelling scenario, but the journey to that point will likely be marked by significant price swings and unforeseen events.