Profit-Taking Resurfaces in Bitcoin Market

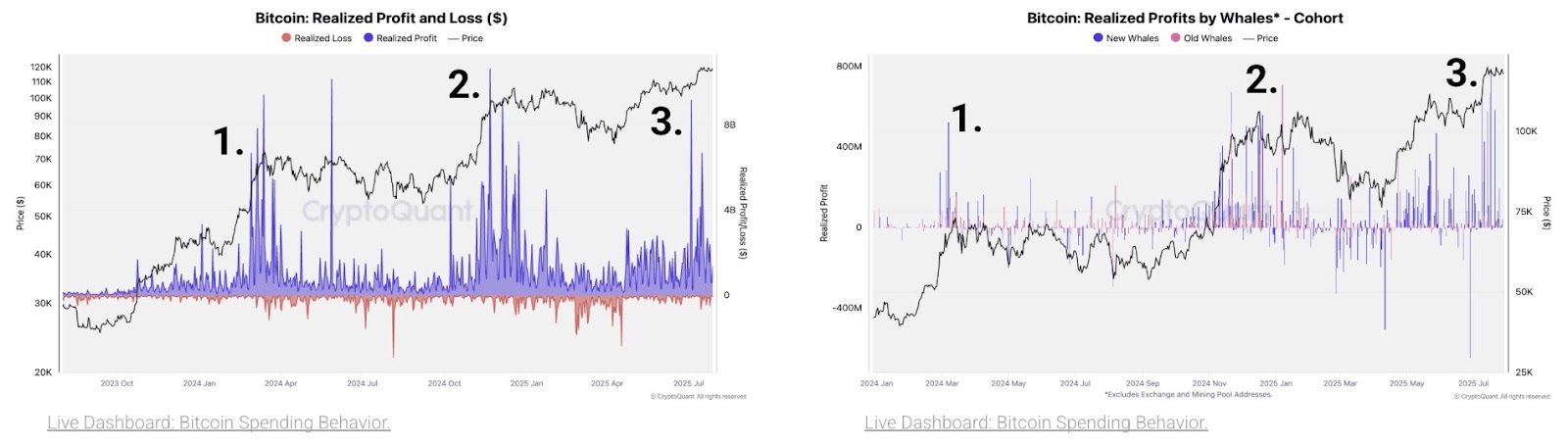

Bitcoin‘s recent inability to maintain levels above the $120,000 mark has triggered a significant wave of profit-taking, marking the third major instance of such activity during this current market cycle. On-chain analytics firm CryptoQuant has pinpointed “new whales” as the primary catalyst behind this recent sell-off. These entities, holding at least 1,000 BTC, are characterized by their more recent accumulation of Bitcoin, often suggesting they may include institutional investors or corporate entities.

The Rise of the ‘New Whales‘

The term “whale” in the cryptocurrency world refers to individuals or entities that hold a substantial amount of Bitcoin, capable of influencing market dynamics. Traditional whales often accumulated their holdings early in Bitcoin‘s history. “New whales“, however, represent a more recent influx of large holders, often linked to institutional investment or corporate adoption. Their decision to realize gains, once Bitcoin surpassed the $120,000 threshold, demonstrates a strategic approach to profit-taking, potentially indicating a shift in sentiment or the expectation of a near-term market correction.

Historical Context: Profit-Taking Waves and Market Cycles

The CryptoQuant analysis draws parallels with previous profit-taking waves. The prior two waves followed significant events such as the launch of US spot Bitcoin exchange-traded funds and the run-up to a major political inauguration. Historically, these periods of profit-taking were succeeded by a cooling phase in the Bitcoin market, sometimes culminating in more substantial corrections. However, it’s essential to note that Bitcoin‘s performance has been robust, achieving a new all-time high in July, despite these profit-taking events, suggesting the market’s overall strength.

Old Whales Awaken: A Tale of Giants

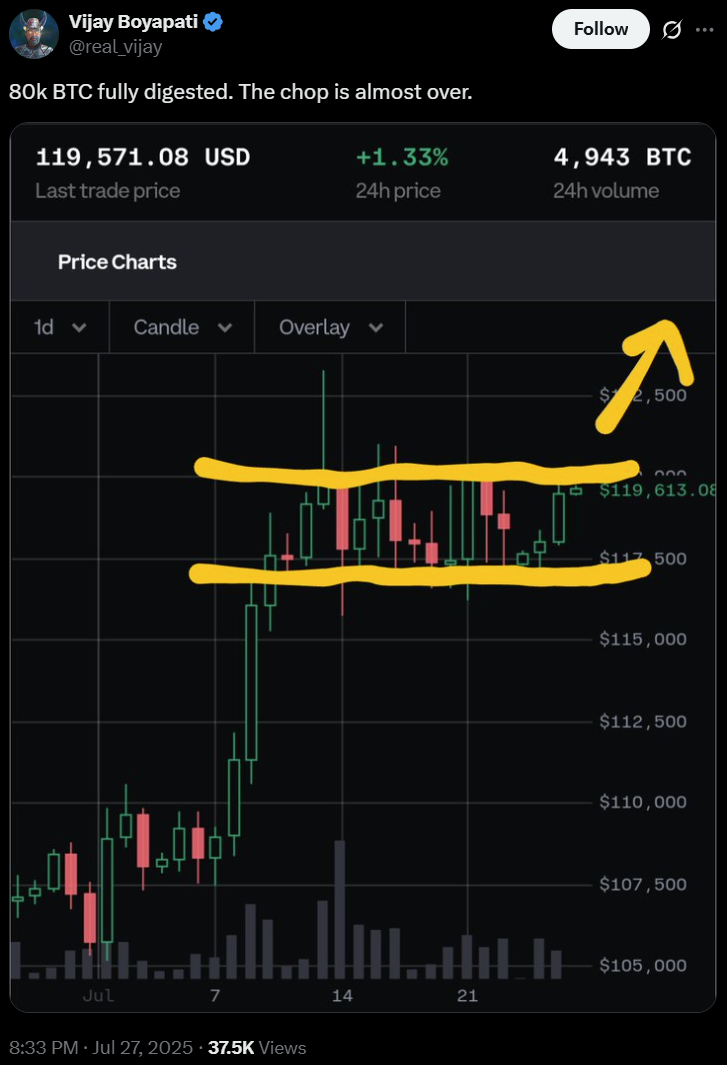

Adding to the narrative, a long-dormant entity from the Satoshi Nakamoto era recently realized profits of $9.7 billion. This transaction involved the sale of 80,000 BTC. The sale was executed via Galaxy Digital and routed through major exchanges like Binance, Bybit, Coinbase, and Bitstamp. Despite an immediate, albeit brief, market dip, the price of Bitcoin quickly rebounded. This rapid recovery suggests robust demand and the market’s capacity to absorb large-scale liquidations. This contrasts the previous situation, proving a bullish sentiment for Bitcoin.

Market Performance: Bitcoin Versus Traditional Assets

Bitcoin continues to demonstrate superior performance compared to many traditional assets, including the stock market. The S&P 500 reached record highs recently, yet, measured in Bitcoin terms, it is down significantly year-to-date. This performance reinforces Bitcoin‘s narrative as a potential store of value and a hedge against traditional market fluctuations, and shows Bitcoin’s overall strength in this current market cycle.

Looking Ahead: Implications and Considerations

The recent profit-taking activity serves as a reminder of the inherent volatility within the cryptocurrency market. While the participation of “new whales” and the resurgence of older entities add complexity to market analysis, it’s essential to consider the broader context. Market trends, regulatory developments, and the overall sentiment surrounding Bitcoin will continue to shape the market. The actions of these whales, in particular, warrant close observation as we move forward.