Bitcoin Navigates New Highs: Uptober‘s Uncertain Path

Bitcoin (BTC) has once again reached uncharted territory, achieving a new all-time high. However, the crypto market is not solely celebrating. The excitement is tempered by cautious optimism as analysts and traders alike begin to assess the landscape for the remainder of October. The question at hand: is a rapid ascent to $150,000 realistic, or will Bitcoin consolidate before its next major move?

Consolidation Phase Ahead?

The current consensus leans towards a period of consolidation. Several market participants suggest that Bitcoin might need time to build a solid foundation before attempting another significant price surge. This expectation is fueled by technical analysis and insights from advanced analytical tools, including AI-powered prediction models.

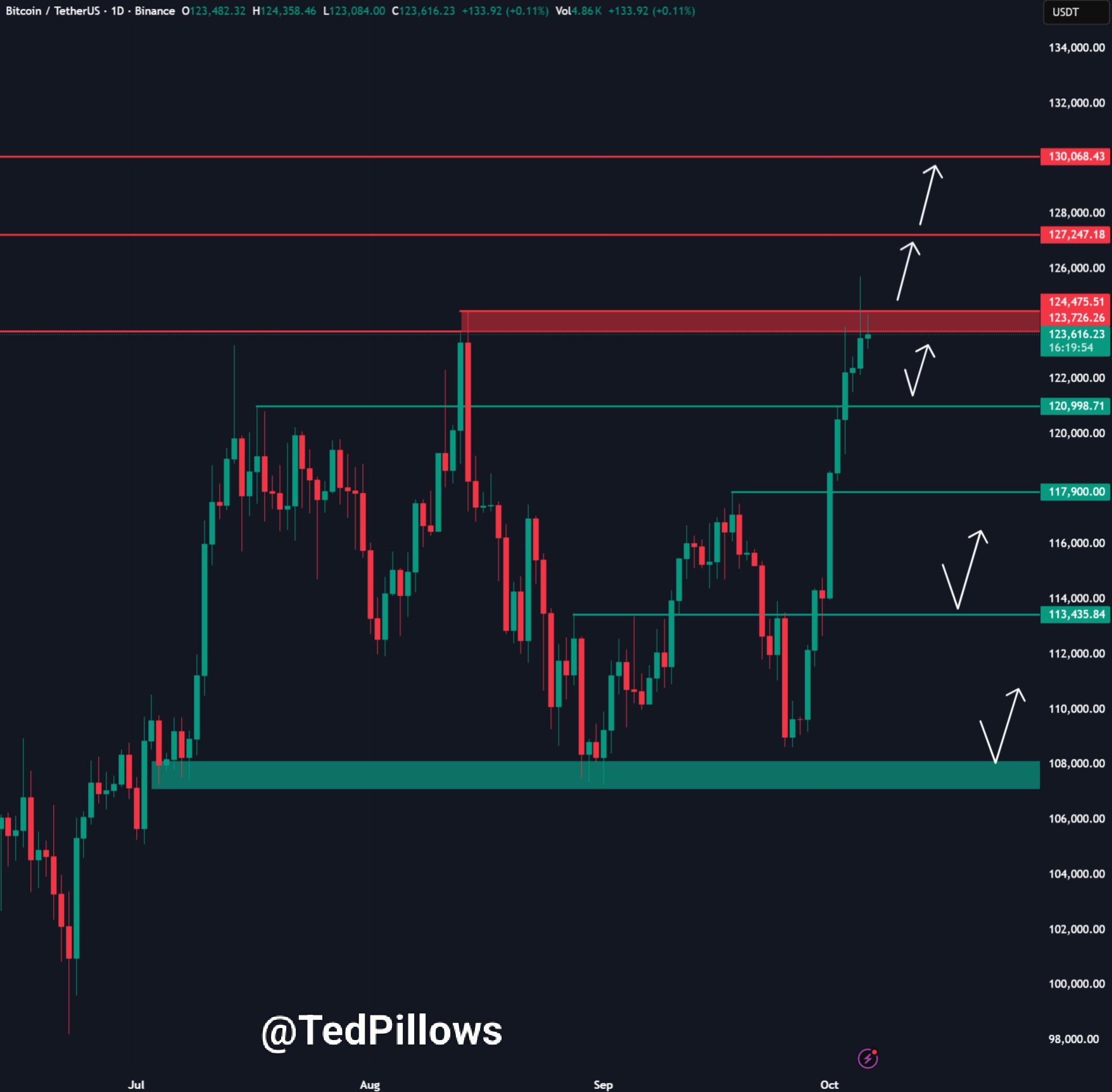

Key Support and Resistance Levels

Several key levels are under the spotlight for potential support and resistance. The 50-period Exponential Moving Average (EMA) on the four-hour timeframe is a focal point. This level, currently around $119,250, is being closely monitored for potential retests. Furthermore, traders are watching a rising trend line that intersects around $118,000. On the resistance side, the $123,000 mark is considered a crucial level that needs to be flipped from resistance into support for sustained bullish momentum.

AI-Driven Insights

Perhaps the most intriguing perspective comes from an AI-based prediction model. The model suggests that an October breakout is less likely, predicting that Bitcoin will continue to fluctuate within the existing range. The AI further highlights that these fluctuations are expected to occur primarily in the upper half of this range. This suggests that, while a dramatic price surge might be delayed, the overall outlook remains bullish for the medium to long term.

Macroeconomic Headwinds and Tailwinds

External factors are also influencing the market. The ongoing US government shutdown is delaying the release of crucial macroeconomic data, leaving Federal Reserve officials to navigate uncertainty. While the shutdown has the potential to disrupt markets, its impact has so far been limited. Further, the sentiment within the market is greedy, but not excessively so, as per the Fear & Greed Index, suggesting investors are still relatively calm despite the new all-time highs.

Expert Opinions and Market Sentiment

Several influential figures are contributing their perspectives on the current market conditions.

- Michaël van de Poppe foresees a consolidation phase before Bitcoin pushes towards the $150,000 target.

- Rekt Capital emphasizes the importance of establishing support at the top of the current trading range before a sustained move upwards.

- The generally held consensus is that “Uptober” may not play out as swiftly as some might hope.

Conclusion: Patience is Key

The path forward for Bitcoin appears to involve a blend of technical analysis, AI predictions, and macroeconomic influences. While the prospect of immediate gains may be tempered, the overall trend remains positive. Patience, coupled with a keen eye on key support and resistance levels, will be essential for navigating the weeks ahead.