ARK Invest Still Bullish on Bitcoin‘s Long-Term Prospects

Despite recent volatility in the cryptocurrency market, investment management firm ARK Invest, led by Cathie Wood, is holding firm on its bullish outlook for Bitcoin. Wood recently reiterated the firm’s $1.5 million Bitcoin price target for 2030, a figure that has remained consistent even amidst market corrections and evolving economic conditions. This unwavering confidence stems from a belief in improving market dynamics and anticipated shifts in US monetary policy.

Liquidity and Monetary Policy: The Fuel for a Potential Rally

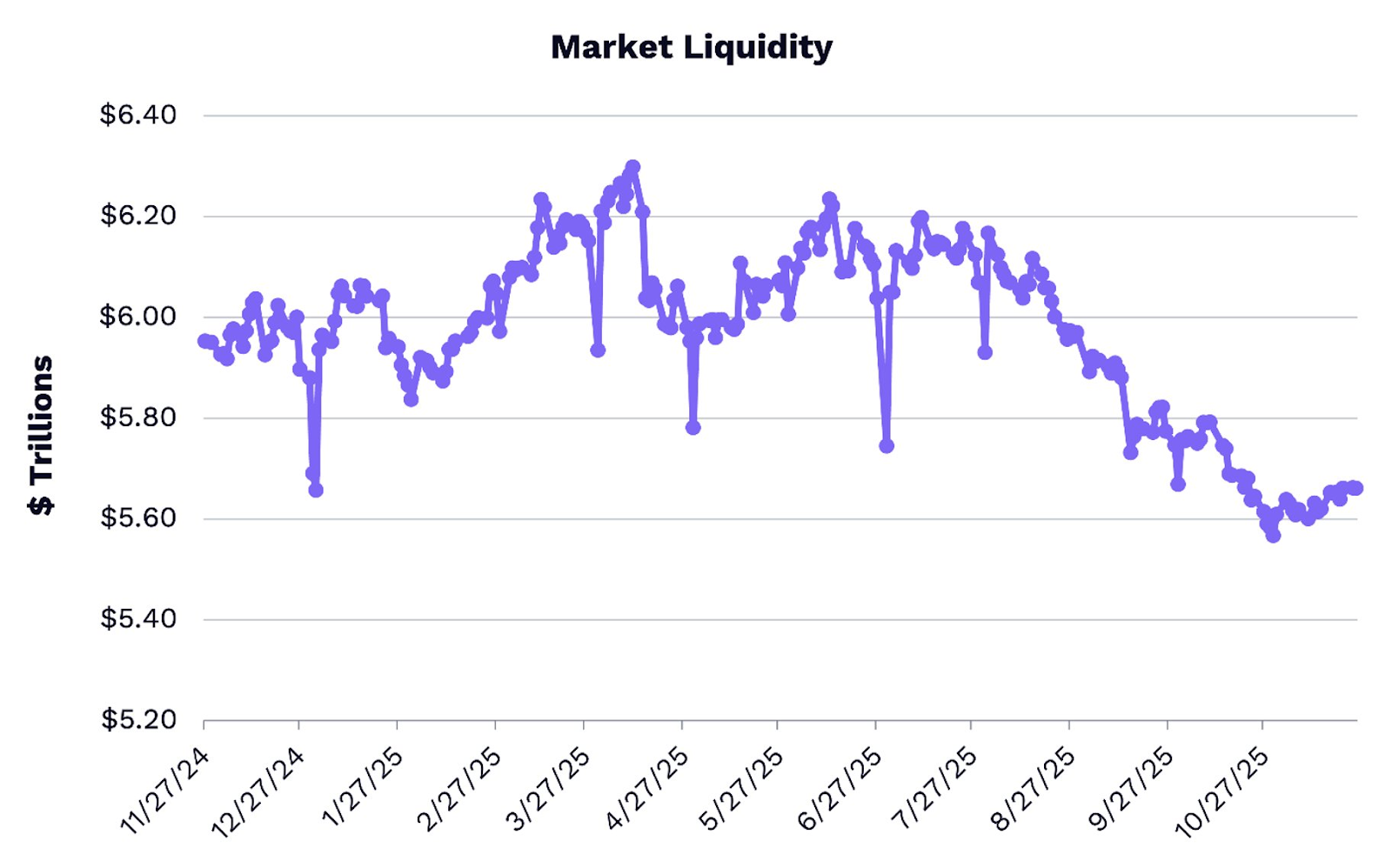

ARK Invest sees several catalysts potentially fueling a positive turn for Bitcoin and the broader market. One key factor is the anticipated return of liquidity. Following the end of the US government shutdown, approximately $70 billion has already flowed back into markets, with an estimated $300 billion more expected to return in the coming weeks. Furthermore, the firm highlights the potential impact of the Federal Reserve’s shift towards quantitative easing (QE), scheduled to end its quantitative tightening program on December 1st. This move, which involves bond-buying to lower borrowing costs and stimulate economic activity, is seen as a supportive factor for market growth.

Wood’s Perspective: Stablecoins and Gold’s Performance

Wood acknowledged during a recent webinar that stablecoins have gained prominence, potentially impacting Bitcoin‘s role as a safe-haven asset. However, she emphasized that this effect is offset by the unexpected appreciation of gold. “So net, our bull price, which most people focus on, really hasn’t changed,” Wood stated. This indicates that while the landscape is shifting, ARK Invest believes the fundamental drivers supporting their long-term price target remain valid.

Market Sentiment and Analyst Predictions

Other prominent figures in the crypto space share Wood’s optimism. Arthur Hayes, co-founder of BitMEX, has predicted a substantial Bitcoin rally, potentially reaching $250,000, if the Federal Reserve pivots to QE. However, market conviction remains fragile. As Iliya Kalchev, dispatch analyst at Nexo, noted, a broader recovery may depend on Bitcoin reclaiming the $92,000 level, which could open the door for a more significant upswing, provided that macro conditions align favorably.

Key Takeaways

- ARK Invest maintains its $1.5 million Bitcoin price target for 2030.

- Improving liquidity and a shift towards quantitative easing are seen as potential catalysts.

- Wood acknowledges the impact of stablecoins but highlights the positive performance of gold.

- Market analysts share optimistic outlooks, though market conviction remains uncertain.

The coming months will be crucial in determining whether these predictions materialize. The interplay of liquidity, monetary policy, and evolving market dynamics will be closely watched by investors as they navigate the volatile world of cryptocurrencies.