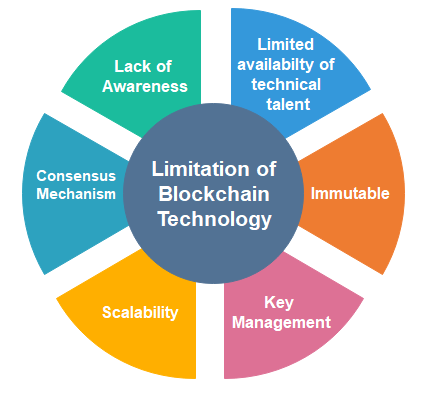

Blockchain technology has gained significant attention over the years for its potential to revolutionize various industries by providing decentralized, secure, and transparent systems. While blockchain promises many benefits, its widespread adoption faces several challenges and limitations. These issues need to be addressed to unlock the full potential of blockchain and ensure its long-term success.

1. Scalability Issues

The Current Landscape:

One of the most significant challenges facing blockchain technology is scalability. As the number of users and transactions on a blockchain network increases, the system often faces slow processing times and high transaction fees.

For example, Bitcoin’s blockchain processes around 7 transactions per second (TPS), while Ethereum can handle roughly 30 TPS. In comparison, traditional payment systems like Visa can process thousands of transactions per second. This disparity highlights the scalability problem that blockchain networks need to address.

Why Scalability is an Issue:

- Transaction Speed: Blockchain’s consensus mechanisms, such as Proof of Work (PoW), are designed to ensure the integrity and security of transactions. However, they are not optimized for high-speed transactions, leading to delays in processing.

- Block Size and Time: Each blockchain block has a limited size, and it takes time to confirm transactions. As more transactions are added to the network, the block size and time constraints cause congestion, leading to slower processing times.

Solutions:

- Layer-2 Solutions: Technologies like Lightning Network (for Bitcoin) and Plasma (for Ethereum) are designed to help scale blockchain networks by allowing off-chain transactions that are later settled on the main blockchain.

- Sharding: This is a method that divides the blockchain into smaller, more manageable pieces called “shards.” Each shard can process its transactions, improving the overall speed and scalability of the network.

- Alternative Consensus Mechanisms: Proof of Stake (PoS) and other consensus algorithms are being explored to replace PoW. PoS, for example, reduces the computational power needed to verify transactions, leading to faster processing.

2. High Energy Consumption

The Current Landscape:

Blockchain networks that use Proof of Work (PoW), such as Bitcoin, consume a significant amount of energy. This has raised concerns about the environmental impact of blockchain technology. Mining operations require massive computational power to solve complex mathematical puzzles, which results in high electricity consumption.

For instance, Bitcoin mining alone consumes more electricity annually than some entire countries, leading to debates about the environmental sustainability of PoW blockchains.

Why Energy Consumption is an Issue:

- Mining Power: The mining process requires a vast amount of computational resources to validate transactions and secure the network. This power-intensive process contributes to blockchain’s carbon footprint.

- Increasing Demand: As more people adopt blockchain-based applications, the energy demands of the networks will only increase, further exacerbating the environmental concerns.

Solutions:

- Proof of Stake (PoS): Ethereum’s transition to PoS aims to reduce energy consumption by replacing miners with validators who are chosen based on the number of coins they hold and are willing to “stake” as collateral.

- Hybrid Consensus Mechanisms: Some blockchains are experimenting with hybrid consensus mechanisms that combine the benefits of PoW and PoS to improve energy efficiency.

- Renewable Energy Sources: Encouraging mining operations to use renewable energy sources, like solar or wind power, can help mitigate blockchain’s environmental impact.

3. Regulatory Uncertainty

The Current Landscape:

Blockchain technology operates in a decentralized, borderless environment, which makes it difficult for governments and regulators to establish clear frameworks. This regulatory uncertainty can be a significant barrier to the adoption of blockchain technology, especially for businesses and financial institutions.

- Cryptocurrency Regulations: Cryptocurrencies, a major use case for blockchain, have been at the forefront of regulatory challenges. Countries have different approaches to regulating cryptocurrencies, ranging from complete bans (e.g., China) to partial regulation (e.g., the United States and Europe).

- Data Privacy and Compliance: Blockchain’s transparency, which is one of its advantages, can also be a liability when it comes to complying with data privacy laws like the General Data Protection Regulation (GDPR) in Europe. Since transactions are immutable, personal data that is recorded on a blockchain could be difficult to delete or modify, violating privacy regulations.

Why Regulatory Uncertainty is an Issue:

- Lack of Legal Clarity: The legal status of blockchain-related activities, such as cryptocurrency trading, Initial Coin Offerings (ICOs), and smart contracts, is still unclear in many jurisdictions.

- Cross-Border Issues: Blockchain operates across borders, which complicates regulatory enforcement. Different countries may have conflicting regulations, making it difficult for global businesses to navigate blockchain adoption.

Solutions:

- Clearer Regulatory Frameworks: Governments and regulators are working to develop clearer guidelines around blockchain and cryptocurrencies. International collaboration on regulations will help create a more predictable environment for blockchain adoption.

- Regulatory Sandboxes: Some countries have introduced regulatory sandboxes, where blockchain companies can test their products in a controlled environment while regulators assess the risks and benefits.

4. Security and Vulnerability Issues

The Current Landscape:

Blockchain is often hailed as an incredibly secure technology, with cryptographic techniques ensuring the integrity of transactions. However, while the blockchain itself is secure, vulnerabilities can still exist in other areas of the system, such as smart contracts and user behavior.

- Smart Contract Bugs: Smart contracts, which are self-executing agreements on the blockchain, are vulnerable to coding errors. If a bug is present in the smart contract, it can be exploited by malicious actors.

- 51% Attacks: Although difficult and expensive, blockchain networks using Proof of Work are susceptible to 51% attacks. In such an attack, if an entity controls more than 50% of the mining power, it can potentially manipulate the blockchain and double-spend coins.

- Phishing and Private Key Theft: While the blockchain itself is secure, individuals and organizations are often targeted through phishing attacks or by having their private keys compromised.

Why Security is an Issue:

- Human Error: Users and developers can make mistakes that result in vulnerabilities, such as poor smart contract design or inadequate protection of private keys.

- Hackers and Exploits: Blockchain-based systems are not immune to hacking. The exploitation of vulnerabilities in exchanges, wallets, or smart contracts has led to substantial losses for individuals and organizations.

Solutions:

- Security Audits: Regular audits of smart contracts and blockchain platforms can help identify vulnerabilities before they are exploited.

- Multi-Signature Wallets: Using multi-signature wallets (which require more than one key to authorize a transaction) can help prevent theft and unauthorized access.

- Improved Consensus Mechanisms: More robust consensus mechanisms, such as Proof of Stake or hybrid models, can help reduce the likelihood of a 51% attack.

5. User Experience and Adoption Barriers

The Current Landscape:

For blockchain to achieve mass adoption, user experience (UX) plays a critical role. Currently, interacting with blockchain-based systems can be complex, requiring technical knowledge that many users lack.

- Wallet Management: Managing private keys, cryptocurrency wallets, and decentralized applications (DApps) can be challenging for non-technical users.

- Transaction Fees: High transaction fees on blockchain networks, especially during periods of congestion, can make blockchain applications less appealing for everyday use.

Why User Experience is an Issue:

- Complexity: Setting up wallets, managing keys, and interacting with decentralized applications (DApps) require a level of technical expertise that can be a barrier to entry for the average user.

- Cost: Transaction fees, such as the “gas fees” on the Ethereum network, can fluctuate and become prohibitively expensive during periods of high demand.

Solutions:

- User-Friendly Interfaces: Blockchain developers are working to create more intuitive and accessible interfaces, enabling users to interact with blockchain systems without needing technical knowledge.

- Layer-2 Solutions: Layer-2 solutions, such as Polygon for Ethereum, aim to reduce transaction fees and improve the user experience by offering faster and cheaper transactions.

Conclusion

Blockchain technology holds immense promise, but it also faces a range of challenges and limitations that must be addressed before it can be adopted on a mass scale. Scalability, energy consumption, regulatory uncertainty, security vulnerabilities, and user adoption barriers are some of the key obstacles standing in the way of blockchain’s widespread use.

While solutions are being developed to overcome these challenges, it will take time and innovation to ensure that blockchain can deliver on its full potential. As blockchain continues to evolve, it is essential for developers, regulators, and industry stakeholders to work together to address these issues and create a more sustainable, secure, and user-friendly ecosystem for blockchain applications.

By overcoming these challenges, blockchain could become a transformative force that reshapes industries and revolutionizes the way we interact with technology, data, and digital assets.