Government Reopening and the Crypto ETF Landscape

The recent resumption of normal legislative sessions in the United States, following the end of government shutdowns, is generating significant buzz within the cryptocurrency market. According to market analysts, this development could catalyze a wave of approvals for new crypto exchange-traded funds (ETFs) by the Securities and Exchange Commission (SEC) in the coming years. This potential influx of new investment vehicles is poised to reshape the landscape of digital asset investment and potentially infuse fresh capital into the market.

ETF-palooza: A Market Anticipation

Industry experts are predicting what could be termed an “ETF-palooza” in the crypto sector. Matt Hougan, Chief Investment Officer at Bitwise, a prominent investment firm, estimates that we could see over 100 crypto ETF launches. He anticipates a proliferation of single-asset crypto ETPs, with a particular focus on the expansion of index-based crypto ETPs. This interest stems from the desire of investors to diversify their portfolios by gaining passive exposure to various digital assets through a single investment vehicle. These products facilitate the flow of capital from traditional financial markets into cryptocurrencies, potentially driving up prices.

Mixed Signals: Inflows and Outflows

The narrative surrounding crypto ETFs is complex. While demand is undeniably present, the market also exhibits periods of outflow. The recent launch of Canary Capital’s XRP ETF (XRPC) saw a robust debut, with significant trading volume on its first day. However, even with this initial success, the price of XRP experienced a downturn, illustrating the volatile nature of the market.

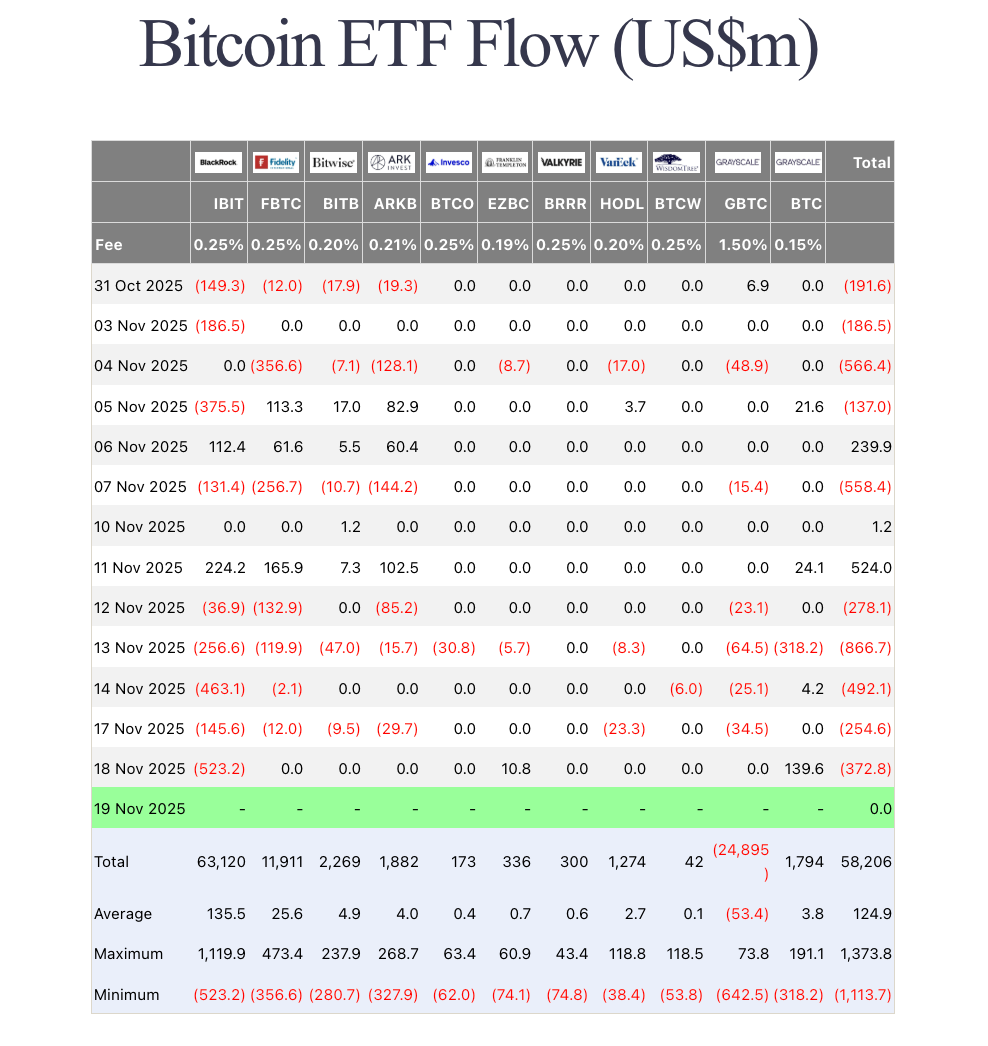

Similarly, Bitcoin ETFs have shown net outflows, particularly in recent weeks, causing some investors to hold underwater positions.

These trends reflect the inherent volatility of the crypto market and the sensitivity of these investment vehicles to broader market sentiment. It is important to remember that markets can be unpredictable.

Impact and Implications

The growth of crypto ETFs is a pivotal trend with wide-ranging implications. The accessibility and liquidity offered by these instruments can draw in institutional and retail investors who may be hesitant to directly hold digital assets. However, the performance of these ETFs remains inextricably linked to the underlying assets. While ETFs may act to increase prices, declines in prices of the underlying asset can have a devastating effect on investor value.

Investor Sentiment and the Future

Long-term Bitcoin whales were responsible for the majority of Bitcoin sold in recent months. The crypto market’s future trajectory hinges on a delicate balance of factors, including regulatory developments, institutional adoption, and overall investor sentiment. The continued evolution of crypto ETFs will undoubtedly play a crucial role in shaping the direction of the digital asset market.