The Rise of A7A5: A Sanction-Defying Stablecoin

In a surprising turn of events, the Russian ruble-backed stablecoin A7A5 has become the largest non-US dollar stablecoin, defying international sanctions and raising eyebrows within the cryptocurrency community. With a market capitalization nearing $500 million, A7A5 now accounts for a significant 43% of the total non-USD stablecoin market, according to data from CoinMarketCap and DefiLlama. This ascendance highlights the dynamic and evolving nature of the digital asset space, particularly in the context of geopolitical tensions and regulatory scrutiny.

A Brief History of A7A5

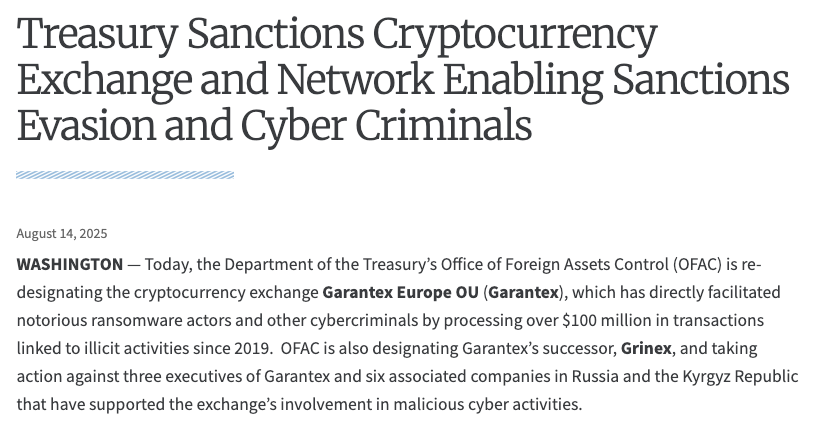

Launched in February, A7A5 positioned itself as a stablecoin backed by ruble deposits held in Kyrgyz banks. Initially issued on Ethereum and Tron, the project promised daily passive income derived from deposit interest. However, its origins quickly became a point of contention. Blockchain analysts linked A7A5 to Grinex, a crypto exchange suspected of being a successor to the sanctioned Garantex exchange. The situation escalated when the US Treasury imposed sanctions on Garantex and related entities, also identifying a Moldovan oligarch as a key figure behind A7A5’s issuer.

Despite facing significant international sanctions, A7A5 has not only survived but thrived. The United Kingdom also sanctioned several Kyrgyz banks allegedly used by A7A5 to circumvent financial restrictions. A key driver of its recent growth was a massive $350 million surge in market capitalization within a single day. This propelled A7A5 past other stablecoins like EURC, which is pegged to the Euro, further solidifying its dominance in the non-USD stablecoin arena.

Token2049 and Controversies

A7A5‘s prominent presence at the recent Token2049 conference in Singapore sparked considerable debate. Its appearance at the major crypto industry event raised questions surrounding sanctions compliance, regulatory loopholes, and the project’s growing international reach. Some members of the crypto community raised concerns about the firm’s legitimacy and its potential role in aiding the evasion of financial restrictions.

Geopolitical Implications and Chinese Ties

Further complicating matters are allegations of A7A5‘s connection to China. Reports suggest a significant portion of its transactions flow through Chinese jurisdictions. The Centre for Information Resilience (CIR) reported that almost 80% of transactions went through Chinese jurisdictions. Furthermore, A7A5 has expanded into Africa, establishing offices in countries such as Nigeria and Zimbabwe. This expansion raises questions about potential financial flows and any links to Russian political influence.

What’s Next for A7A5?

The ongoing saga of A7A5 serves as a compelling illustration of the complex interplay between cryptocurrency, international sanctions, and geopolitical strategies. Its rapid ascent raises crucial questions about the future of stablecoins and their role in facilitating cross-border transactions. As investigations continue, and the regulatory landscape evolves, the long-term sustainability of A7A5, and its broader impact, remains a subject of intense scrutiny. The stablecoin‘s journey is far from over, and its implications will likely be felt across the globe.