Ethereum‘s Price Stalls: A Deeper Dive

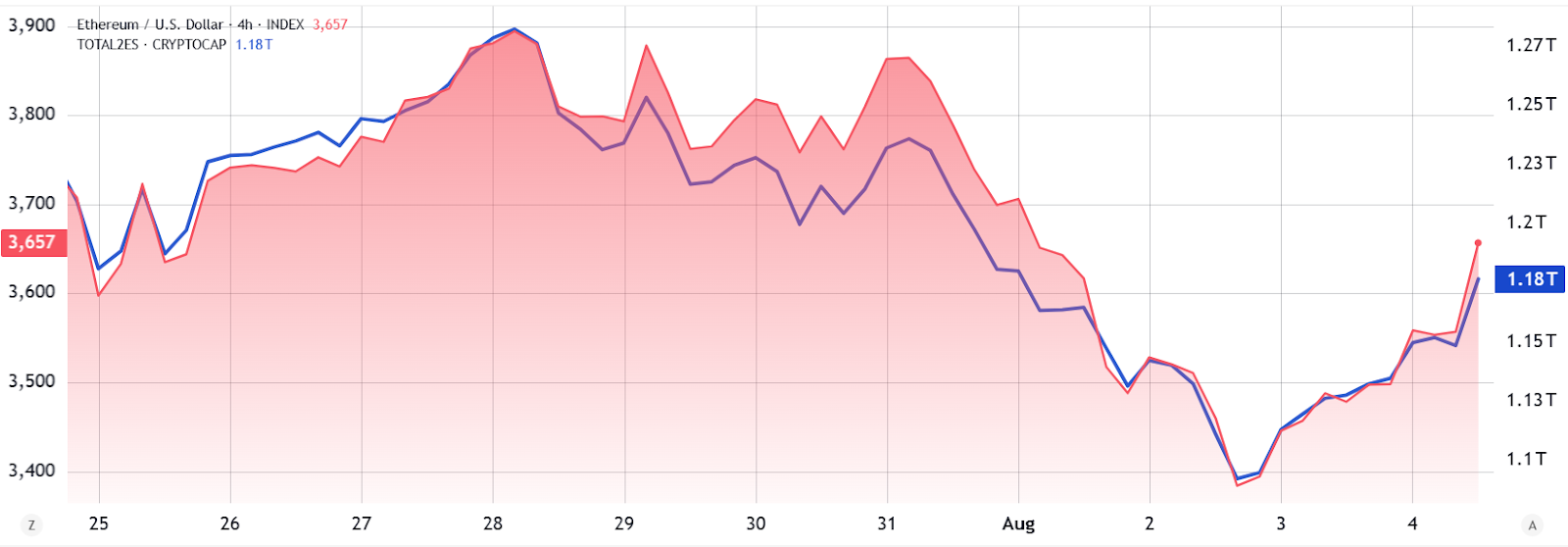

Ethereum (ETH) has recently shown a modest price recovery, yet its path towards reclaiming the $3,800 mark, let alone breaking higher, appears fraught with challenges. While a 9% gain from recent lows might seem promising, deeper analysis reveals a market hesitant to fully commit to a sustained bullish trend. This reluctance is largely attributable to a confluence of factors, primarily the absence of strong institutional buying pressure, as indicated by various market metrics.

Derivatives Data Paints a Mixed Picture

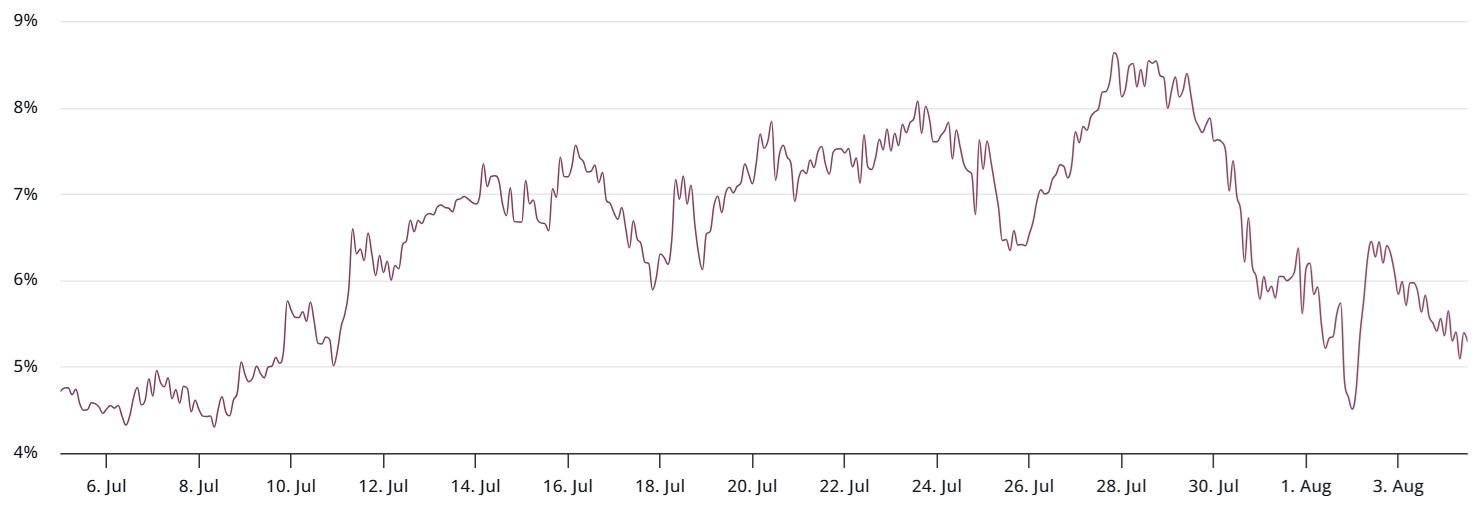

Examining derivatives markets offers valuable insights into investor sentiment. Ether’s futures and options data currently signal a neutral-to-bearish outlook. The 3-month futures annualized premium hovers around the neutral threshold, a concerning sign considering that even price levels approaching $3,900 failed to stimulate bullish sentiment. This suggests that traders are not yet convinced of a sustained upward trajectory for ETH.

The Role of Institutional Investors

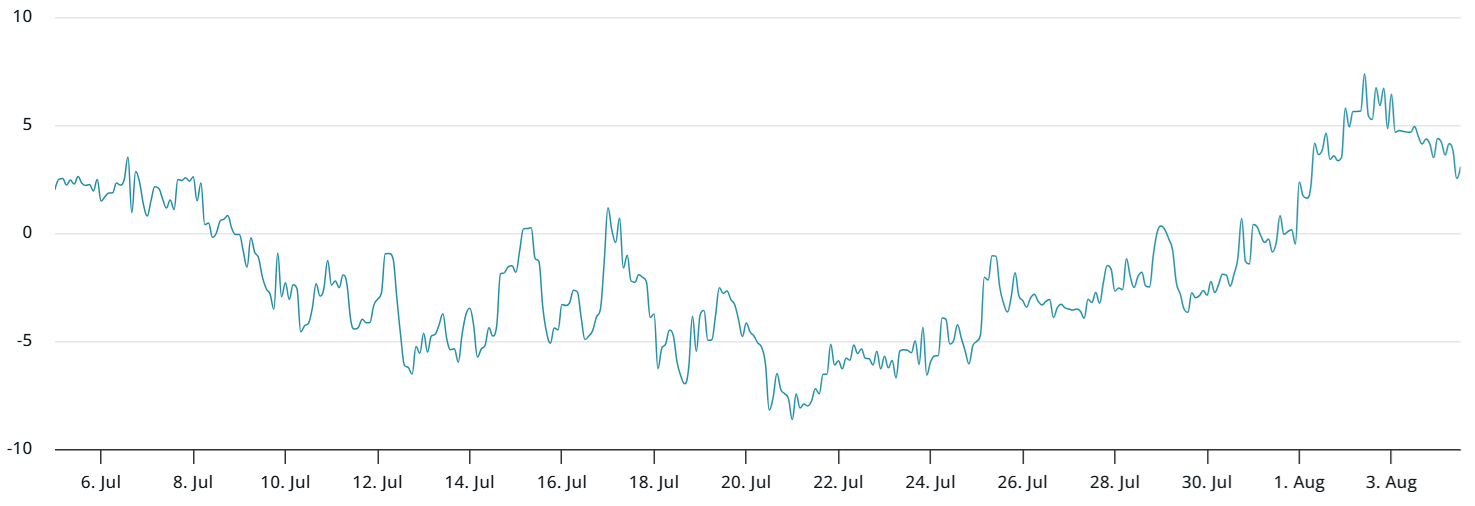

Institutional interest, or the lack thereof, plays a crucial role in Ethereum‘s price movements. Evidence suggests a decline in institutional demand. This is further supported by the observation of Ether spot exchange-traded funds (ETFs) experiencing significant net outflows. These outflows, coupled with a slight discount on Coinbase and Kraken compared to other exchanges like Binance and Bitfinex, hint at weaker demand from institutional players. Historically, premiums on exchanges like Coinbase and Kraken have indicated institutional accumulation, which is currently not the case.

Factors Weighing Down ETH

Several factors contribute to the challenges Ethereum faces. The decline in Total Value Locked (TVL) on the Ethereum network, while still dominating in USD terms, reflects a slowdown in activity within the decentralized application (DApp) ecosystem. Other blockchain platforms like BNB Chain and Solana show positive TVL growth in comparison. Moreover, broader macroeconomic concerns, such as global trade war risks and uncertainties surrounding the US job market, further dampen overall market sentiment.

Options Market Signals Investor Hesitation

The options market provides another lens through which to assess investor sentiment. The 25% delta skew (put-call) indicator is currently hovering around neutral, indicating a balanced risk assessment. This implies that bullish sentiment has not yet fully returned, as the demand for protective put (sell) options is not significantly higher than for call (buy) options. The current readings suggest that investors are hedging against potential downside risks rather than aggressively betting on an upward price movement.

Conclusion: The Path Forward for ETH

Without a resurgence of institutional interest and positive catalysts to drive demand, ETH is likely to continue moving in alignment with the broader altcoin market. Breaking the $3,800 barrier appears unlikely in the short term, given current market dynamics. A shift in investor sentiment, supported by strong institutional inflows and positive ecosystem developments, will be essential for Ethereum to overcome its current hurdles and resume a sustained upward trend.