Metaplanet Faces Bitcoin Valuation Headwinds After Market Correction

Japanese investment firm Metaplanet experienced a notable decrease in its Bitcoin valuation gains during the third quarter, a direct consequence of the October crypto market downturn. The company reported gains of 10.6 billion yen (approximately $1.4 billion) from its Bitcoin holdings. While still substantial, this figure represents a significant 39% decline compared to the previous quarter’s 17.4 billion yen ($2.4 billion), as detailed in their recent financial disclosures.

The Aftermath of the Crypto Market Rout

The aftermath of the substantial $19 billion market correction on October 10th continues to influence the strategies of corporate Bitcoin holders like Metaplanet. The investment firm’s Bitcoin holdings are presently underwater, given their average acquisition cost of $108,000 per Bitcoin, with the current price hovering around $103,000. This underlines the inherent volatility of the cryptocurrency market and the impact on entities that have embraced Bitcoin as a core component of their financial strategy.

Strategic Outlook and Acquisition Goals

Despite the short-term fluctuations, Metaplanet remains committed to its long-term Bitcoin acquisition strategy. They aim to amass 210,000 Bitcoins by the end of 2027, primarily through equity financing. In a statement, Metaplanet emphasized that their “Bitcoin Treasury Business continues to progress steadily in line with plan and is not dependent on short-term price fluctuations.”

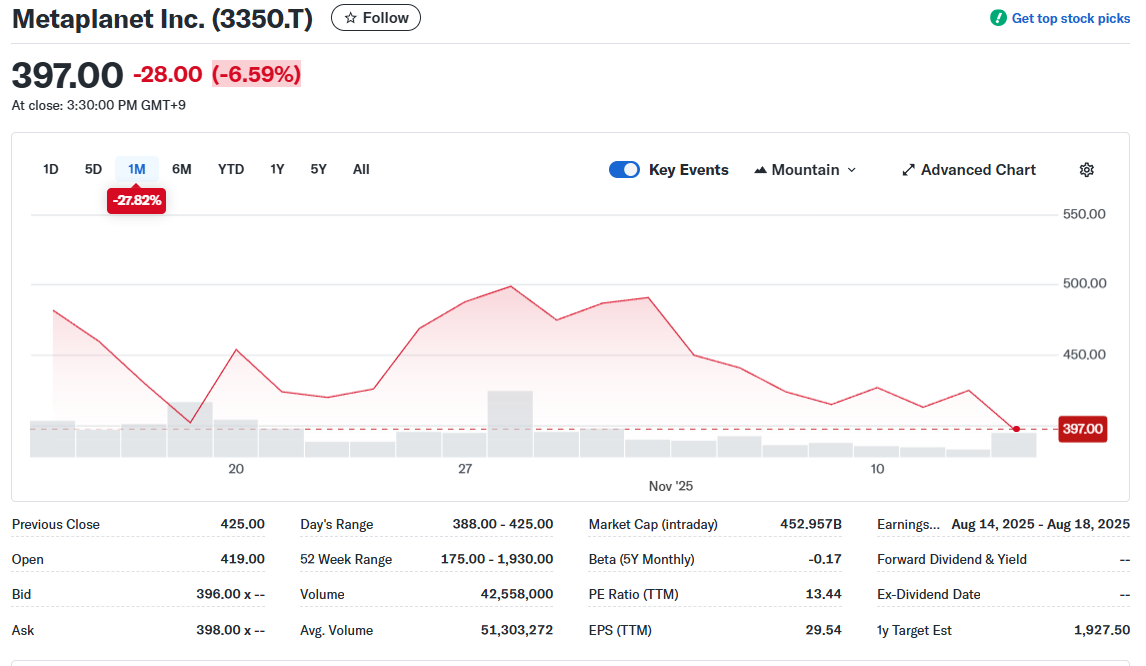

Financial Metrics and Market Pressures

Beyond the Bitcoin valuation, Metaplanet also disclosed a stock amortization cost of $26 million for the third quarter, which is linked to the costs associated with issuing new shares. Moreover, the company’s stock price has experienced downward pressure, declining over 27% in the past month. This decline is partly fueled by concerns surrounding potential regulatory scrutiny from the Japan Exchange Group (JPX) regarding publicly listed cryptocurrency holding firms. However, Metaplanet’s CEO has indicated that these concerns primarily target companies that may not adhere to rigorous approval processes and disclosure rules.

Analyst Perspectives and Risk Assessment

Analysts are scrutinizing Metaplanet‘s approach, including a recent $100 million Bitcoin-backed loan secured to acquire more BTC. The loan, which used Bitcoin holdings as collateral, aims to reduce their overall cost basis. However, some analysts view this strategy with skepticism, given the current market dynamics. As macro analyst Kashyap Sriram noted, the company’s significant position is currently “5% underwater.”

Looking Ahead

The situation underscores the risks and rewards of incorporating Bitcoin into corporate treasuries. While Metaplanet remains optimistic about its long-term vision, its financial performance is undeniably linked to the volatile nature of the cryptocurrency market. The company’s ability to navigate market corrections and regulatory changes will be crucial in achieving its long-term Bitcoin acquisition targets.