NFT Winter’s Deep Freeze: A Look at the Declining Market

The non-fungible token (NFT) market is enduring a significant downturn, with monthly sales figures hitting the lowest point of the year. This latest dip highlights a persistent struggle for digital collectibles, mirroring the broader trends seen in the cryptocurrency market. The data paints a concerning picture for investors and creators alike, with implications extending beyond the immediate numbers.

Sales Figures Tell a Story

Recent reports reveal a sharp decline in NFT sales. In November, the market witnessed a substantial reduction in transaction volume, falling to $320 million, a considerable drop from October’s $629 million. This figure places the market back to levels not seen since September 2024. The early days of December offered little respite, with a mere $62 million in sales during the first week, marking the weakest weekly showing of 2025. This slow start suggests that the negative trend might persist.

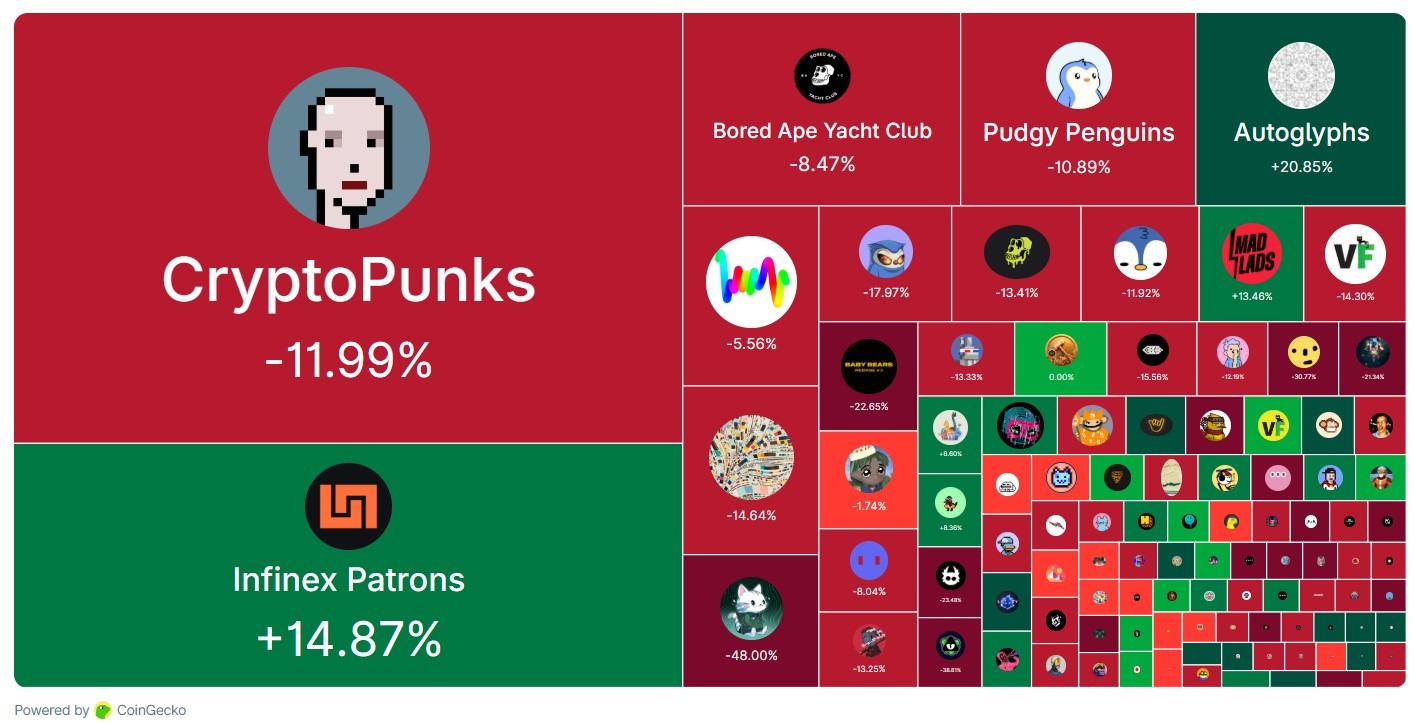

Blue Chip Blues and Contrasting Performances

The downturn has impacted prominent NFT collections. CryptoPunks, a leading collection by market capitalization, experienced a notable decline, dropping 12% in the last 30 days. Bored Ape Yacht Club (BAYC) and Pudgy Penguins also felt the pressure, with drops of 8.5% and 10.6%, respectively. Even art-focused collections like Chromie Squiggle and Fidenza haven’t been spared, showing losses during the same period. However, not all collections followed the trend. Infinex Patrons saw gains of 14.9%, and Autoglyphs posted a remarkable 20.9% surge.

The Broader Market Context

This decline in sales volume correlates with a broader market contraction in the overall valuation of the NFT sector. According to CoinGecko, the overall market capitalization has declined significantly, down 66% from its January highs. This drop showcases the current challenges in the market, as market cap has fallen to $3.1 billion, representing a significant correction from its peak. This downturn comes after an October-November slide. Digital collections saw a drop of 46% in just 30 days, going from $6.6 billion to $3.5 billion.

The current landscape highlights the volatility of the NFT market and the complex factors influencing its performance. Despite periodic rebounds, the persistent downward trend suggests that the sector needs to address factors related to wider market sentiment, utility, and user adoption. While some collections like Infinex Patrons and Autoglyphs defy the trend, the overall picture points to a challenging environment for NFT investors and creators as 2025 concludes.