Solana‘s Meteoric Rise: Open Interest Hits New Highs

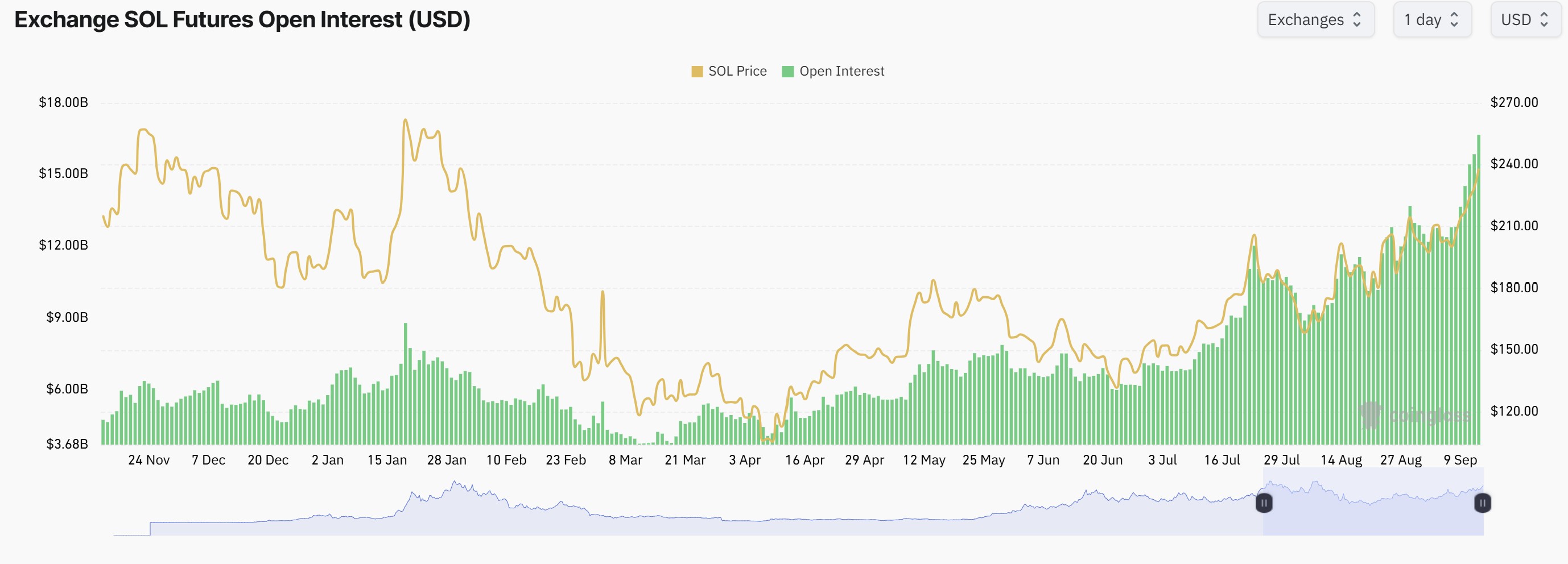

Solana (SOL) is experiencing a remarkable surge in both price and market interest, with its futures open interest reaching an unprecedented $16.6 billion. This surge highlights the growing enthusiasm surrounding the blockchain and its potential for continued growth. The data, sourced from platforms like CoinGlass, paints a compelling picture of a market poised for further expansion, fueled by a confluence of factors from both retail and institutional interest.

Futures vs. Spot: A Tale of Two Markets

While the futures market is booming, the rally appears to be primarily spot-driven. This is a crucial distinction. Analysis shows a buy-heavy net taker volume, which indicates more aggressive buying activity. However, the aggregated futures cumulative volume delta (CVD) remains flat, indicating a balance between long and short positions even at record open interest levels. Simultaneously, the spot CVD is climbing, suggesting the price increase originates from the spot market, traditionally viewed as a healthier setup for sustained upward movement.

Institutional Giants Jump In: Galaxy Digital and Forward Industries

Institutional investors are actively participating in the Solana ecosystem. Arkham Intelligence reports that Galaxy Digital is executing a substantial SOL purchase program on behalf of Multicoin Capital’s Solana DAT. This program has already resulted in a $326 million acquisition of SOL. Moreover, Forward Industries, a Nasdaq-listed firm, announced a $1.65 billion SOL-native treasury, backed by prominent players like Galaxy Digital and Jump Crypto. This represents a significant step forward in corporate adoption of Solana, potentially paving the way for further institutional involvement.

Price Target: The $250 Crucible

The $250 level is a crucial point of interest. Currently trading below its all-time high, SOL hovers near the $250 mark. This level has historically acted as both resistance and support, making it a critical juncture for determining future price movements. A sustained close above $250 could signal a shift in market sentiment and pave the way for a retest of the all-time high and beyond, potentially entering price discovery. Conversely, failure to break through could lead to a period of consolidation.

In conclusion, Solana‘s surging open interest, coupled with spot-driven buying and institutional backing, paints a bullish picture. While the $250 level represents a critical test, the overall market sentiment suggests that Solana could be poised for further growth, potentially reaching new heights in the coming months.