From Humble Beginnings to Crypto Riches

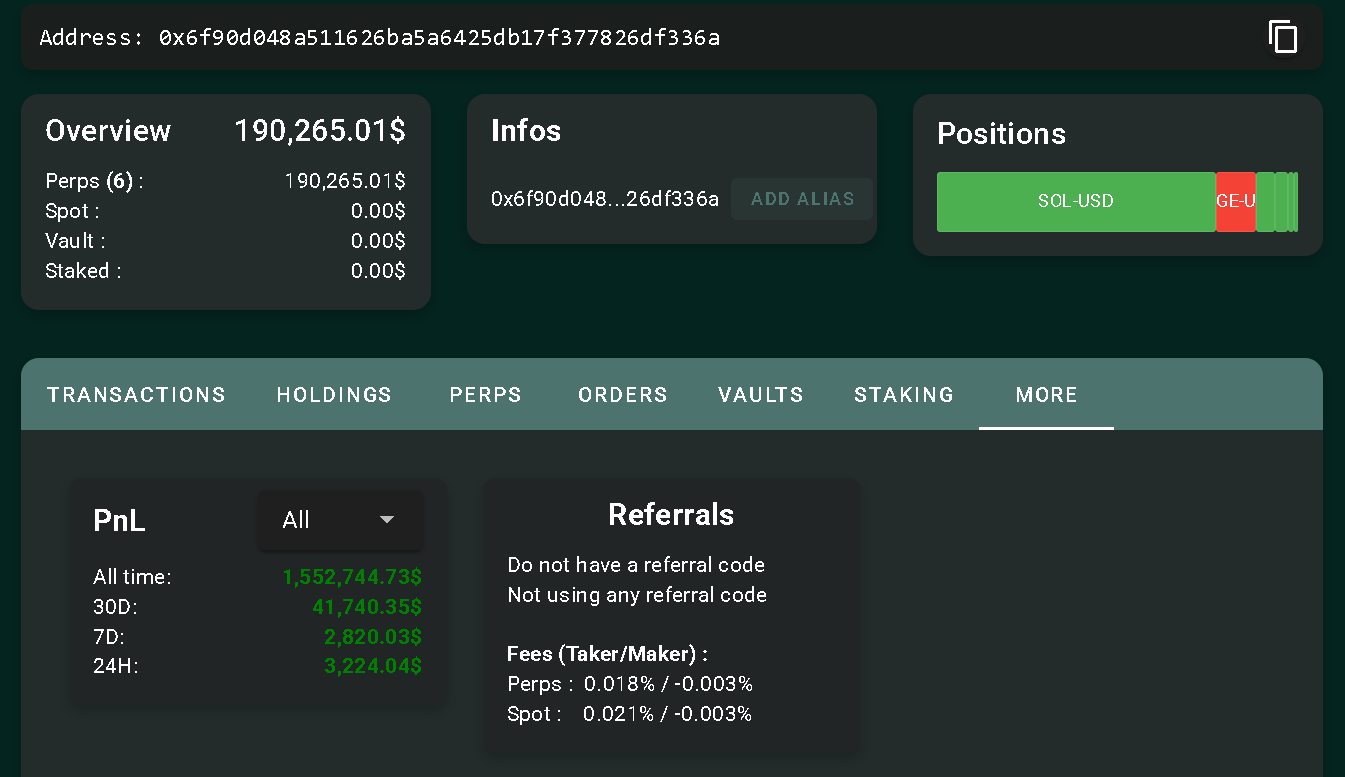

In the volatile world of cryptocurrency trading, stories of meteoric rises and crushing falls are commonplace. However, a recent tale stands out for its sheer audacity and impressive gains. An unknown crypto trader, operating with a relatively modest initial investment of just $6,800, has miraculously transformed that sum into a staggering $1.5 million profit. This remarkable feat has sent ripples of astonishment throughout the crypto community, particularly considering the trader’s unorthodox approach, which has captured the attention of many market observers.

Decoding the Unconventional Strategy

The trader’s success appears to stem from a highly specialized, and potentially high-risk, trading strategy focused on perpetual futures contracts. Publicly available data indicates the trader has consistently provided a significant portion of maker-side liquidity on a major crypto exchange, accounting for over 3% of the total. The strategy, according to available observations, seems to involve quoting only one side of the order book at a time – either bids or asks. This approach, while potentially exposing the trader to adverse selection, allows for the accumulation of profits. The trader’s ability to consistently pull it off suggests sophisticated risk management and execution capabilities.

Inside the Trading Toolkit

The trader appears to be heavily reliant on maker rebates, a common incentive offered by centralized exchanges to attract liquidity providers. These rebates, coupled with the trader’s high-frequency execution and presumably, sophisticated quoting logic, allow for generating profits even before significant price movements occur. The trader’s focus exclusively on perpetual futures contracts, rather than spot holdings or staking, further supports the hypothesis of a high-frequency trading (HFT) or automated market-making (AMM) strategy. There are hints that this trading might be assisted by colocated servers or latency-optimized execution systems. These factors would enable the trader to quickly take advantage of tiny arbitrage opportunities and generate steady returns.

Portfolio Snapshot and Risk Management

As of the latest report, the trader currently maintains a significant long position in Solana (SOL)/Tether (USDT) perpetual futures, valued at $175,000. Simultaneously, a smaller short position in Dogecoin (DOGE), amounting to $20,000, is also in play. The fact that the trader is managing a maximum drawdown of only 6.48% suggests a tightly risk-managed approach, possibly employing a market-neutral strategy to limit exposure to directional price fluctuations.

Community Reaction and Implications

The crypto community has reacted with a mixture of awe and curiosity. Many market observers have praised the trader’s skill and audacity, recognizing the extraordinary nature of the returns achieved. The rapid increase in trading volume over a short period adds further intrigue. This case serves as a strong reminder of the potential for substantial returns in the crypto markets but also highlights the intense competitiveness and risks associated with high-frequency trading. The ability to identify and exploit micro-opportunities in the market, as shown by this trader, underscores the evolving sophistication of crypto trading strategies. It will be interesting to see how this trader fares as their activities are further analyzed by the broader crypto community.