Whales Go Short: A Pre-Trump Market Shift?

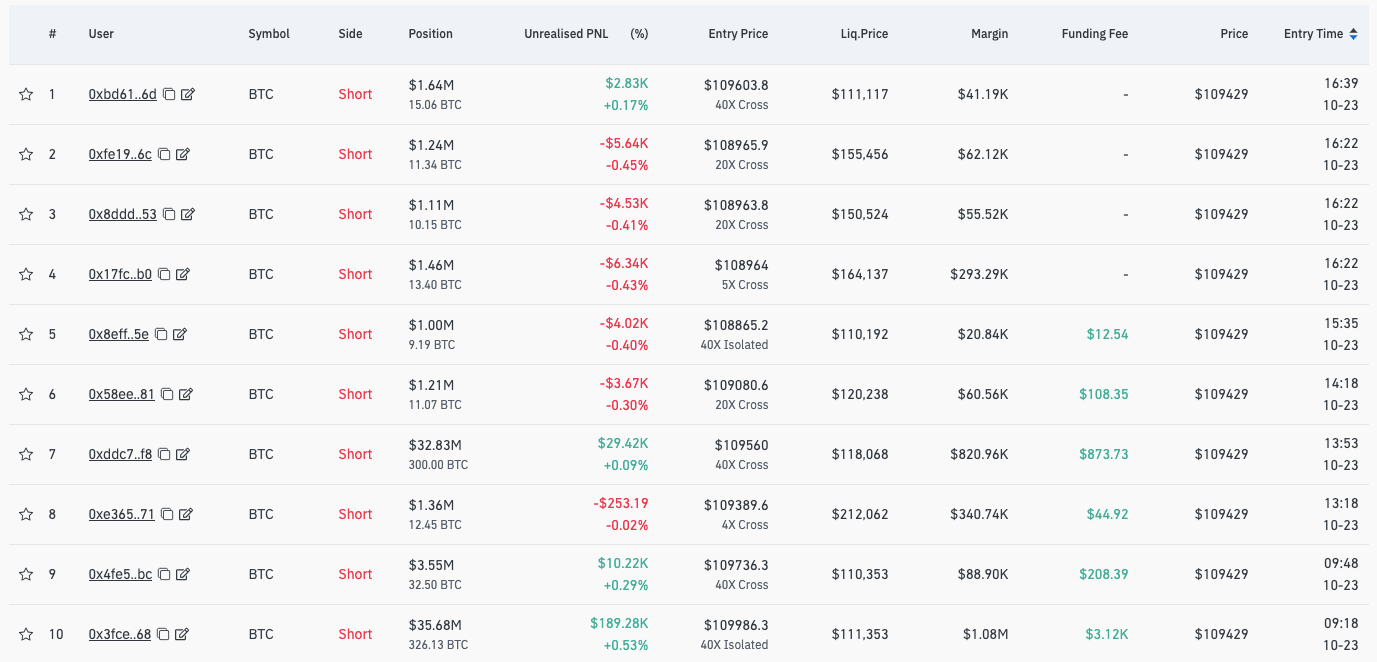

The Bitcoin market is bracing itself for potential volatility. Large-volume Bitcoin traders, often referred to as “whales,” have significantly increased their short positions on the cryptocurrency, a move occurring just hours before a much-anticipated announcement from former US President Donald Trump. This sudden shift towards bearish sentiment raises eyebrows and highlights the heightened risk perception surrounding the current market environment.

Leverage and Liquidation Levels: A Dangerous Combination

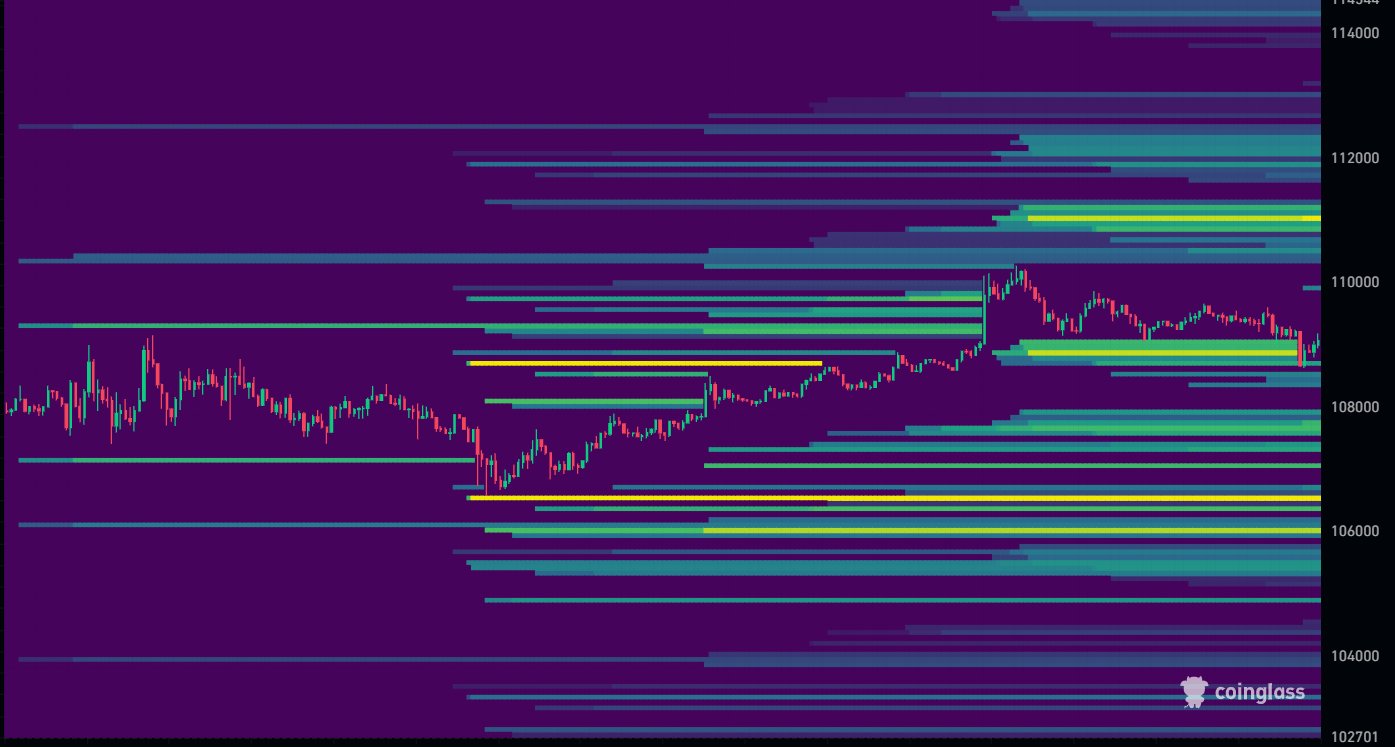

One notable instance of this bearish positioning involves a whale utilizing a staggering 40X leverage on their short position. This high level of leverage amplifies both potential gains and losses, indicating a high-stakes bet on a downward price movement. The substantial risk involved underscores the conviction, or perhaps the perceived certainty, of these market participants. Coupled with this aggressive approach, liquidation levels have become a focal point. Charts from resources like CoinGlass showcase significant clusters of potential liquidations just above the $106,000 mark. These levels often act as price magnets, influencing market behavior as traders and bots seek to trigger these events, thereby driving prices toward specific targets.

Trump Announcement: A Catalyst for Volatility?

The timing of these whale activities, coinciding with Trump‘s planned White House announcement, is far from coincidental in the eyes of many market observers. The event itself introduces an element of uncertainty. Market participants are left to speculate on the potential impact of Trump’s comments on the crypto markets. Given the history of market reactions to political statements, the anticipation has led to a cautious stance. Rumors and speculation surrounding Trump’s intentions inevitably influence trading strategies, driving traders to hedge their positions and take proactive measures to manage risk. The potential for sudden price swings makes this a particularly delicate time for leveraged positions.

Market Sentiment and On-Chain Analysis

Beyond the whale activity, broader market sentiment appears to be leaning towards caution. On-chain analytics from Glassnode reveal “defensive” positioning, with net-premium flows indicating concentrated selling within a specific price range. This suggests that traders are using recent price gains as opportunities to hedge their bets, anticipating a potential downturn. This contrasts with the exuberant buying seen during the previous bull run, adding another layer of complexity. Furthermore, some analysts are highlighting the lack of robust trading volume in the market, even as Bitcoin approaches previous all-time highs. This could signal a potential lack of conviction behind recent price movements, increasing the risk of sharp corrections.

Navigating the Uncertainty

The current landscape is characterized by uncertainty. Traders are closely monitoring key support and resistance levels. The $107,000 level is considered crucial by many, while a break above $111,000 is seen as a potential bullish signal. In this environment, caution is advised. As always, investors must perform their due diligence and consider market volatility risks.