The Return of a Crypto Maverick: James Wynn Re-Enters the Fray

The cryptocurrency market is known for its volatility, and the players within it are often just as unpredictable. One such character, the pseudonymous trader James Wynn, has re-emerged after a series of costly liquidations, making waves with new leveraged positions on Bitcoin (BTC) and the memecoin PEPE. This latest venture highlights the enduring allure and inherent risks of high-stakes trading within the digital asset ecosystem.

Leverage: A Double-Edged Sword

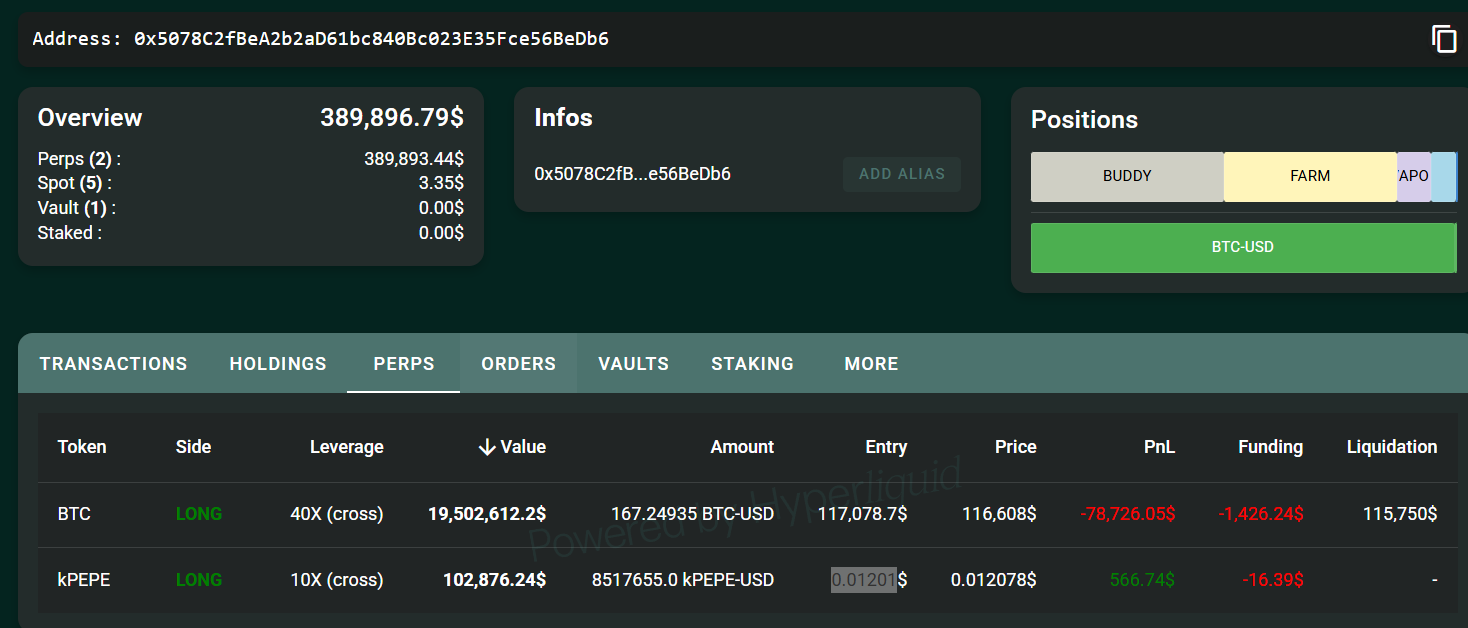

Wynn’s return to the market features a 40x leveraged Bitcoin long position, worth over $19.5 million. Such a position is a testament to his bullish conviction in Bitcoin‘s short-term price movement, but it also underscores the perilous nature of leverage. For every dollar Wynn invests, he essentially controls forty, amplifying potential profits but also magnifying the potential for losses. With a liquidation price set, his position is at risk of being wiped out if Bitcoin‘s price dips below a specific threshold. Beyond the initial investment, Wynn has already sunk $1.4 million into funding fees to maintain the position, a testament to the ongoing costs of leveraged trading.

Beyond Bitcoin: A PEPE Gamble

Adding to the intrigue, Wynn has also placed a 10x leveraged long position on PEPE, a popular memecoin. While the exact liquidation price of this bet remains undisclosed, this move shows a willingness to venture into the higher-risk, higher-reward world of meme tokens. The performance of PEPE is often driven by social media trends and speculative enthusiasm, further compounding the volatility associated with this particular investment. This reveals Wynn’s strategy to diversify risk, or perhaps, that he has an appetite for extremely volatile assets.

The Market’s Perspective and Counter-Positions

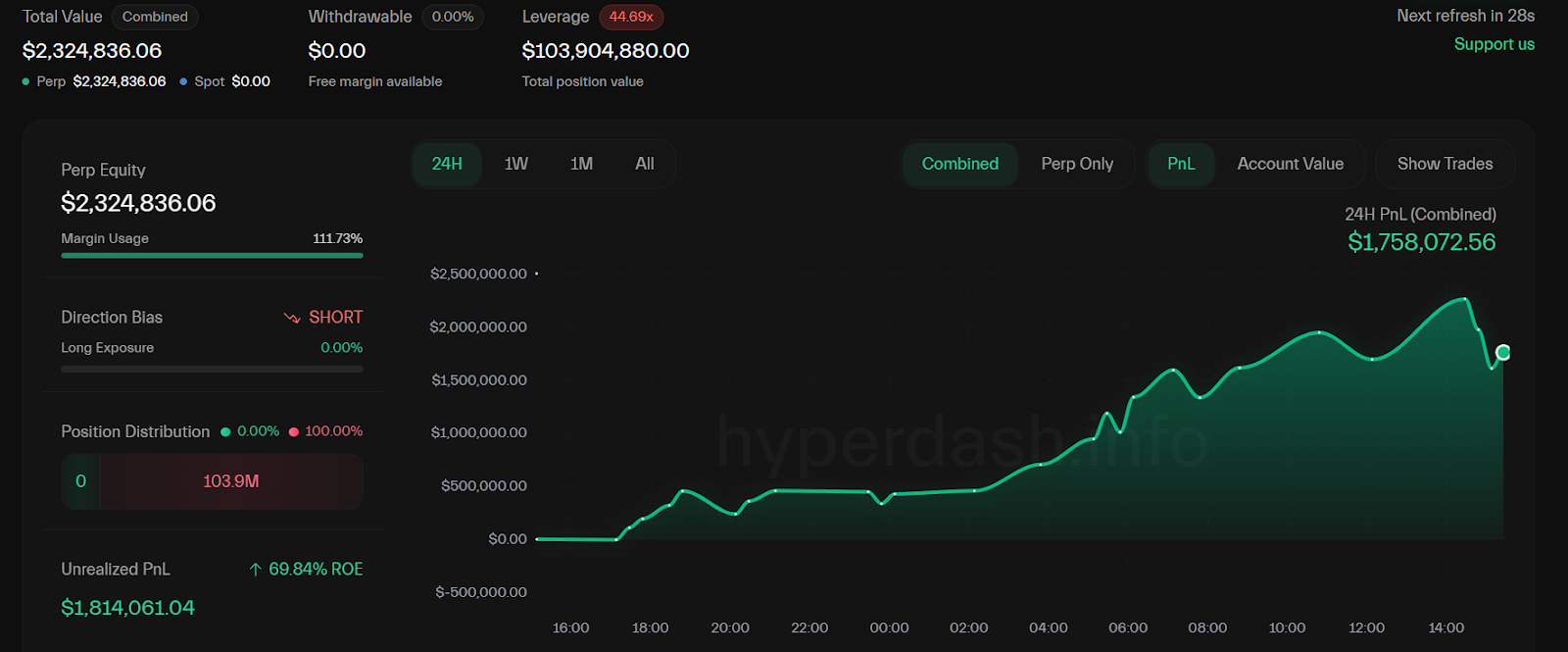

Wynn’s actions aren’t without their detractors. Other traders, like Qwatio, have taken the opposite view, opting for a 40x leveraged short position on Bitcoin, effectively betting on its price decline. Qwatio’s history of liquidations serves as a cautionary tale about the dangers of aggressive leverage, highlighting the unforgiving nature of the market. This divergence in strategies underscores the varying perspectives and risk appetites within the crypto community. The market, seemingly, is divided.

Implications and Market Sentiment

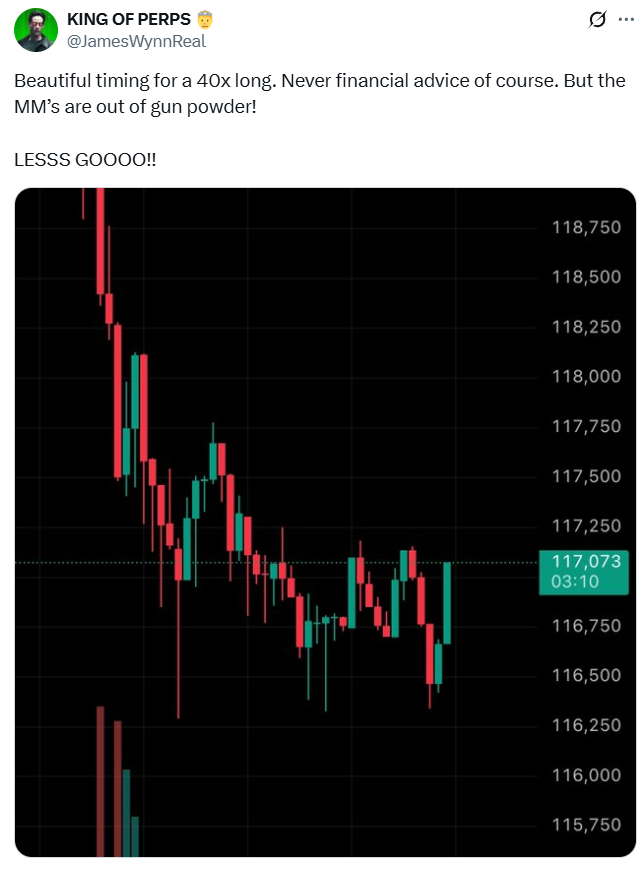

Wynn’s return and leveraged bets have reignited conversations about market manipulation and the role of market makers. He has previously accused market participants of targeting his liquidation levels, a claim that has sparked debates among analysts. His recent comments regarding market makers being “out of gun powder” indicates his view the market might be ready to consolidate gains. This sentiment, alongside his position, hints at his conviction in near-term upside. Despite the risks, Wynn’s moves serve as a compelling case study in the high-stakes world of crypto trading. The coming weeks will prove whether his strategy pays off or leads to another chapter in his liquidation story.