XRP Shows Strength: A Look Beyond the Dip

The cryptocurrency XRP is currently exhibiting promising signs of recovery after a period of downward pressure, sparking interest within the crypto community. Having dipped below the $2 mark on November 21st, XRP has since clawed its way back, reclaiming critical support levels. This resurgence, accompanied by a surge in network activity, strong institutional demand, and a dwindling supply on exchanges, paints a bullish picture for the digital asset.

Network Activity and Whale Movements Fuel Recovery

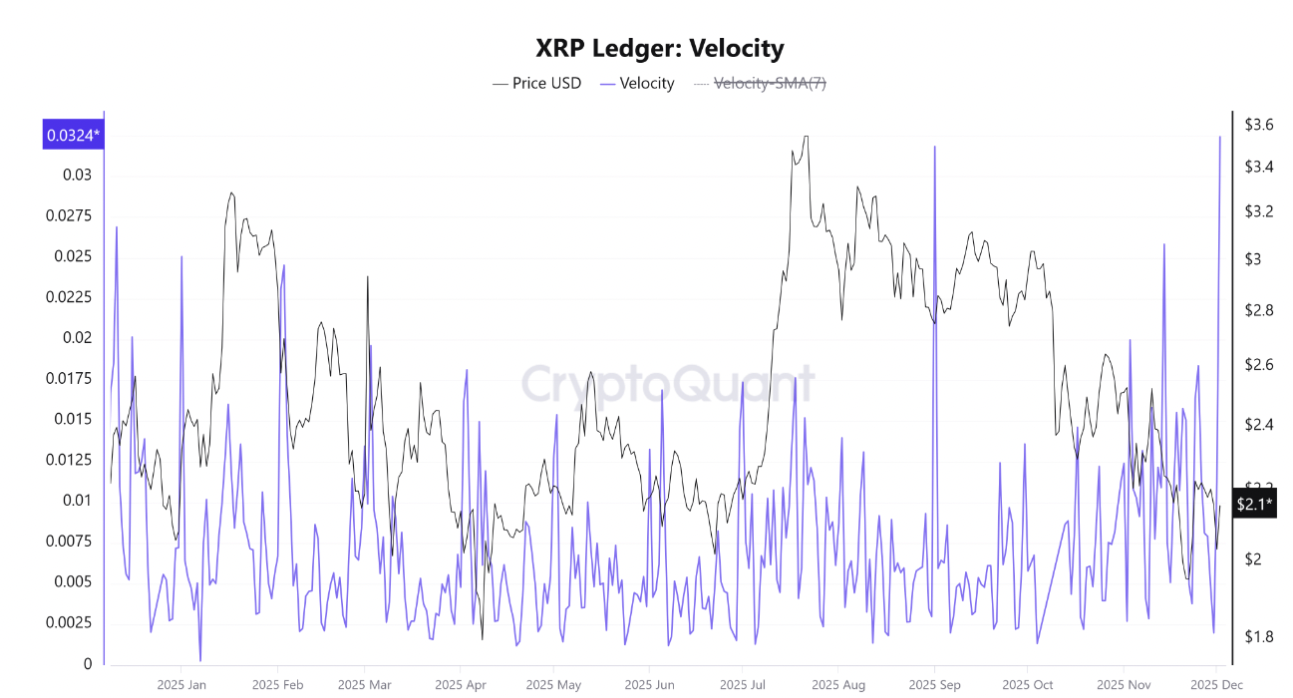

A key indicator of XRP‘s current momentum is the notable increase in network activity, particularly evidenced by a spike in XRP Ledger velocity. Data from CryptoQuant reveals this metric reaching a yearly high, signaling increased usage and transaction frequency on the XRP Ledger. Essentially, a higher velocity suggests that XRP is being actively utilized in on-chain transactions, indicating healthy economic activity rather than simply being held.

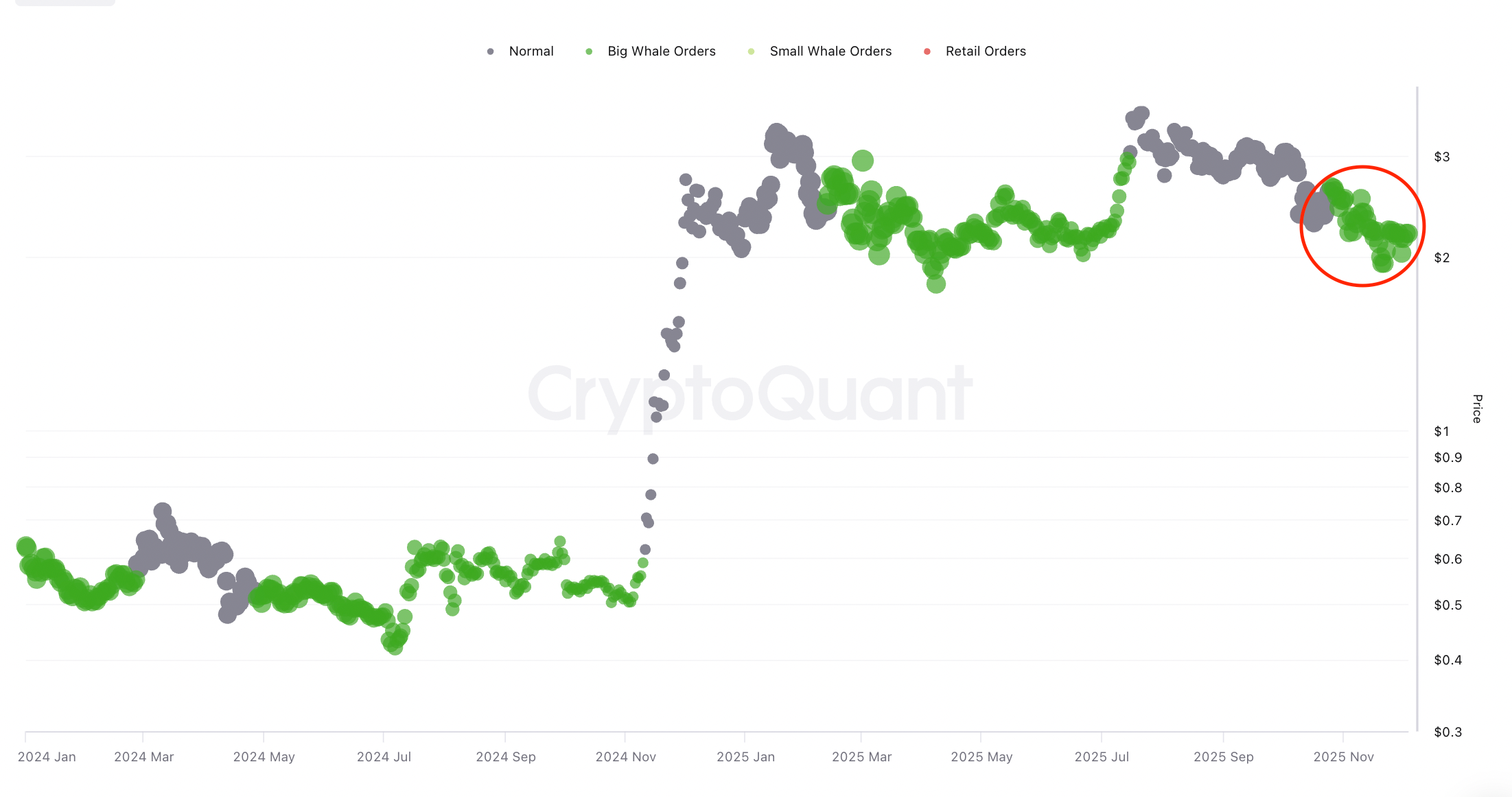

The movement of larger holders, often referred to as “whales,” also supports the positive sentiment. Increased whale activity typically signifies significant involvement from traders or large-scale movements within the ecosystem.

Exchange Dynamics and Supply Squeeze

Another crucial factor bolstering XRP‘s recovery is the significant reduction in the token’s supply on exchanges. Data indicates a substantial outflow of XRP tokens from exchanges over the past month. This reduction in available supply, coinciding with record exchange outflows, indicates strong accumulation by holders, who are seemingly more inclined to hold their tokens rather than sell them. This, in turn, reduces immediate selling pressure and could contribute to upward price movement.

$2.15: The Critical Support Level

From a technical analysis perspective, the $2.15 level has emerged as a crucial support zone for XRP. The price’s ability to reclaim and maintain this level suggests a potential for sustained recovery. This price point is also aligned with the 50-period simple moving average (SMA), which further reinforces its significance. Historically, reclaiming this trendline has often preceded substantial price gains for XRP.

Several other elements could contribute to XRP’s potential for further gains. Persistent spot ETF inflows and a bullish divergence in the Relative Strength Index (RSI) on price charts suggest potential bullish momentum. However, readers should conduct their own research when making a decision and remember that all investments involve risk.