Crypto’s Coming of Age: Yat Siu on a New Era

Animoca Brands co-founder Yat Siu has a clear vision for the future of crypto, and it’s one marked by maturity, real-world utility, and a shift away from pure speculation. In a recent analysis, Siu outlined his perspective on the current state of the market, the impact of regulatory developments, and Animoca’s strategic moves to capitalize on the evolving landscape.

The Trump Factor and the Lessons Learned

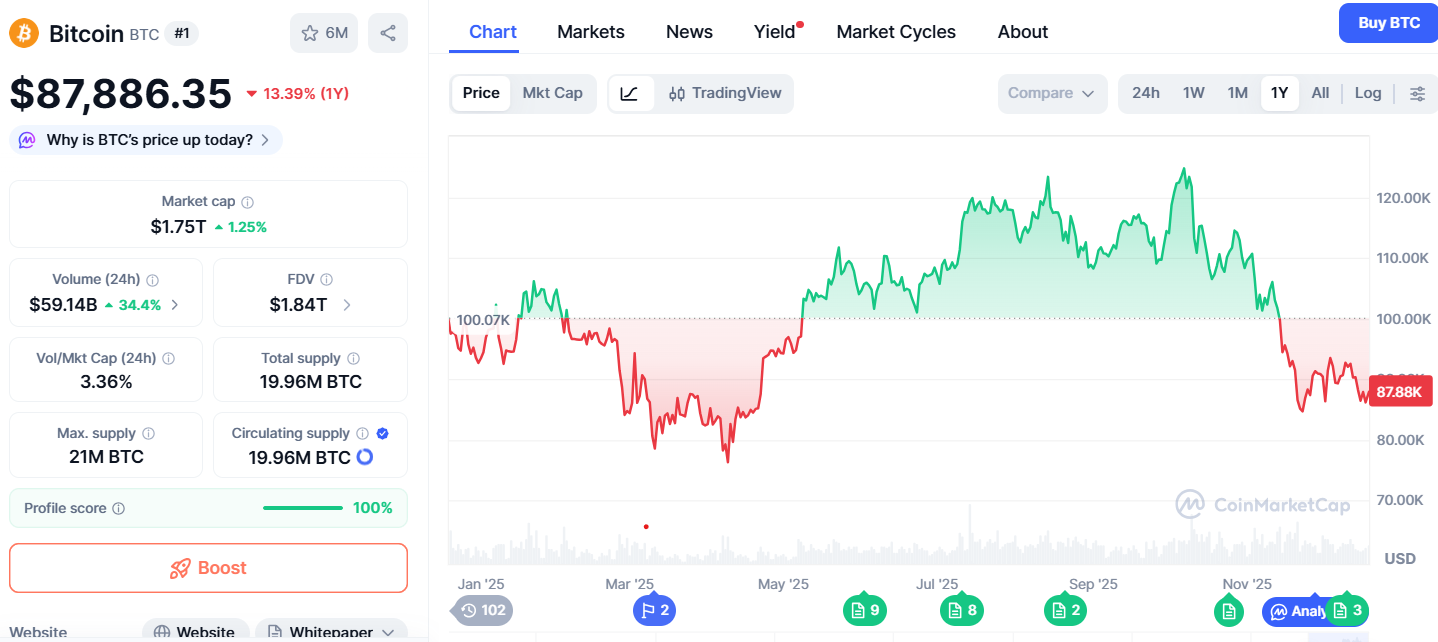

Siu frames 2025 as the year the crypto industry miscalculated, betting too heavily on the potential influence of Donald Trump. While the anticipated ‘Trump trade’ didn’t materialize, it served as a wake-up call, highlighting the need for crypto to become less reliant on political winds and more focused on fundamental value. The memecoin frenzy, fueled by speculation, is waning, and Siu believes that the market is now demanding tangible use cases.

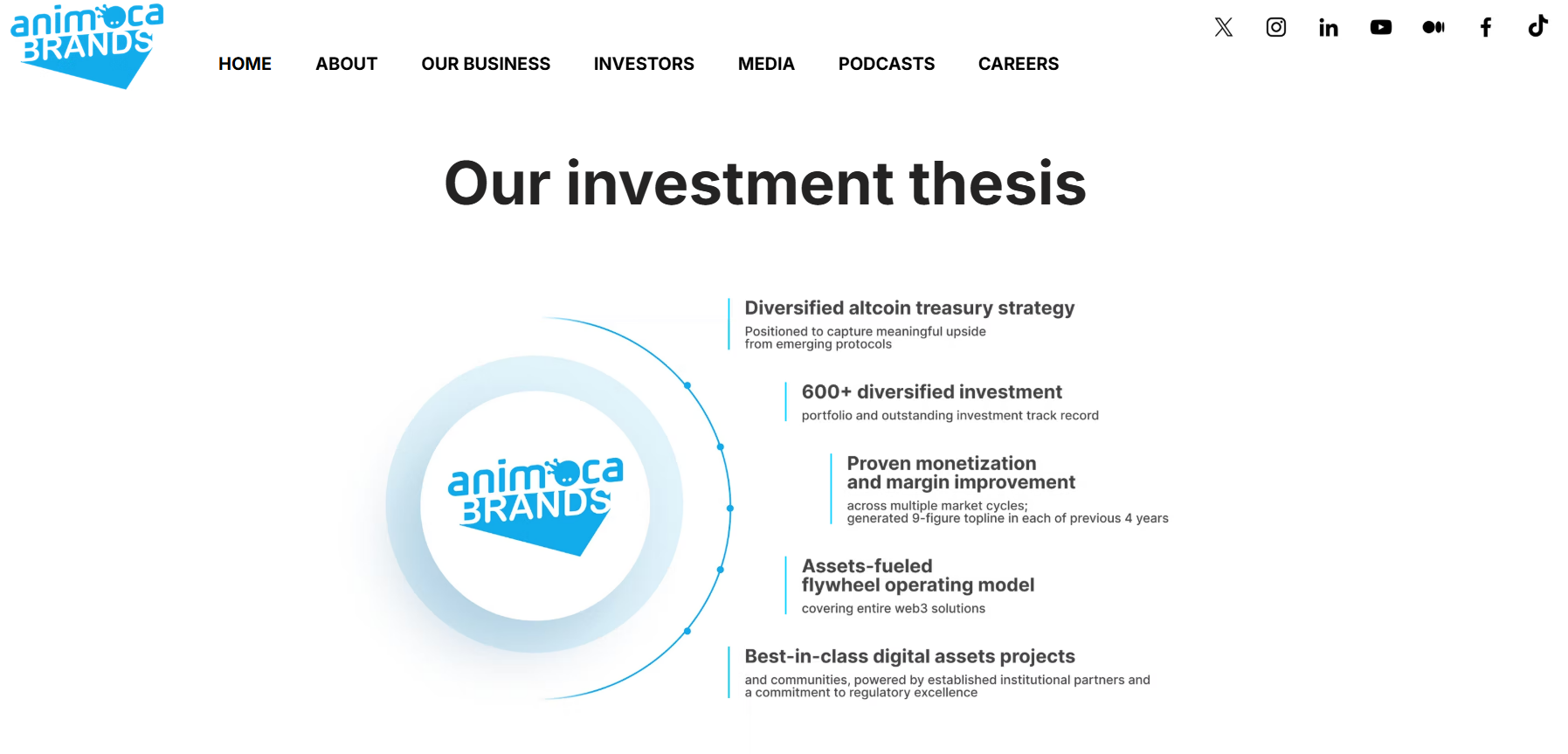

Animoca’s Vision: An Altcoin Proxy for Public Markets

Recognizing the need for a diversified exposure to the altcoin space, Animoca Brands is planning a reverse merger IPO to provide public market investors with an ‘altcoin proxy.’ This strategic move aims to offer a public vehicle for investors looking to access the broader altcoin market, mirroring the success of MicroStrategy in providing Bitcoin exposure. Animoca, with its extensive portfolio of over 620 companies, aims to become a SoftBank-style aggregator for the altcoin and Web3 ecosystem.

Regulation and the Rise of Utility Tokens

Siu sees regulatory clarity, particularly through initiatives like the Clarity Act and the GENIUS Act in the US, as a catalyst for a new wave of tokenization. He anticipates that clear frameworks for issuing, trading, and supervising tokens will encourage established companies to enter the market, launching tokens tied to their existing businesses. This move towards ‘tokenizing or dying’ is seen as essential for mainstream adoption, with real-world assets (RWAs) and tokenized securities serving as the bridge to an industry projected to reach trillions by 2030.

2026: The Year of Utility

According to Siu, the industry is entering a new phase characterized by utility tokens. He believes that the focus will shift from speculative memecoins to products that solve real-world problems for gamers, creators, and brands. With clearer regulatory guidelines, Animoca expects a flood of utility tokens that will attract new users and foster sustainable growth, moving the industry beyond its initial, speculative phase.

Animoca’s Strategy

The company is aiming to be a bridge between traditional equity markets and on-chain ownership. Animoca is seeking partnerships to help with RWA projects. Siu is positioning Animoca as a leader in this new era.

The Road Ahead

In conclusion, Yat Siu‘s analysis presents a compelling roadmap for the future of crypto. With a focus on utility, compliance, and real-world applications, Animoca Brands aims to be at the forefront of this new, mature phase of the industry. The company’s strategic moves, coupled with regulatory clarity, suggest that the coming years will be pivotal in shaping the long-term success of the crypto ecosystem.