Bitcoin Reclaims Six-Figure Mark Amidst Bullish Momentum

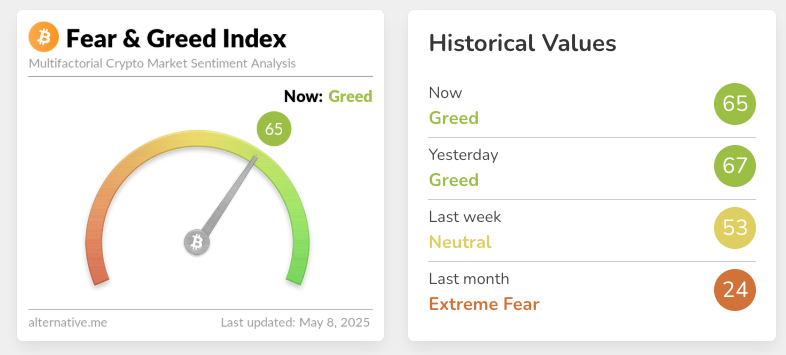

Bitcoin (BTC) has once again climbed above the psychologically significant $100,000 price level, reaching a peak not seen since January. This surge, driven by a confluence of factors, has sparked renewed bullish sentiment among investors. The digital asset surged 4.2% from its intraday low on May 8, reaching the coveted $100,000 mark for the third time since its initial breakthrough in December 2024.

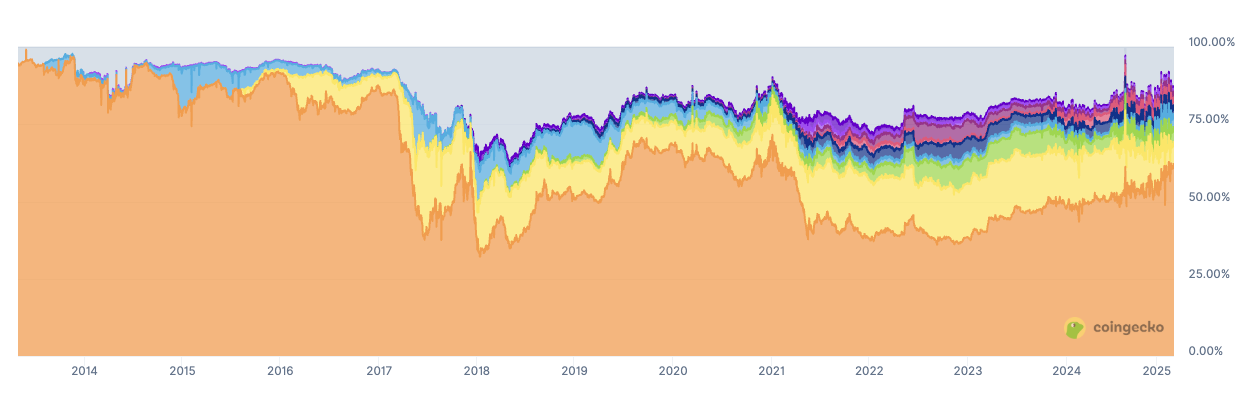

Bitcoin Dominance Rises, Signaling Potential Altcoin Weakness

A notable factor behind Bitcoin‘s recent strength is its growing dominance within the cryptocurrency market. Bitcoin‘s share of the total crypto market capitalization has steadily risen over the past year, surpassing 60% during its latest push to $100,000. This increased dominance could indicate potential bearish sentiment for altcoins, as investors shift their focus towards Bitcoin. The last time Bitcoin dominance reached these levels was in early 2021, when the asset was trading around $36,000.

Institutional Inflows and Trade Deal Hopes Fuel Rally

Analysts point to a combination of factors driving Bitcoin‘s price surge. Institutional inflows, particularly into Bitcoin exchange-traded funds (ETFs), continue to bolster the asset’s value. The past week saw a significant $1.8 billion influx into spot Bitcoin ETFs, a testament to growing institutional confidence. Additionally, some analysts link Bitcoin‘s upward trajectory to potential trade deals, specifically a rumored agreement between the US and the UK. President Trump’s hints about a major trade deal on May 7 fueled speculation, adding to the bullish sentiment.

Economic Data to Watch: A Potential Catalyst for Volatility

While Bitcoin‘s current momentum is strong, experts caution that upcoming economic data releases could significantly impact the asset’s trajectory. Key data points like the US budget data on May 12 and the Consumer Price Index (CPI) on May 13 are expected to influence Bitcoin‘s future price movements. The trade deal narrative will need to translate into concrete progress for the rally to sustain.

Looking Ahead: Potential for New Highs and Long-Term Growth

Despite the potential for volatility due to economic data, some analysts predict that Bitcoin may chart new highs above $110,000 in the near future. The asset is aiming to solidify its position above $100,000, potentially setting the stage for a strong finish to the current four-year cycle. The combination of ongoing progress in global crypto regulation, strategic Bitcoin reserve initiatives, and increased institutional interest paints a picture of potentially prolonged and accelerated growth beyond 2025.