The Awakening of a Bitcoin Behemoth

The cryptocurrency market is abuzz following a massive Bitcoin transfer, a move that’s sending ripples through the financial ecosystem. A dormant Bitcoin whale, holding a significant stash from the early days of the cryptocurrency, has initiated a colossal transaction, moving approximately $9.6 billion worth of Bitcoin. This transfer, originating from holdings dating back to 2011 when Bitcoin traded at a fraction of its current value, has immediately triggered speculation and debate amongst market analysts and investors alike.

Regulatory Ripples and Market Sentiment

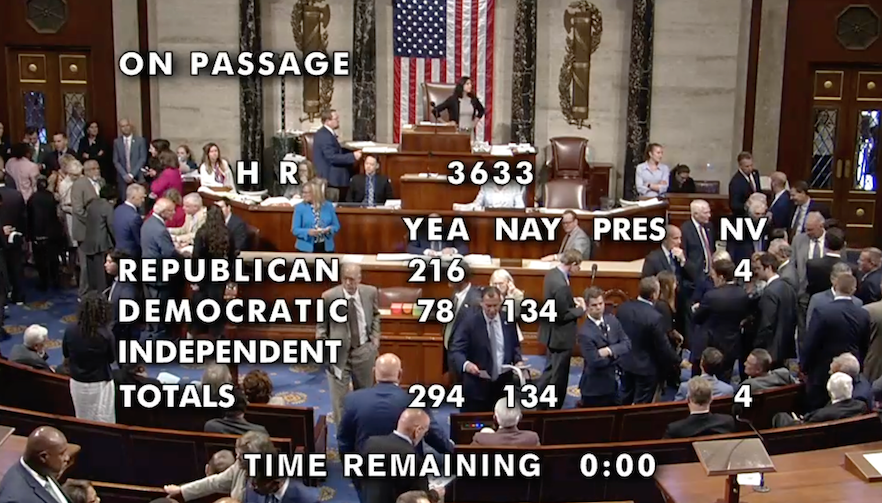

The timing of this substantial move coincides with a pivotal moment for the US crypto market. The US Senate recently passed several key pieces of legislation, including the GENIUS Act, aimed at providing greater clarity and structure to the digital asset landscape. While some experts view these regulatory steps positively, potentially fostering long-term stability and adoption, others are more cautious. Some analysts believe the whale‘s decision to move such a substantial sum may be tied to concerns around the evolving regulatory environment, especially regarding stablecoins and compliance.

The GENIUS Act, in particular, is drawing considerable attention. Jacob King, financial analyst and CEO of WhaleWire, suggests the new regulatory landscape, which includes stricter audit requirements for stablecoins, could have significant ramifications. However, Katalin Tischhauser, head of investment research at digital asset bank Sygnum, presents a contrasting view, arguing that the GENIUS Act could establish clear regulatory frameworks and pathways for the legal recognition of stablecoins as settlement instruments. This divergence in expert opinions highlights the complexities and uncertainties inherent in the evolving crypto regulatory environment.

Whale Psychology and Market Reactions

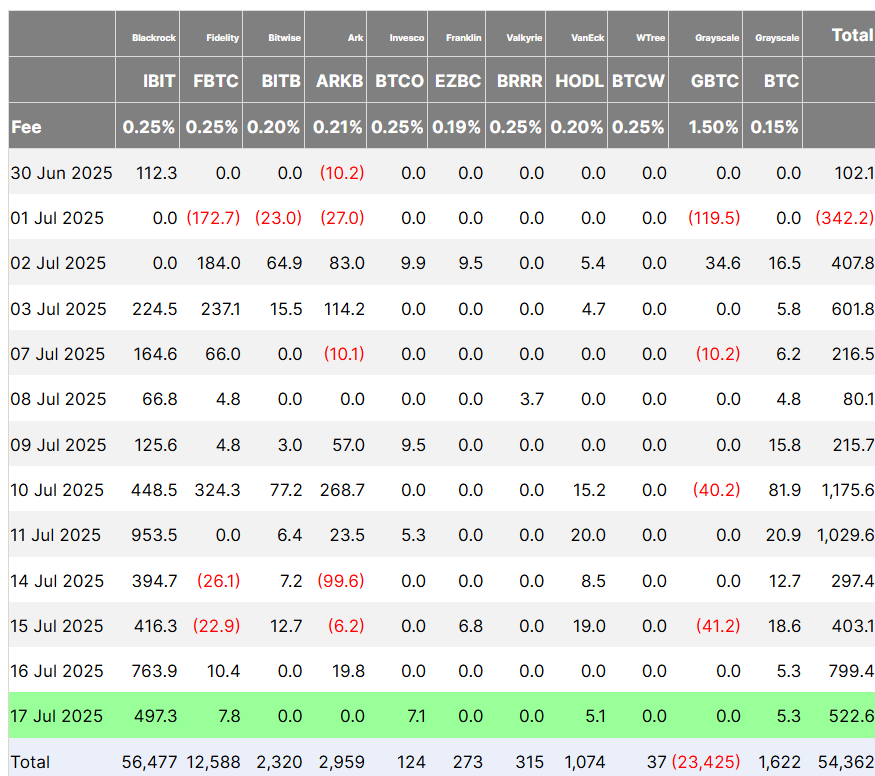

The motivations behind the whale‘s move remain open to interpretation. Nicolai Sondergaard, research analyst at Nansen, suggests that even with increased regulation, long-term Bitcoin holders often seek to realize their profits. This perspective underlines the natural evolution of wealth and the desire to enjoy the fruits of long-term investment. The market’s reaction, however, is not entirely uniform. While some investors may be hesitant, awaiting potential market corrections, others remain optimistic, especially considering the sustained positive inflows into US spot Bitcoin exchange-traded funds, which have continued to accumulate substantial investment.

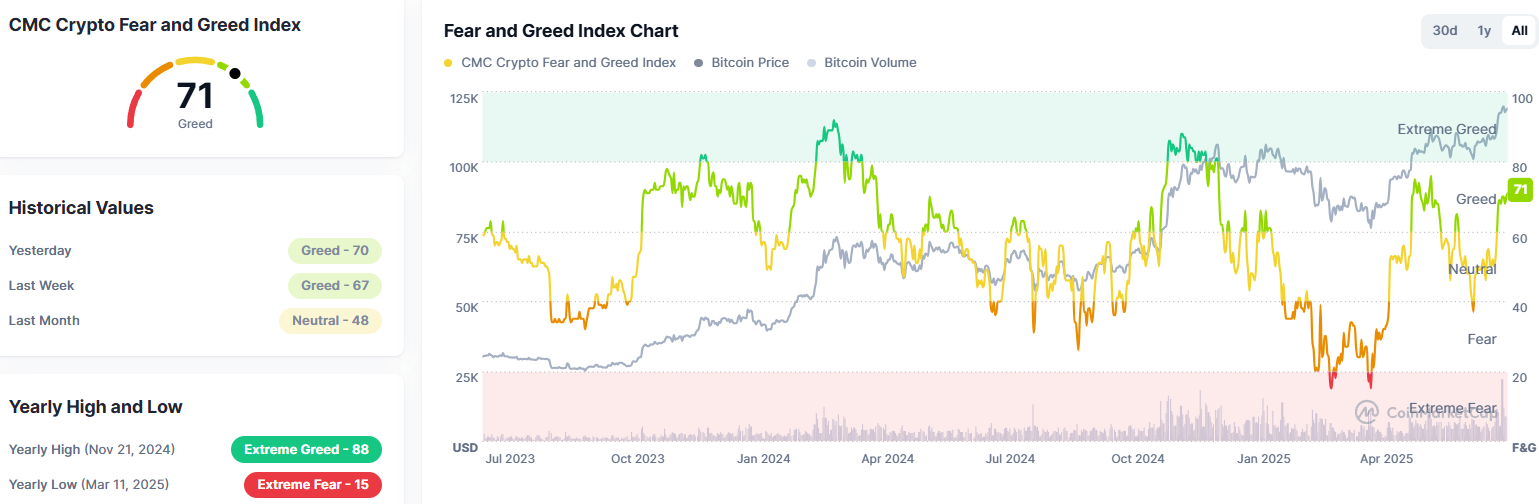

The current Fear & Greed Index indicates some level of greed in the market, at 73. This suggests that while some investors might be wary and anticipate potential pullbacks, many remain confident and see this moment as an opportunity to further invest. Nansen’s analysis of the options data further supports this, indicating a mildly bullish sentiment, with investors hedging their bets in both directions. This complex interplay of investor sentiment, regulatory developments, and whale activity continues to shape the dynamic and unpredictable world of Bitcoin and the broader crypto market.