BlackRock Embraces Blockchain for Traditional Finance

BlackRock, a titan in the world of asset management, is making another foray into the blockchain realm. The firm has filed to create digital ledger technology (DLT) shares mirroring one of its money market funds, highlighting the increasing embrace of blockchain technology within traditional finance.

These DLT shares will track BlackRock‘s BLF Treasury Trust Fund (TTTXX), a fund holding over $150 million in US Treasury bills and cash. Notably, these shares will not be tokenized, meaning they won’t be directly represented by crypto tokens. Instead, they will function as a transparency tool to verify ownership, leveraging blockchain‘s immutability to create a secure and auditable record.

BlackRock emphasizes that traditional book-entry records will remain the official ownership ledger. This approach distinguishes the DLT shares from BlackRock‘s USD Institutional Digital Liquidity Fund (BUIDL), which is tokenized and operates on a decentralized platform. The proposed DLT shares, however, will only be available to institutional investors with a minimum investment of $3 million.

Following Fidelity‘s Lead

BlackRock‘s latest move follows Fidelity‘s announcement in March to list an Ethereum-based OnChain share class tracking its Fidelity Treasury Digital Fund (FYHXX). While Fidelity‘s filing is still pending regulatory approval, both these initiatives showcase a growing trend among Wall Street giants exploring the potential of blockchain for financial applications.

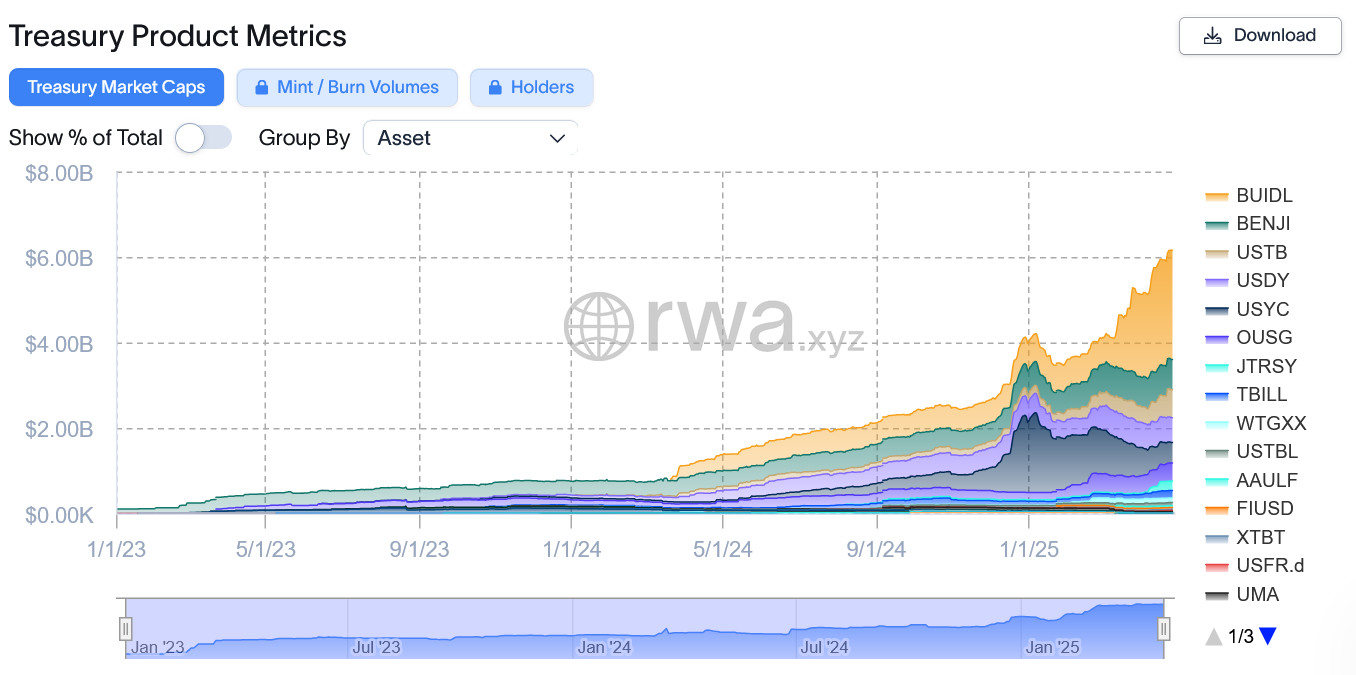

The tokenization of traditional assets, including Treasury bills, bonds, and private credit, has gained traction in recent years. According to rwa.xyz, the treasury tokenization market is currently valued at $6.16 billion, with BlackRock‘s BUIDL and Franklin Templeton’s Franklin OnChain US Government Money Fund (BENJI) leading the way.

Ethereum’s Dominance

Ethereum remains the dominant blockchain for tokenizing treasury assets, currently holding over $4.55 billion in value. The Stellar and Solana networks follow with $474.9 million and $274.5 million, respectively.

BlackRock CEO Larry Fink has been a vocal proponent of RWA tokenization, believing it could revolutionize investing. These recent developments suggest that Wall Street is taking heed, embracing blockchain as a tool to enhance transparency, efficiency, and access within traditional financial markets.

“We’re still in the early days of this technology, but the potential is enormous,” Fink stated in a recent interview. “Blockchain can help to create a more efficient and transparent financial system, which will ultimately benefit investors.”

As these initiatives gain momentum, the future of finance may see a greater convergence of traditional financial institutions and blockchain technology. Whether these DLT shares will become a widespread phenomenon or remain niche offerings remains to be seen, but they undoubtedly signal a broader shift toward exploring blockchain‘s potential within traditional finance.