Canada‘s Stablecoin Stalemate: Is the Loonie Losing Ground?

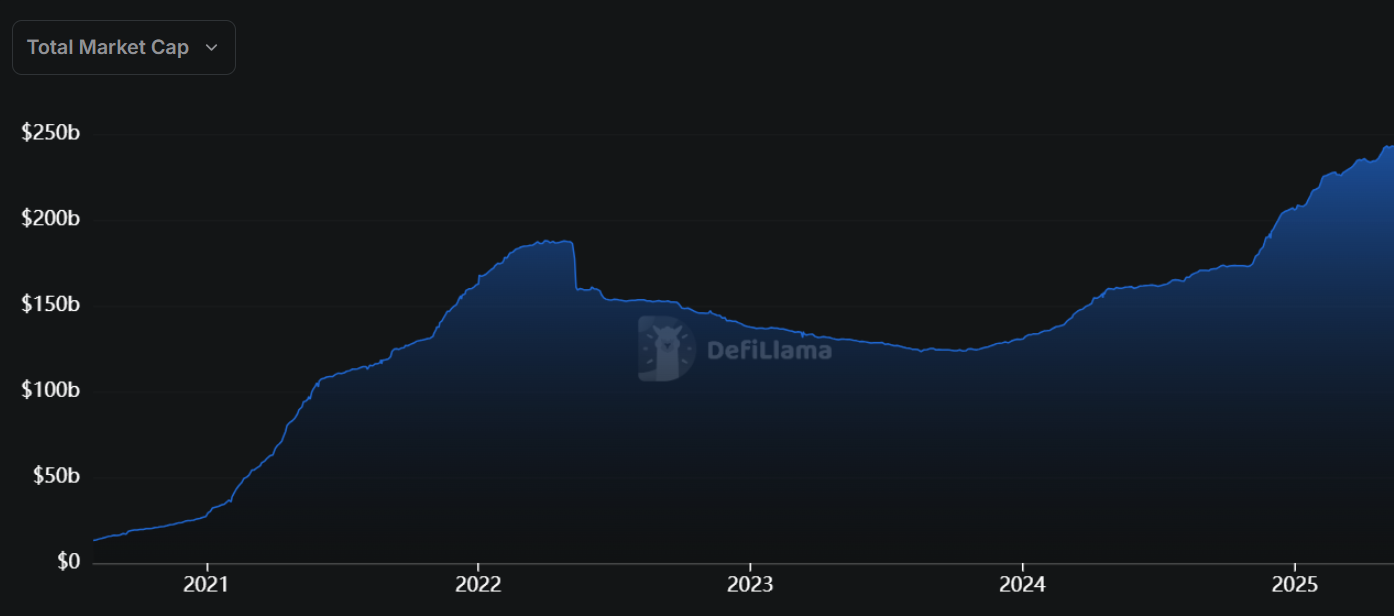

While the global stablecoin market is booming, Canada is lagging behind. This has some crypto industry experts worried that the country is falling behind in a crucial area of digital finance.

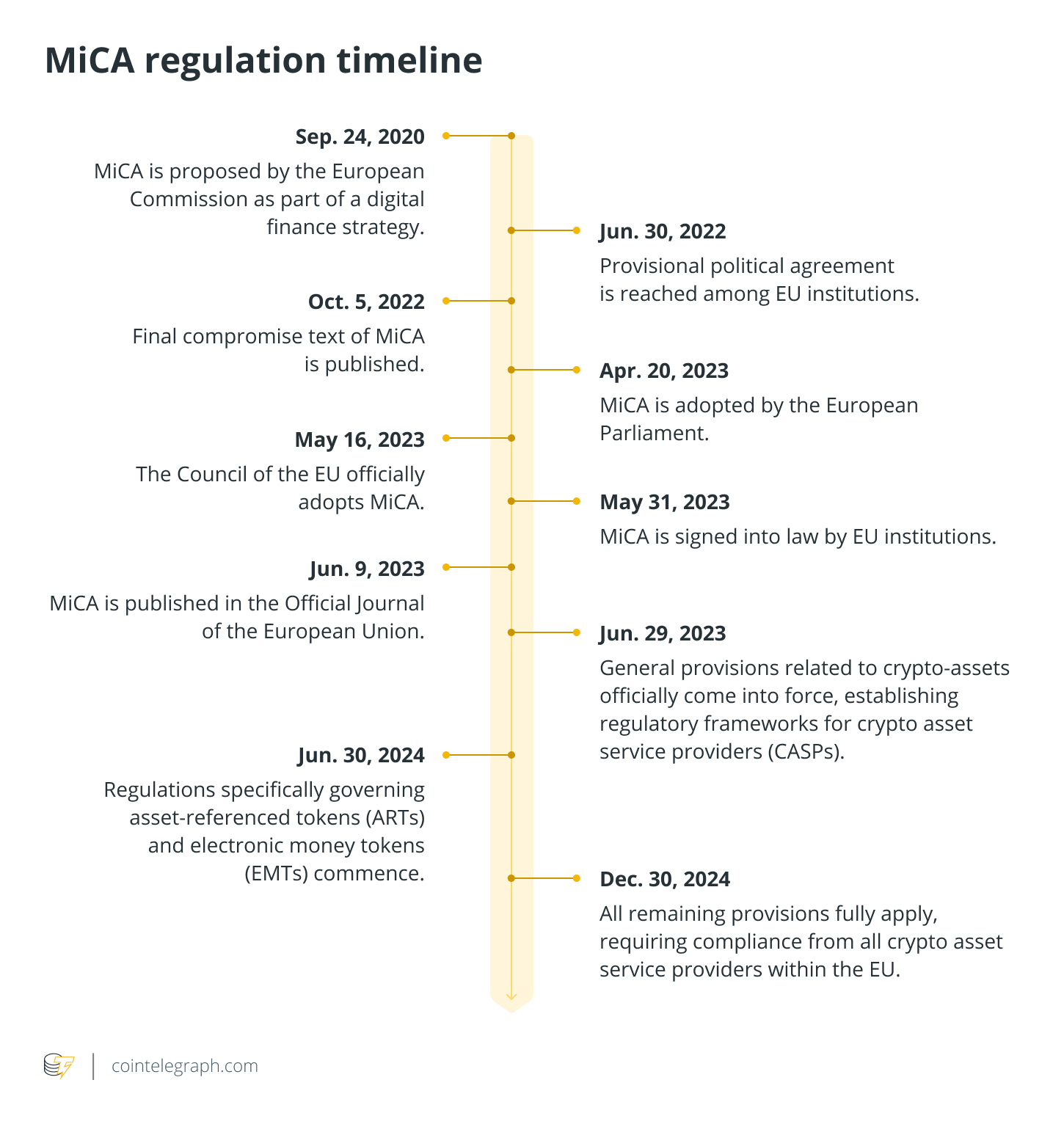

The Canadian Securities Administrators (CSA) classified stablecoins as “securities and/or derivatives” in December 2022, a move that has led to a lack of local stablecoin issuance. In contrast, the United States and European Union have taken a more lenient approach, resulting in significant growth in their stablecoin markets.

The CSA‘s stringent stance has drawn criticism from Canadian crypto industry players. They argue that this approach stifles innovation and makes Canada less competitive.

Fear of the ‘Dollar Drain’

One of the primary concerns is that the lack of CAD-denominated stablecoins could lead to a “dollar drain” as Canadians and businesses turn to USD-pegged alternatives for cheaper and faster peer-to-peer (P2P) payments. This, in turn, could weaken the Canadian dollar’s (CAD) standing in global markets.

Som Seif, founder of Canadian investment firm Purpose Financial, highlights the potential impact: “If Canada does not create the regulatory framework and environment that encourages the development of CAD stablecoins, consumers and businesses will default to using USD-pegged alternatives, eroding the relevance of CAD in global markets.”

Stablecoins: A Payment Solution in Search of a Framework

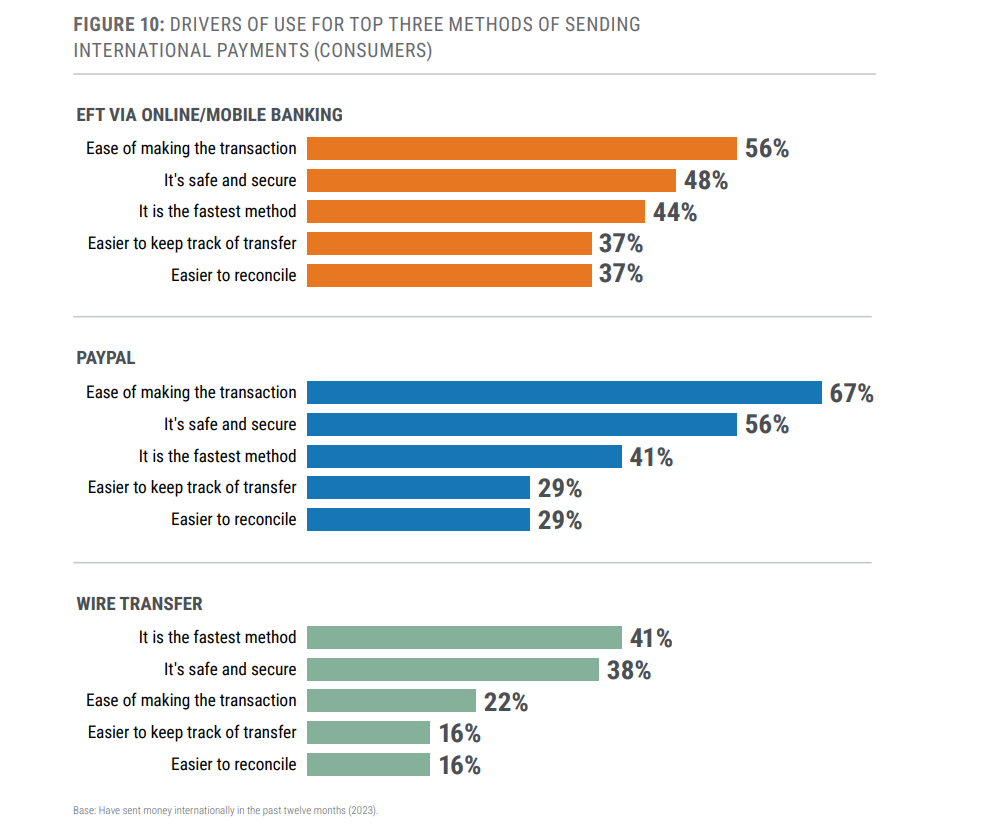

While the lack of a robust P2P payments network in Canada has been a long-standing issue, stablecoins offer a compelling solution. They provide a faster, cheaper, and more transparent way to send and receive money compared to traditional wire transfers or even Interac e-Transfer, the primary domestic P2P platform.

Lucas Matheson, CEO of Coinbase Canada, stresses the need for a stablecoin for Canadians, noting the inefficiencies of current options. The industry, however, faces the hurdle of integrating stablecoins with mainstream financial services. Although some crypto platforms offer P2P transfers, they haven’t gained widespread adoption.

The Future of Stablecoin Regulation in Canada

The Canadian crypto industry is advocating for a more nuanced regulatory framework for stablecoins, one that acknowledges their potential as a payment instrument. The industry is looking to the example set by the EU’s Markets in Crypto-Assets (MiCA) law, which takes a less restrictive approach to stablecoins.

Despite his previous skepticism towards cryptocurrencies, Prime Minister Justin Trudeau has expressed openness towards stablecoins, emphasizing the need for robust regulations and safeguards. This suggests that a revised regulatory framework could emerge, but the path forward remains uncertain.

Whether Canada can bridge the gap and create an environment conducive to the development of stablecoins remains to be seen. The country’s future in the rapidly evolving world of crypto finance hangs in the balance, and the Loonie’s fate may be intricately tied to it.