Unpacking the CLARITY Act: A New Era for Crypto Regulation?

The digital asset space has long been yearning for clarity. The ambiguity surrounding the regulatory landscape has stifled innovation and left both investors and businesses navigating a minefield of uncertainty. Enter the CLARITY Act, a legislative endeavor designed to bring structure and defined boundaries to the often chaotic world of cryptocurrencies. But does it truly deliver on its promise of clarity, or does it risk creating further complexities?

Dividing the Regulatory Pie: SEC vs. CFTC

One of the core aims of the CLARITY Act is to delineate the responsibilities of the two primary regulatory bodies in the United States: the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). The bill proposes a division of labor, with the SEC retaining authority over primary offerings, investor protections, and required disclosures, while the CFTC gains oversight over digital commodity transactions, particularly in secondary and spot markets. This division, if effectively implemented, could provide a more predictable environment for market participants.

Defining Digital Assets: Digital Commodities and Beyond

Central to the CLARITY Act is the attempt to classify digital assets. The legislation introduces the term “digital commodity,” referring to assets whose value stems primarily from the functionality of their underlying blockchain. This distinction is crucial, as it impacts the regulatory framework applied to each type of asset. This nuanced approach acknowledges that not all crypto assets are created equal and that regulatory oversight should reflect these differences. However, the exact parameters of “sufficient decentralization” needed to qualify as a digital commodity remain a point of discussion.

Stablecoins: A Separate Framework

Recognizing the unique characteristics of stablecoins, the CLARITY Act acknowledges the framework established by the GENIUS Act. This means stablecoins, if they meet certain criteria, will not be automatically classified as securities or commodities. This approach aims to address the specific risks and concerns associated with stablecoins, such as reserve requirements and redemption processes, while integrating them into the broader digital asset market.

The “Mature” Blockchain: A Path to Lighter Regulation

The legislation includes the concept of a “mature” blockchain. A blockchain that meets certain decentralization and functionality criteria could see its associated tokens shift towards being treated as digital commodities under CFTC oversight. This offers a pathway to potentially reduced regulatory burdens as a project matures, incentivizing decentralization and broader distribution, a key element for the crypto industry to mature.

Potential Challenges and Criticisms

Despite its ambitious goals, the CLARITY Act faces potential challenges and criticisms. Some worry that its definitions may not fully capture the complexity of decentralized finance (DeFi) projects, where regulatory models are still evolving. Others raise concerns about the adequacy of investor protections, particularly in comparison to traditional securities standards. Further, potential overlaps and conflicting authority between the SEC and CFTC could still pose issues.

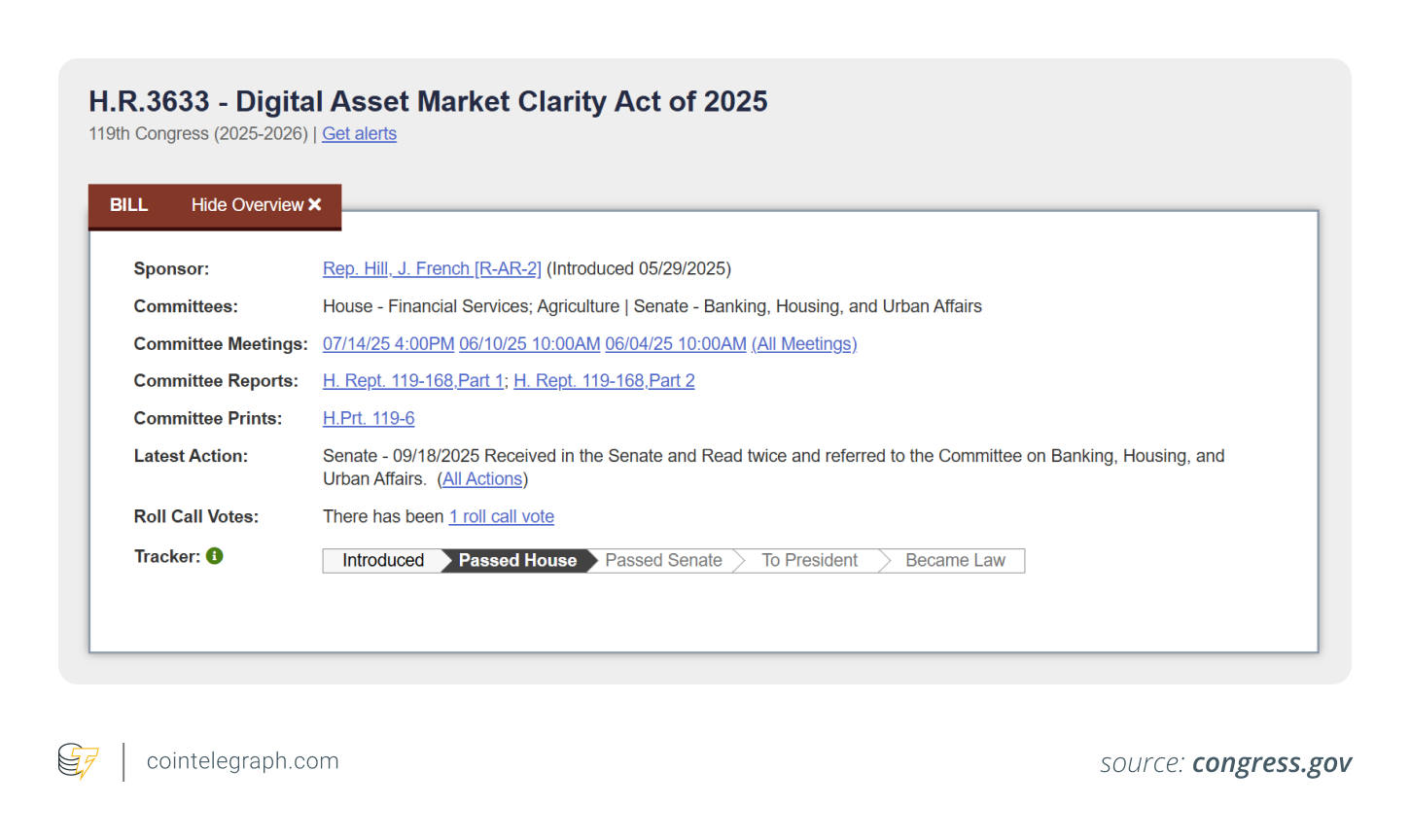

The Road Ahead: Implementation and Impact

The CLARITY Act has already cleared the House of Representatives and now awaits a decision in the Senate. Its ultimate impact on the crypto market will depend not just on its passage but also on its implementation, any subsequent rulemaking, and potential amendments. Whether the act successfully delivers clarity and fosters innovation while safeguarding investors remains to be seen. The coming years will be crucial in determining the CLARITY Act‘s true legacy.

- The CLARITY Act aims to address regulatory ambiguity.

- It proposes distinct roles for the SEC and CFTC.

- It introduces the term “digital commodity.”

- Stablecoins are governed by a separate framework.

- The “mature” blockchain concept offers a pathway to lighter regulation.

The CLARITY Act is a crucial step towards creating a transparent regulatory framework, but its full impact will be felt over time.

The CLARITY Act is a significant piece of legislation for the digital asset space.