Ethereum’s Ascent to $5,000: A Tale of Three Catalysts

The recent surge in Ethereum’s price has reignited hopes of a new all-time high in 2025. While the path to $5,000 remains uncertain, experts point to three potential catalysts: institutional interest, AI adoption, and the growth of layer-2 networks.

The Institutional Enigma: ETF Approval and Staking

Institutional adoption is a double-edged sword for Ethereum. While analysts believe it’s the prime candidate for institutional diversification due to its regulatory clarity and multiple spot ETFs, the current lack of institutional appetite for ETH-based products raises concerns.

A crucial factor in attracting institutional investors is the approval of in-kind Ethereum ETFs, which could unlock significant liquidity and investment inflows. The SEC’s stance on these applications will play a crucial role in shaping the future of ETH’s institutional adoption.

Moreover, staking, which allows investors to earn rewards by holding ETH, could further attract institutional capital seeking passive income. The potential for both in-kind ETFs and staking approval to materialise before year-end adds fuel to the bullish narrative.

The AI Edge: Expanding Ethereum’s Footprint

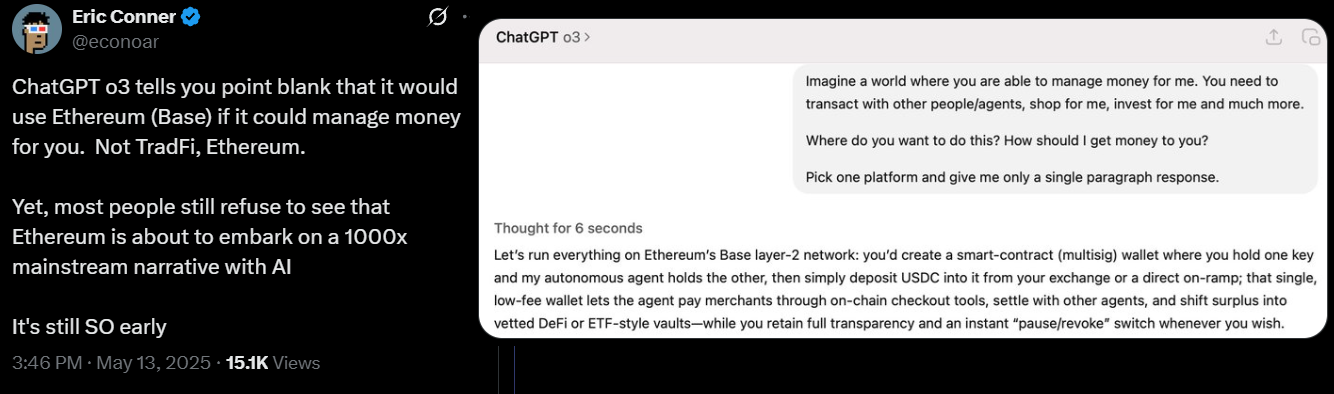

Artificial intelligence (AI) presents a compelling opportunity for Ethereum. As AI systems increasingly interact with smart contracts and decentralized finance (DeFi) applications, the demand for on-chain activity is expected to grow significantly.

With Ethereum’s layer-2 infrastructure becoming a favoured platform for AI applications, the potential exists for a tenfold increase in smart contract activity. This growth could drive network usage and potentially restore the deflationary burn mechanism, adding further momentum to ETH’s price.

Layer-2 Networks: Fueling Scalability and Demand

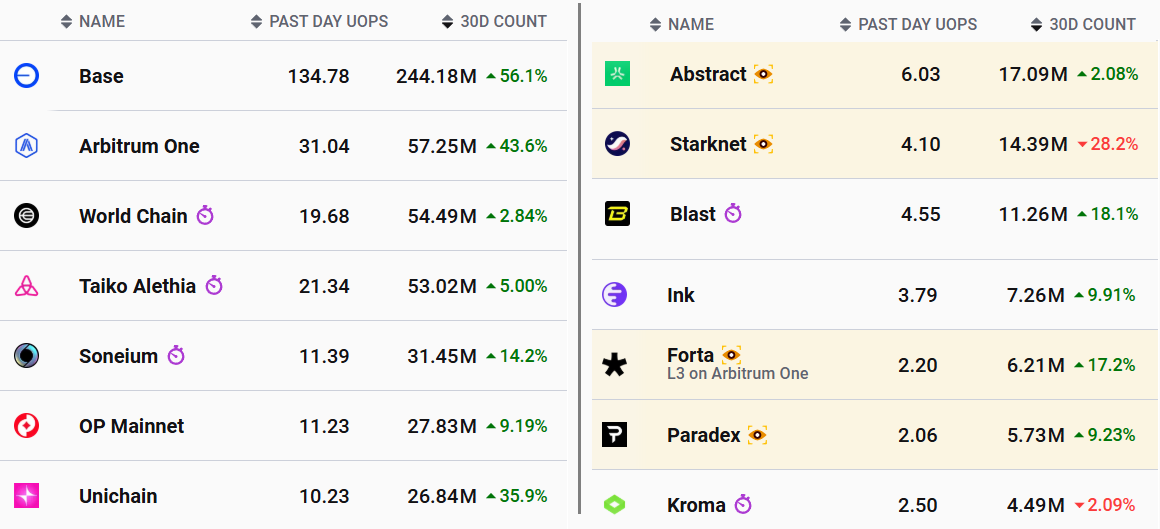

Ethereum’s commitment to scalability through layer-2 networks is a critical aspect of its long-term success. The recent ‘Pectra’ upgrade has significantly improved data transmission efficiency, enabling enhanced scalability and boosting activity on layer-2 networks.

The rising popularity of layer-2 networks, particularly Base, with its impressive transaction volume, highlights the growing demand for scalable Ethereum solutions. As these networks continue to thrive, they are likely to generate sustained demand for ETH, bolstering its value proposition.

Navigating the Challenges: Competition and Uncertainty

Despite these potential catalysts, Ethereum faces challenges. Competition from other cryptocurrencies, particularly in the realm of institutional investment and AI adoption, poses a risk.

The lack of direct ETF competition, however, could be a major advantage for Ethereum. The SEC’s approval of in-kind ETFs and staking, coupled with AI adoption and the expansion of layer-2 networks, could potentially tip the scales in Ethereum’s favor.

Ultimately, the path to a $5,000 ETH price remains uncertain. But the confluence of institutional interest, AI adoption, and layer-2 growth presents a compelling case for a bullish future for Ethereum.