Grayscale‘s Bold Staking Play: A Signal for the Future?

Grayscale Investments, a prominent player in the digital asset management space, has made a significant move, staking a substantial $150 million worth of Ether (ETH). This decision comes on the heels of the company introducing staking for its exchange-traded products (ETPs), marking a potential turning point in the landscape of US-based crypto funds.

Unpacking the $150 Million ETH Stake

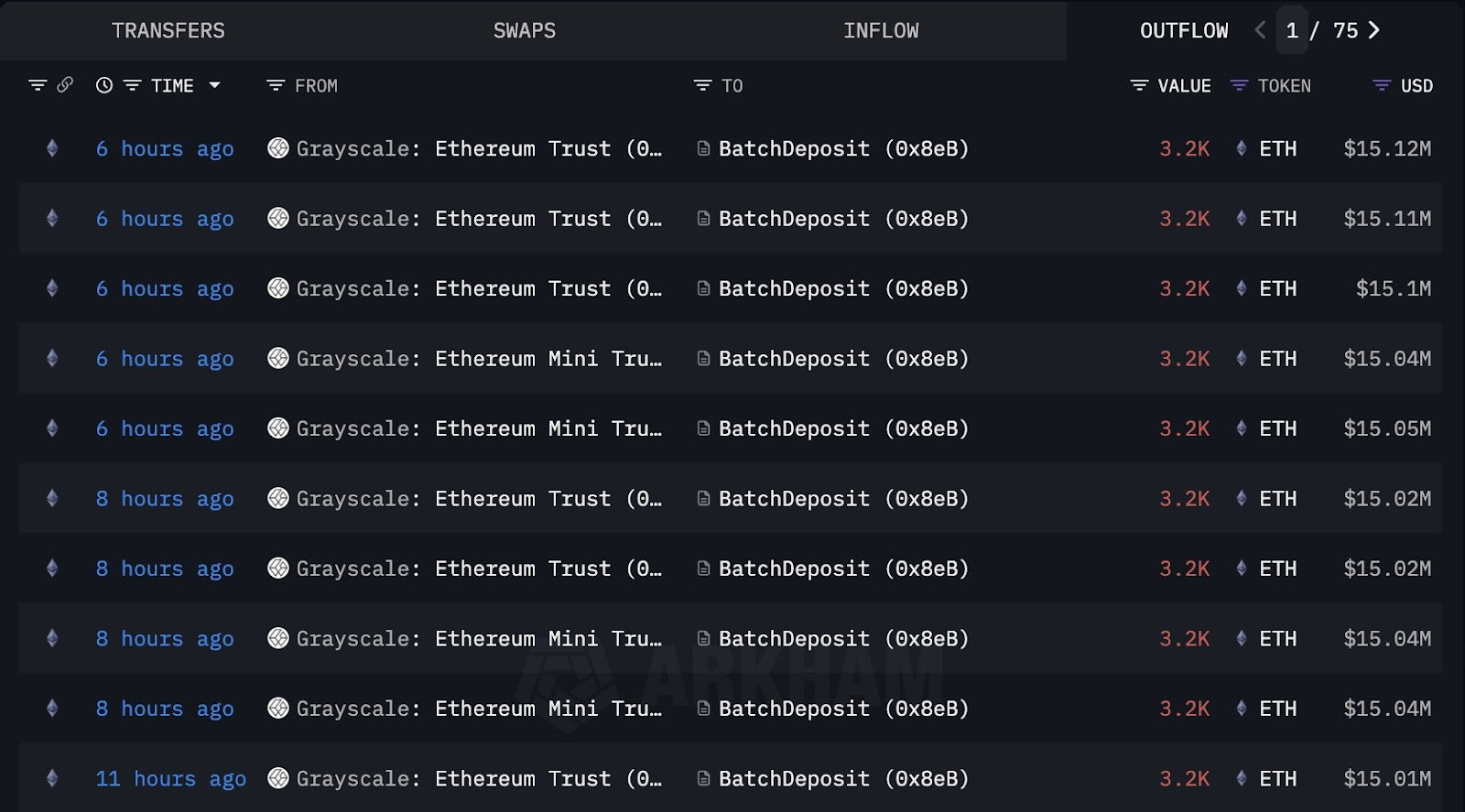

According to blockchain data, Grayscale has staked approximately 32,000 ETH. The move enables Grayscale’s ETPs and their shareholders to generate passive income via staking rewards. These rewards will be integrated into the “assets of the fund,” and shareholders stand to receive a significant portion of the generated staking rewards, post-deduction of sponsor and custodian fees. For those invested in Grayscale’s Ethereum Trust, shareholders can expect up to 77% of the staking rewards, and a more attractive 94% for the Ethereum Mini Trust, based on the disclosed fee structures.

The ETP vs. ETF Distinction and SEC Timelines

It’s crucial to understand the regulatory structure under which these products operate. Both Grayscale’s Ethereum Trust ETF (ETHE) and the Grayscale Ethereum Mini Trust ETF (ETH) are exchange-traded products registered under the Securities Act of 1933, differentiating them from traditional ETFs governed by the Investment Company Act of 1940. This structural difference has implications for how these products are regulated and how they can operate, including the ability to offer staking rewards.

October: A Critical Month for Crypto ETF Decisions

The SEC has a busy schedule with deadlines approaching for numerous altcoin ETP applications, with October being a pivotal month. This includes filings from 21Shares and BlackRock, among others. These firms are seeking to include staking rewards within their respective ETPs. The potential for regulatory approval and subsequent market adoption will be interesting to watch. The ongoing government shutdown could potentially affect the SEC’s timelines.

Staking‘s Growing Role in Crypto Funds

Grayscale’s move is not an isolated incident. The REX-Osprey Solana Staking ETF launched earlier in July, as the first Solana (SOL) staking ETF under the Investment Company Act of 1940. Meanwhile, Grayscale‘s Solana Trust (GSOL) has also enabled staking and is awaiting regulatory approval. This trend underscores the increasing importance of staking rewards in attracting investors and providing a more diverse investment strategy.

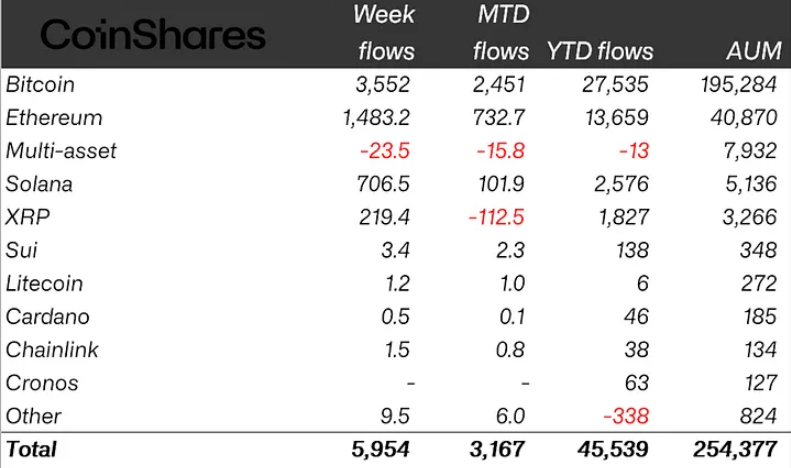

The crypto ETP space saw its highest-ever inflows last week, reaching $5.95 billion, suggesting rising investor appetite. While the government shutdown could introduce uncertainty, the inherent benefits of staking, like generating yield, and the potential for increased rewards could further boost demand. The long-term impact of this shift towards staking in crypto funds remains to be seen, but it clearly signals a new chapter in the evolution of crypto investment products.