Seismic Shift in Japanese Crypto Regulation

Japan‘s Financial Services Agency (FSA) is proposing a transformative reclassification of cryptocurrencies, signaling a significant shift in the country’s approach to digital assets. This initiative, unveiled this week, aims to redefine crypto as “financial products” under the Financial Instruments and Exchange Act (FIEA). This move holds profound implications for the future of crypto investment in Japan, potentially unlocking opportunities for exchange-traded funds (ETFs) and reshaping the existing tax framework.

ETF Launch and Tax Implications

The most immediate consequence of this reclassification is the potential green light for crypto ETFs. This would allow Japanese investors to gain exposure to digital assets through a regulated and familiar investment vehicle. Further fueling investor interest is the proposal to alter the current progressive tax system. The FSA is looking to implement a flat 20% tax on crypto gains, mirroring the treatment of stocks. This uniform tax rate could significantly boost the attractiveness of crypto investing for both retail and institutional players by simplifying tax obligations and potentially increasing after-tax returns. Currently, crypto gains are taxed at rates as high as 55%, making Japan’s proposed change particularly appealing.

Driving Institutional Adoption and Market Growth

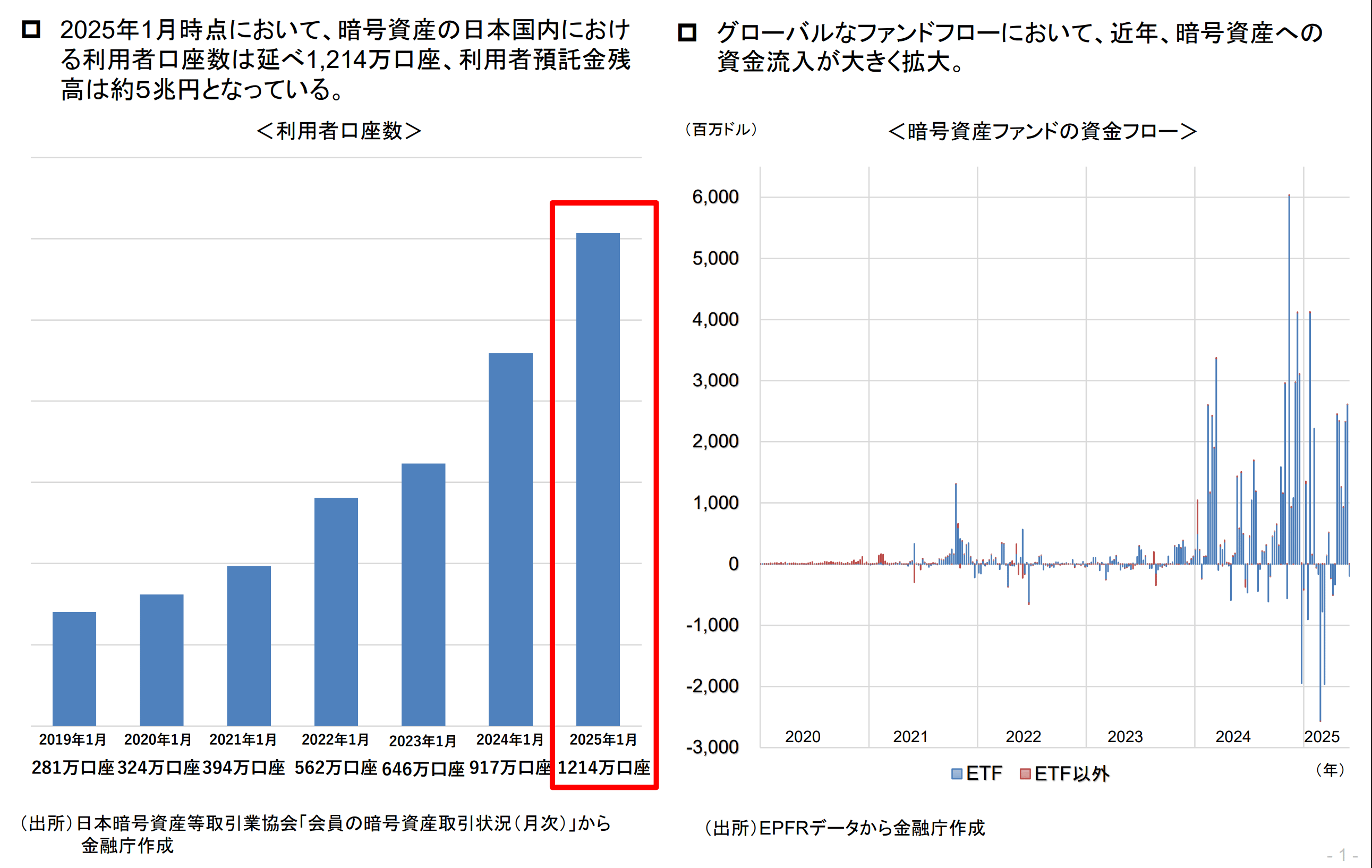

The reclassification of crypto as financial products is aligned with Japan‘s broader “New Capitalism” strategy, designed to bolster the country’s economy through investment. This aligns with the growing trend of institutional engagement with digital assets worldwide. The FSA’s proposal highlights that over 1,200 financial institutions, including prominent players like Goldman Sachs and US pension funds, are already embracing US-listed spot Bitcoin ETFs. Japanese regulators appear keen to support similar developments domestically, recognizing the expanding global interest in crypto ETFs.

Rising Crypto Adoption in Japan

The timing of this regulatory shift coincides with a demonstrable surge in crypto adoption within Japan. According to the FSA, over 12 million domestic crypto accounts were active as of January 2025, with assets held on platforms exceeding 5 trillion Japanese yen (approximately $34 billion). This growing participation has also surpassed participation in some traditional financial products, indicating a shift in investor preferences, especially among tech-savvy retail investors. This growing user base and the increasing market capitalization offer a fertile ground for expanded crypto-based investment products.

Stablecoins and Future Developments

The move toward stablecoins also highlights Japan’s proactive approach. Partnerships, such as the collaboration between Sumitomo Mitsui Financial Group (SMBC), TIS Inc., Ava Labs and Fireblocks, further solidify this trend. These initiatives aim to facilitate the commercialization of stablecoins pegged to both the US dollar and Japanese yen, setting the stage for settlement of tokenized real-world assets. The government has already granted licenses to handle stablecoins, underscoring its commitment to fostering a robust and regulated digital asset ecosystem. These strategic moves position Japan to become a major player in the evolving global crypto landscape, attracting both domestic and international investors eager to participate in this dynamic market.