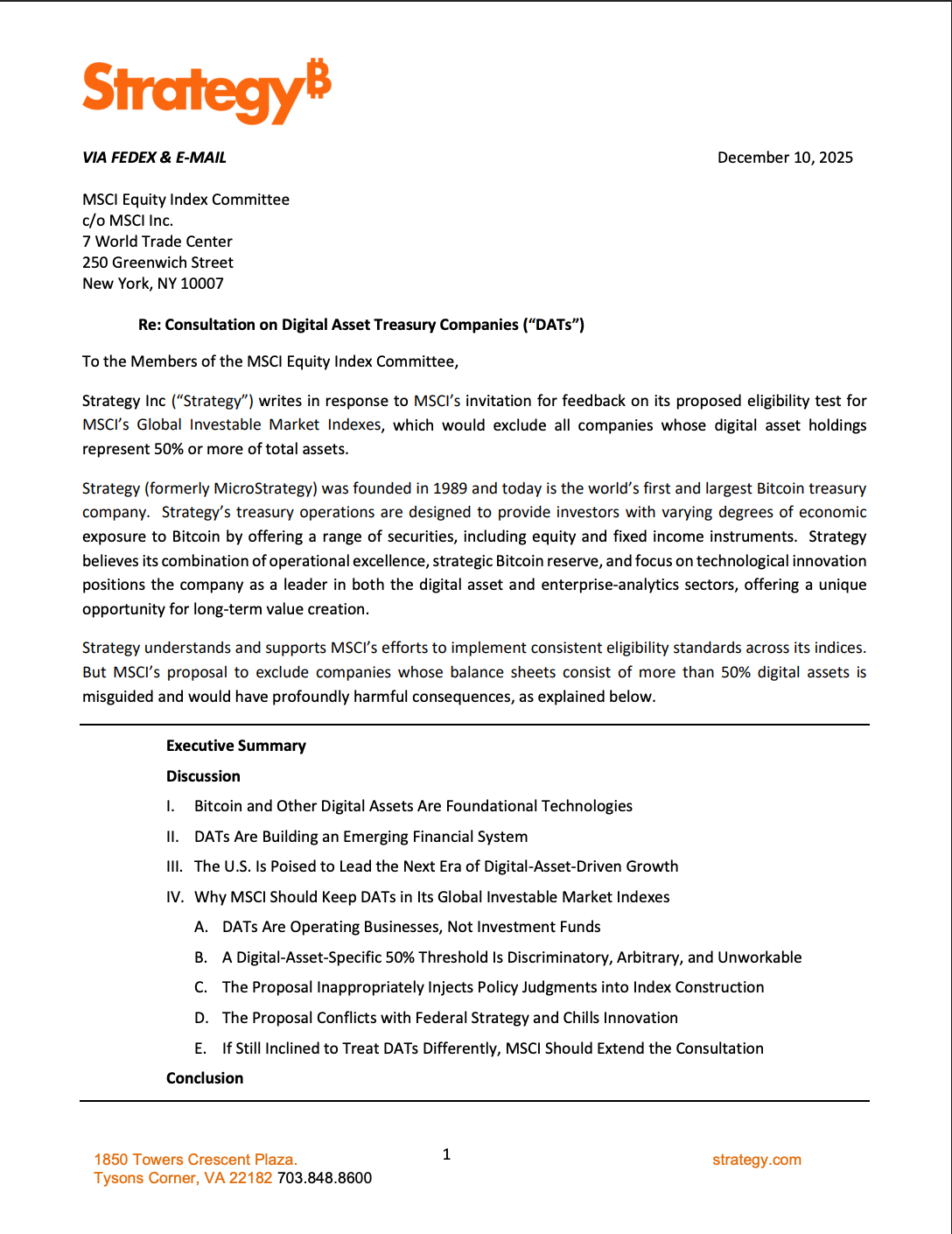

Strategy Responds to MSCI‘s Proposed Crypto Exclusion

MicroStrategy, a prominent Bitcoin treasury company, has fired back at MSCI, a leading index provider, over a proposed policy change that could exclude firms holding significant Bitcoin on their balance sheets from stock market indexes. The crux of MicroStrategy‘s argument, detailed in a formal response to MSCI, centers on what it views as discriminatory treatment compared to other asset-heavy companies.

The Core of the Dispute: Fair Representation

At the heart of MicroStrategy‘s pushback is the assertion that MSCI‘s proposed rules unfairly single out digital asset treasury companies. The company argues that the criteria, which would exclude firms holding 50% or more of their assets in crypto, unfairly targets Bitcoin-focused entities while allowing the inclusion of companies heavily invested in other single asset classes, like real estate investment trusts (REITs) or oil companies. This perceived inconsistency has led MicroStrategy to accuse MSCI of potentially biasing the index against crypto as an asset class, instead of acting as a neutral arbiter.

MicroStrategy‘s Counter-Arguments and Broader Implications

The letter highlights that many financial institutions primarily hold specific asset types, then package and sell derivatives backed by those assets, drawing parallels to the existing financial landscape. Further, the company suggests that the proposed policy could undermine the US’s goal of becoming a global leader in the crypto space. MicroStrategy‘s argument also implicitly acknowledges the criticisms leveled against the inclusion of crypto treasury companies in indexes. However, the company is fighting for a fair representation of their assets.

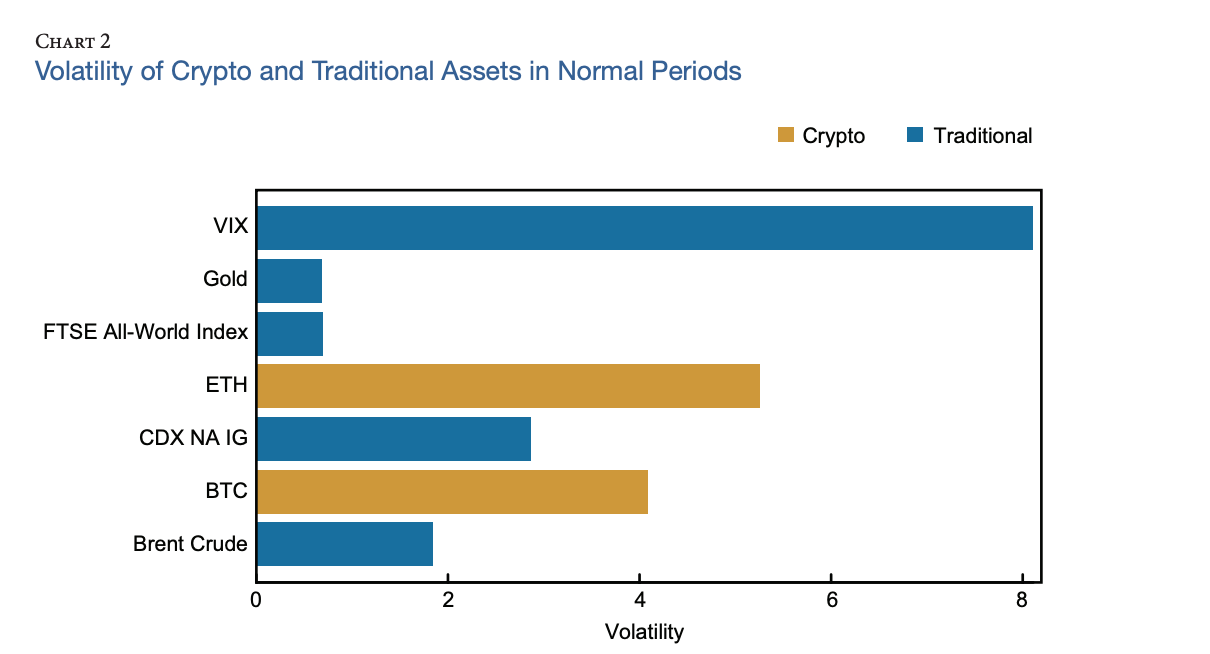

MSCI‘s concerns regarding the inclusion of these companies include potential systemic risks stemming from crypto treasury companies, the lack of standardized valuation methods for cryptocurrencies, and the heightened volatility associated with digital assets. The inherent volatility of Bitcoin, coupled with the potential for leveraged trading, further complicates the issue. The company, as of writing, holds a substantial 660,624 BTC on its balance sheet. The value of this holdings is a subject of concern given the recent stock performance and the volatility of bitcoin itself.

The implications of MSCI‘s policy change extend beyond individual company valuations. It could potentially trigger a divestment of crypto holdings by affected companies seeking to maintain index eligibility, thereby creating additional selling pressure in the digital asset markets. This situation underscores the broader challenges of integrating crypto assets into traditional financial indexes and the ongoing debate surrounding their appropriate valuation and risk assessment. The Federal Reserve has also acknowledged the impact of this volatility. Ultimately, the outcome of this dispute could have significant ramifications for the future of Bitcoin and other digital assets within the broader financial ecosystem.