Missouri on the Verge of a Crypto Tax Haven

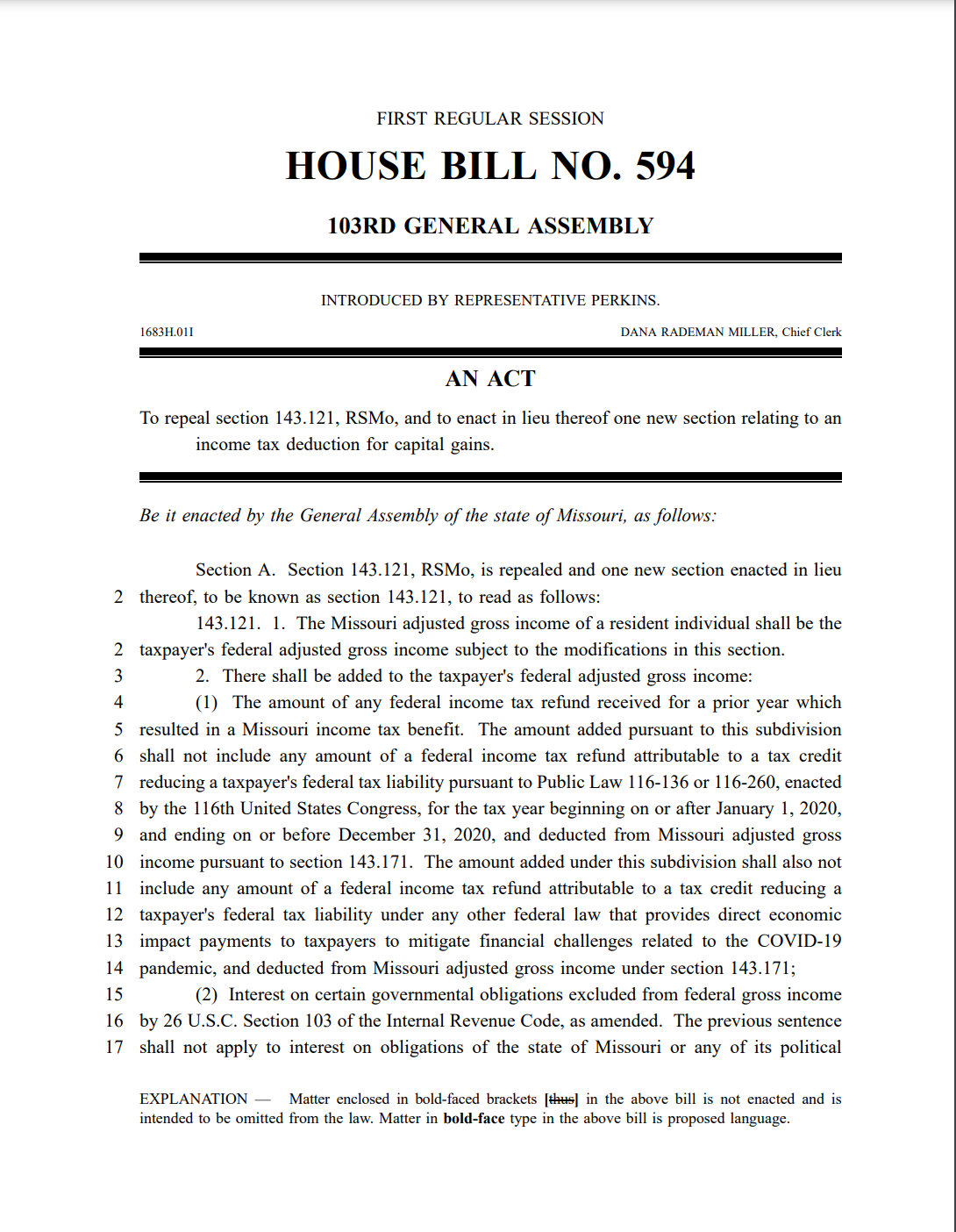

The crypto world is buzzing with excitement as Missouri House Bill 594, a bill that would abolish capital gains tax in the state, inches closer to becoming law. Having passed a vote in the Missouri House of Representatives, it now awaits Governor Mike Kehoe’s signature. If signed, Missouri could become a prime destination for crypto investors seeking tax advantages, potentially attracting a wave of capital and boosting the state’s economy.

A Unique Approach to Tax Exemption

The bill’s mechanism is unique, offering a 100% income tax deduction for any capital gains income. Attorney Aaron Brogan, who has been closely following the bill’s progress, explained that the Missouri tax code doesn’t explicitly differentiate between capital gains and income tax. This unique loophole, according to Brogan, creates a precedent unseen elsewhere.

“The most natural comparison is the state and local tax (SALT) deduction that the federal government offers – where the Internal Revenue Code (IRC) permits individuals to deduct a certain amount of tax paid in state and local taxes. This is the inverse, which I have never seen before.” – Aaron Brogan

A Timely Proposal Amidst Tax Reform

This bill’s timing is particularly significant. It arrives on the heels of proposals from US President Donald Trump to revamp the country’s income tax system. Trump’s plan, which involves potentially eliminating federal income tax and replacing it with revenue from import tariffs, has been met with mixed reactions. Critics argue that the tariffs could hurt the economy, while supporters believe they will boost domestic manufacturing and create jobs.

While the impact of Trump’s plan remains uncertain, Missouri‘s potential move to eliminate capital gains tax could attract investors seeking tax havens and further fuel the debate surrounding tax reform.

The Potential Impact on the Crypto Industry

The potential impact of Missouri‘s bill on the crypto industry is significant. Crypto investors could be incentivized to relocate their operations to the state, bringing with them investment capital, jobs, and economic growth. This move could also contribute to a broader trend of states becoming more crypto-friendly, potentially leading to a more favorable regulatory environment for the industry across the US.

However, the bill’s passage is not guaranteed. Governor Kehoe’s stance on the bill remains unknown, and there are potential hurdles that could arise during the legislative process. It remains to be seen whether Missouri will truly embrace its crypto potential, but the bill’s progress has certainly sparked a lot of interest and discussion within the crypto community.