Monero‘s Privacy-Focused Rally: A Response to Rising Scrutiny

Monero (XMR), the privacy-centric cryptocurrency, has recently reached a new all-time high, propelled by a confluence of factors. This surge isn’t merely a market anomaly; it’s a reflection of growing anxieties regarding digital privacy and the increasingly stringent regulatory landscape governing the crypto space. As governments worldwide tighten Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, investors are increasingly turning to assets that offer enhanced confidentiality.

The Regulatory Tailwinds and Investor Sentiment

The tightening grip of regulators is undeniably a significant driver. The European Union’s impending ban on privacy coins and anonymous crypto accounts, slated for 2027, underscores the global trend of increased scrutiny. This regulatory pressure, ironically, is fueling demand for coins like Monero. Investors, wary of the rising “surveillance” within the digital economy, are seeking financial confidentiality, making XMR an appealing option. This isn’t just about avoiding taxes; it’s about protecting one’s financial footprint in an increasingly transparent world.

Understanding Monero‘s Fundamentals

Monero‘s architecture is specifically designed to provide privacy. Utilizing technologies like ring signatures, stealth addresses, and confidential transactions, Monero obscures transaction details, making it difficult to trace the sender, receiver, and amount transacted. This core functionality is what differentiates it from many other cryptocurrencies that offer a lower degree of privacy. However, it’s worth noting that even with these sophisticated techniques, no system is entirely impenetrable, and the ongoing development and improvement of privacy protocols are crucial.

Navigating the Privacy Coin Landscape: Beyond Monero

While Monero currently leads the charge, the privacy coin sector is not without its competitors. Zcash (ZEC), another prominent privacy coin, has also experienced significant volatility. Its recent performance highlights the risks associated with such investments, including slowing development activity and internal governance disputes. Investors considering privacy coins should conduct thorough research and consider the development teams, technology, and market dynamics of each project.

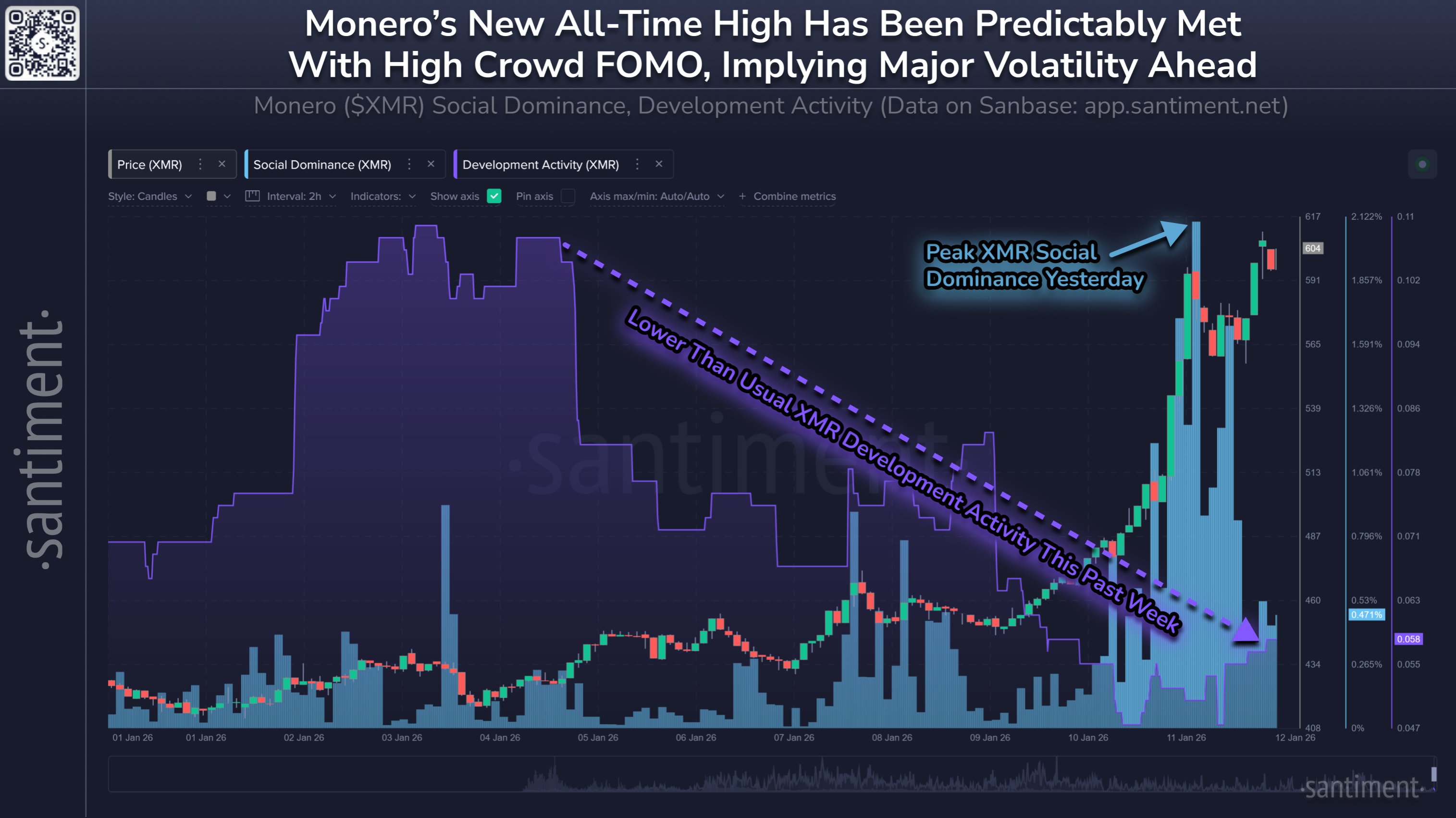

Despite the bullish price action, potential investors should approach with caution. Crypto data platforms are warning about potential overheating in XMR investor sentiment. The falling development activity since January, alongside peak social media dominance, suggest that the current price surge might not be sustainable. It is essential to remember that even as demand for privacy coins grows, these assets face significant regulatory hurdles. The future of Monero and its counterparts will depend on their ability to navigate this complex environment while continuing to innovate and meet the evolving needs of privacy-conscious users.