Nigeria‘s Bold Step into the Stablecoin Arena

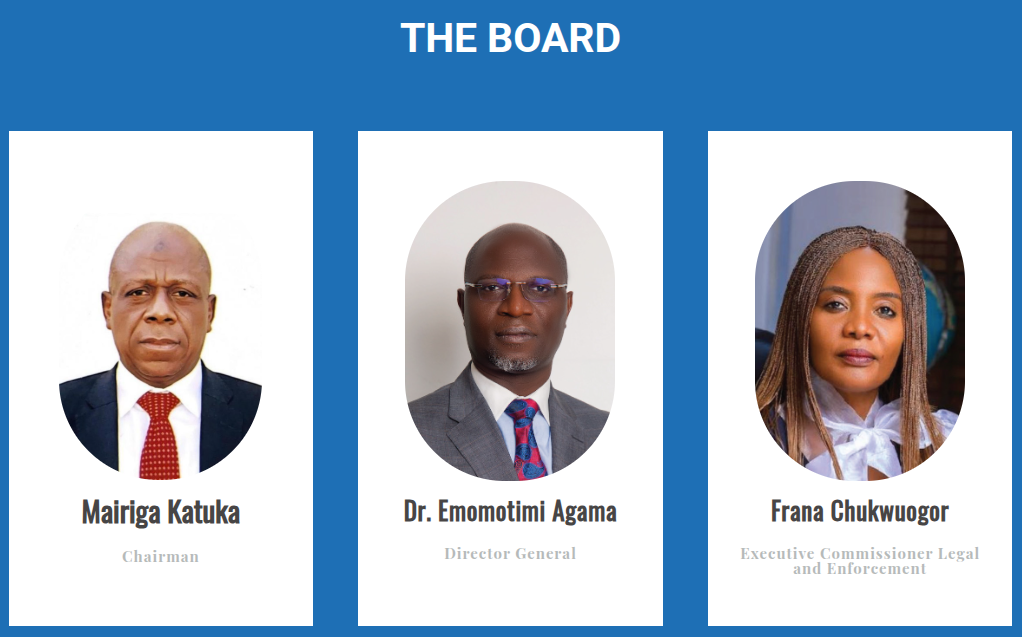

The Nigerian Securities and Exchange Commission (SEC) is signaling a significant shift in its approach to digital assets. Director-General Emomotimi Agama recently announced that the country is now open to stablecoin businesses, provided they comply with local regulations. This move represents a considerable change from previous stances and highlights Nigeria‘s ambition to become a key player in the evolving global financial landscape. The initiative aims to harness the potential of stablecoins while mitigating associated risks.

Regulatory Sandbox and Compliance: The Keys to Entry

Agama emphasized that Nigeria welcomes stablecoin businesses that adhere to the established regulatory framework. Companies that comply are not only welcome, but some have already been onboarded through the SEC’s regulatory sandbox. This proactive approach allows the SEC to monitor and guide the development of stablecoin applications within a controlled environment. Crucially, the regulatory focus will be on protecting the Nigerian market and empowering its citizens.

A Clear Framework for Crypto: A Welcomed Shift

This development aligns with the recent efforts of Nigerian authorities to establish a clear regulatory framework for the broader cryptocurrency industry. This shift has already encouraged increased investment and activity within the country. Blockchain.com, for example, has announced plans to establish a physical office in Nigeria, citing it as their “fastest-growing market” in West Africa. This signifies a growing confidence in the Nigerian market and its potential for crypto adoption.

Navigating the Complexities: Past Challenges and Future Prospects

Nigeria‘s journey with crypto has not been without its hurdles. The government has grappled with defining sensible crypto policies, as evidenced by the recent legal disputes with Binance. However, despite these challenges, certain officials now see the potential of blockchain technology and other digital assets for driving economic growth. The Minister of Information, Mohammed Idris, has acknowledged their growing importance, emphasizing their increasing centrality in how Nigerians conduct transactions and build businesses.

Looking Ahead: The Future of Finance in Africa

The SEC’s commitment to regulating stablecoins is viewed as essential for Nigeria‘s financial development. By embracing stablecoins and fostering a regulatory environment, Nigeria is positioning itself as a leader in Africa’s financial revolution. As Agama stated at the Nigeria stablecoin summit, this move could mark a pivotal moment, moving the nation from potential to action. This proactive approach to regulation could serve as a model for other African nations, paving the way for greater financial inclusion and innovation across the continent.