A New Era of Financial Data: Pyth Network Challenges the Status Quo

The world of financial data is undergoing a significant shift, and Pyth Network, a high-speed blockchain oracle developed by Douro Labs, is at the forefront of this disruption. Michael James, the head of institutional business development at Douro Labs, revealed at Consensus 2025 that Pyth is shaking up the $50 billion industry that provides critical price information to exchanges, brokerages, trading firms, and other institutional entities.

Traditionally, this market has been dominated by a handful of major providers who have held a monopoly on financial data. These companies have enjoyed significant pricing power, charging exorbitant fees for their services. This lack of competition has stifled innovation and prevented smaller players from entering the market.

Pyth’s Disruptive Approach: On-Demand Data and Lower Costs

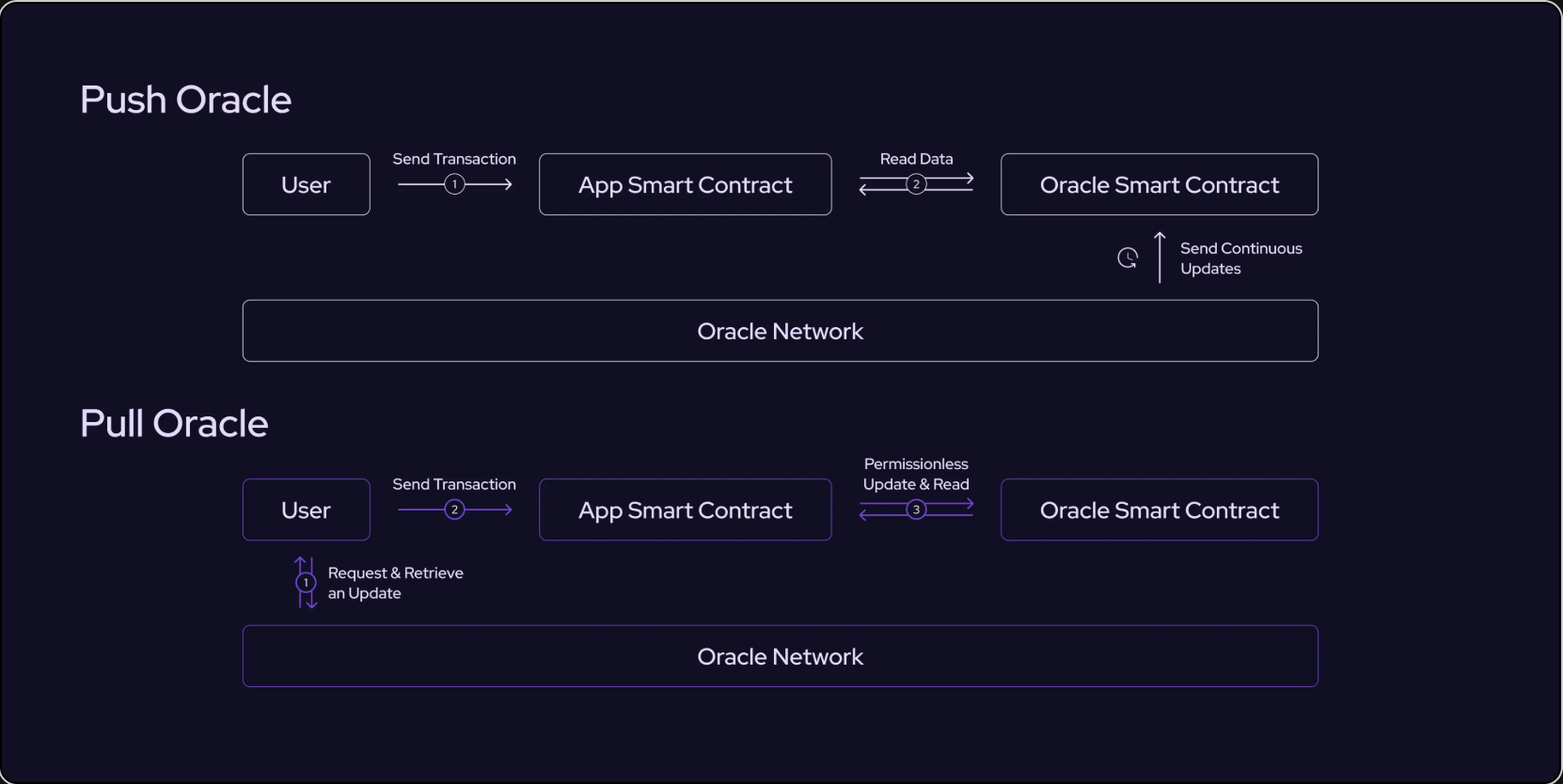

Pyth Network‘s unique data pull model stands in stark contrast to the traditional push models employed by established players. With Pyth, clients only pay for the data they need, when they need it. This on-demand model reduces costs significantly for institutions that rely heavily on real-time market data.

James highlighted the impact of this disruptive approach: “These data vendors have no competition in traditional finance, and so they have all the pricing power in the world. There is no substitutability; whether you are a banker or hedge fund and you are trading more or less—you still have to buy that data for compliance reasons.” This high cost barrier has prevented smaller businesses from entering the financial services industry, further concentrating the sector in the hands of a few large players.

Pyth’s Growth and Impact: Expanding Beyond Crypto

Pyth Network has experienced impressive growth in 2024, expanding its reach beyond cryptocurrencies to include real-time price feeds for equities, FOREX, commodities, and rates. In December 2024, Pyth made headlines by launching real-time oil pricing data on over 80 blockchain networks, tracking data from WTI and Brent Crude Oil. This move opens up new possibilities for energy derivatives instruments and energy trading on blockchain platforms.

The network’s total value secured (TVS) has grown 46-fold throughout 2024, signifying the increasing trust and confidence in Pyth. According to DeFiLlama, Pyth currently holds roughly 11.3% of the blockchain oracle market, showcasing its significant impact on the space.

The rise of Pyth Network represents a significant shift in the financial data landscape. By providing on-demand data at lower costs, Pyth is empowering smaller players and fostering innovation. This disruption has the potential to democratize access to financial information and create a more competitive and dynamic financial ecosystem.