Tokenization: A Gateway to Investment Accessibility

Tokenization, the process of representing real-world assets digitally, has emerged as a powerful tool to revolutionize financial markets. According to Johann Kerbrat, Senior Vice President and General Manager of Robinhood Crypto, this technology has the potential to unlock new opportunities for retail investors, making traditionally restricted asset classes more accessible.

Speaking at the Consensus 2025 event in Toronto, Kerbrat emphasized the importance of tokenization for "financial inclusion." He pointed out that assets like real estate and private equity are currently available only to a select few, often requiring accreditation and substantial wealth. "You need to be an accredited investor to invest in private equity right now," he explained. "How many people can afford a house or an apartment in New York? But you can get a piece of it with fractionalization, through tokenization. And so we think it makes it a lot easier to be exchanged, a lot more accessible for everybody."

Robinhood Joins the RWA Tokenization Movement

Robinhood is among several investment firms and brokerages exploring the potential of tokenizing real-world assets (RWAs). Other prominent players include BlackRock, Franklin Templeton, Apollo, and VanEck. While still in its early stages, RWA tokenization holds the promise of enhancing financial accessibility, with a significant portion of tokenized funds currently focused on private credit and US treasury markets.

According to RWA.xyz, as of May 16th, the total market capitalization of onchain RWAs reached $22.5 billion, distributed across 101,457 asset holders. The average holder owns $221,867 in onchain assets, showcasing the potential of this market to reach a broader audience.

The Rise of Specialized Stablecoins

Beyond tokenized assets, Kerbrat also touched upon the evolving landscape of stablecoins, a key crypto use case. He predicted a future where we see "100 stablecoins" catering to specific market needs.

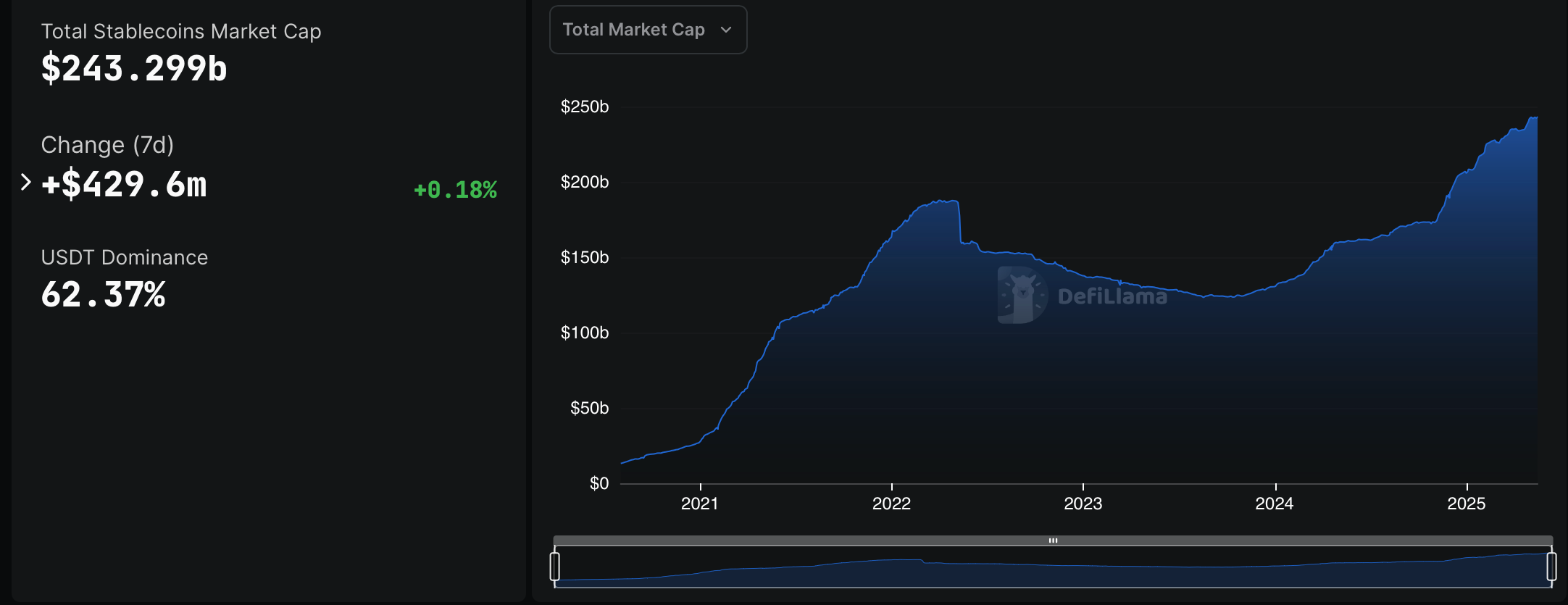

Currently, dollar-pegged stablecoins dominate the sector, with USDT (Tether) and USDC (Circle) accounting for the vast majority of the $243.3 billion stablecoin market cap. However, Kerbrat envisions a future where stablecoins become more specialized, adapting to regional or transactional requirements. "If you’re trying to move funds from the US to Singapore, maybe you will use a specific stablecoin," he suggested. "The shift is going to go from just stablecoin to platforms that are managing all these stablecoins."

This trend aligns with observations made by Dea Markova, Fireblocks’ Policy Chief, who highlighted the growing demand for non-dollar-pegged stablecoins. The potential for a diverse stablecoin ecosystem, catering to various needs and regions, could further enhance financial accessibility and interoperability within the crypto space.