GMX V1 Targeted: A Blow to Decentralized Derivatives

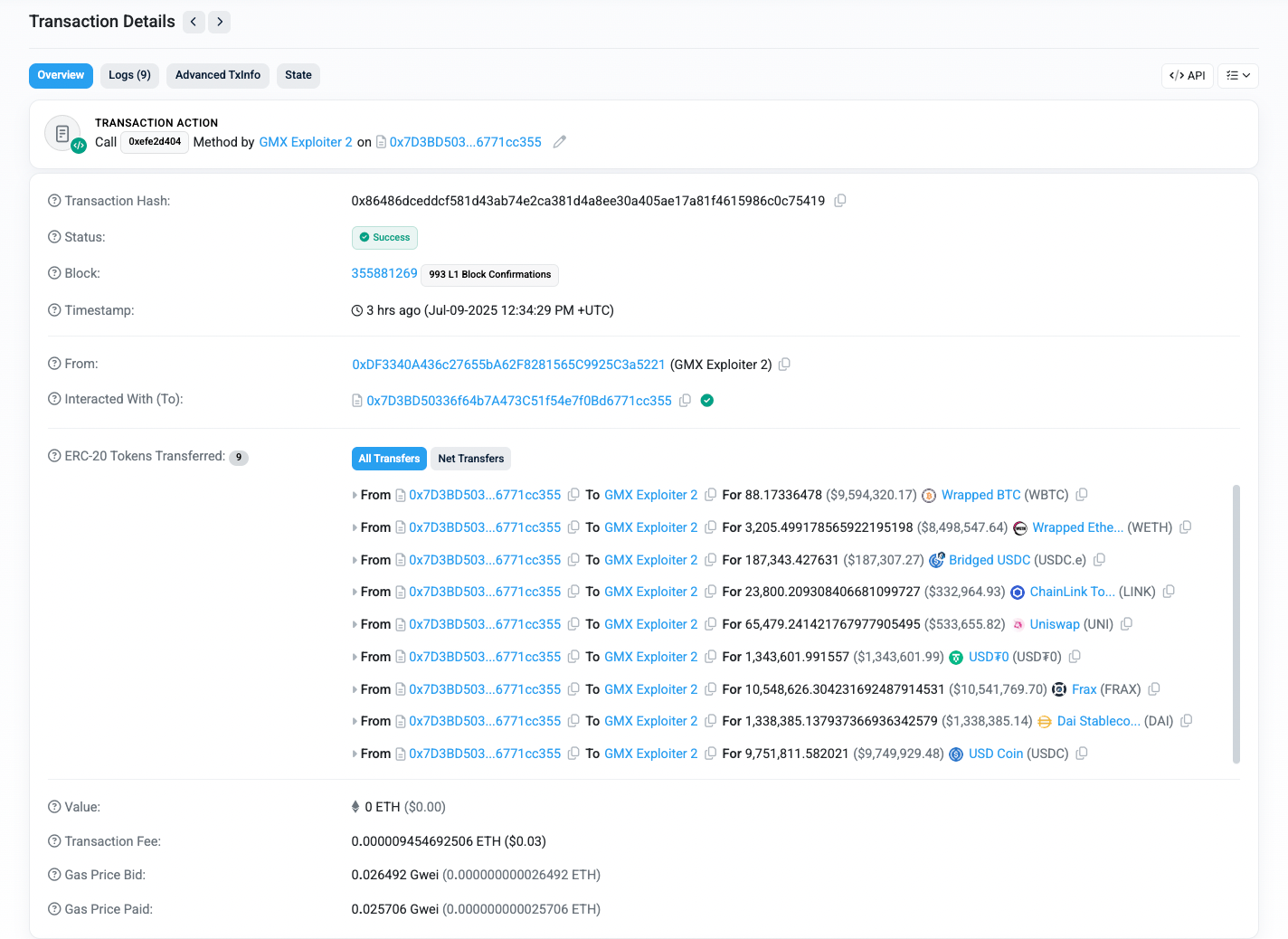

The decentralized perpetual exchange GMX has been hit by a significant exploit, forcing the platform to take drastic measures. Following the attack, which resulted in approximately $40 million in stolen funds, GMX halted trading on its V1 platform and suspended the minting and redemption of GLP tokens across both Arbitrum and Avalanche networks. This incident underscores the ongoing cybersecurity challenges that plague the cryptocurrency space, even within established protocols.

The Anatomy of the Attack

The vulnerability, according to the GMX team and blockchain security firm SlowMist, stemmed from a design flaw within the GMX V1 version. This flaw allowed attackers to manipulate the price of GLP tokens, which represent the liquidity provider’s stake in the protocol, through the manipulation of the total assets under management calculation. The exploited pool, designed to provide liquidity for trading on GMX, included a basket of digital assets like Bitcoin (BTC), Ether (ETH), and stablecoins.

Impact and Response

The immediate response involved halting trading and GLP minting to mitigate further losses. Users were advised to disable leverage and adjust their settings to prevent further GLP minting. The GMX team quickly clarified that the exploit did not impact GMX V2, its markets, or liquidity pools, nor did it affect the GMX token itself, aiming to reassure users and minimize wider market repercussions.

The Broader Context of Crypto Exploits

This latest incident reinforces the vulnerability of the cryptocurrency ecosystem to cyberattacks. The crypto industry has seen numerous hacks and exploits, resulting in billions of dollars in losses. These attacks range from sophisticated phishing scams to exploits targeting smart contract vulnerabilities. The constant threat of cybercrime significantly impacts investor confidence and hampers broader adoption of digital assets. This includes the Bybit hack, Nobitex hack, and North Korean attacks. The United States Treasury’s Office of Foreign Assets Control (OFAC) announced sanctions on Song Kum Hyok.

Looking Ahead: Security Measures and Future Implications

The GMX team has focused on isolating the damage and protecting user funds. The event will likely prompt a renewed focus on security audits, rigorous testing, and the implementation of more robust security protocols across decentralized finance (DeFi) platforms. Such events serve as a learning opportunity, prompting improvements in security practices and risk management within the crypto space. This will be an ongoing battle with ever evolving threat actors and tactics.