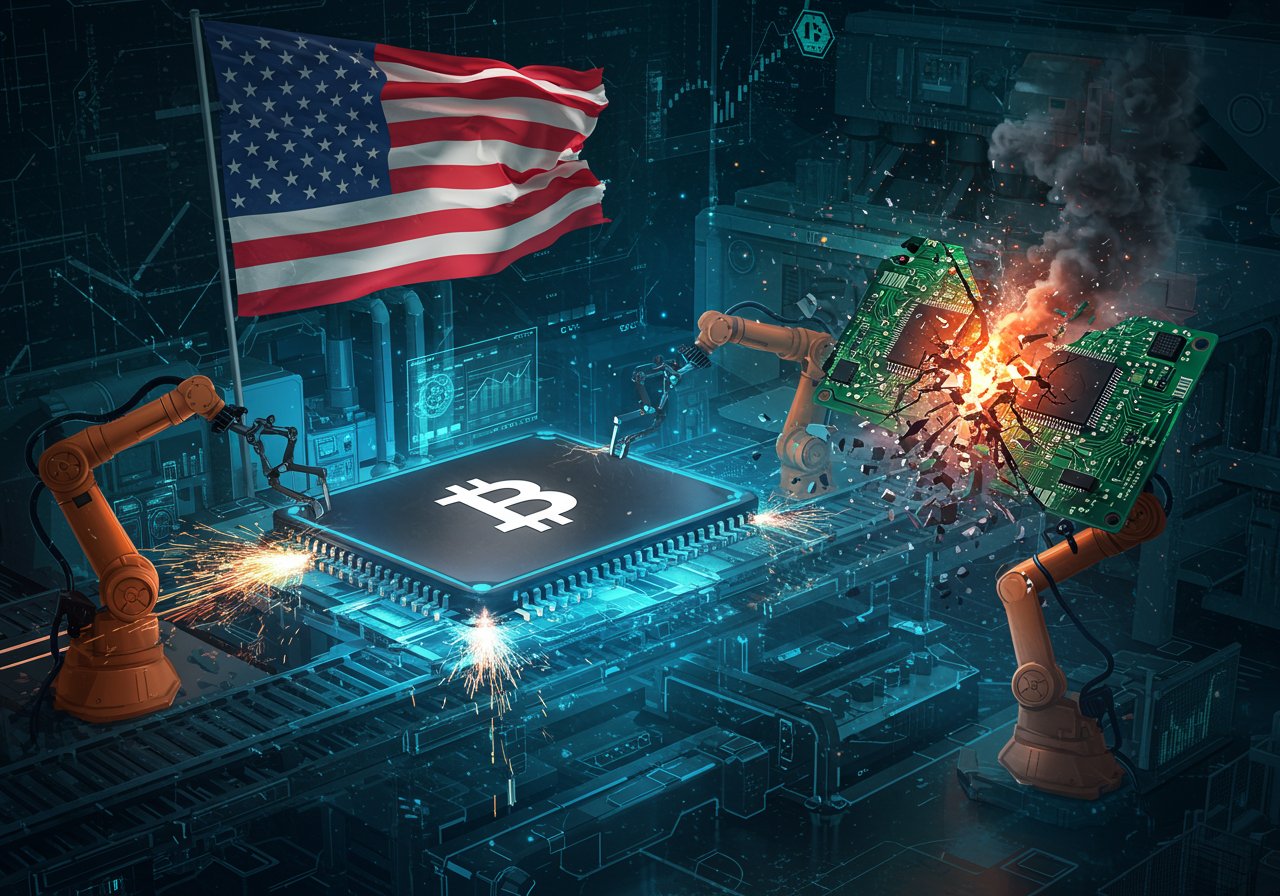

Canaan‘s Strategic Shift: US Production and AI Departure

In a significant move for the Bitcoin mining landscape, ASIC manufacturer Canaan has announced the completion of a pilot production run in the United States. This initiative marks a strategic shift, mirroring its operations previously based in Malaysia. Concurrently, Canaan has decided to discontinue its AI semiconductor business, signaling a sharpened focus on its core strength: Bitcoin mining infrastructure.

Why the US? Geopolitical Considerations and Long-Term Resilience

The decision to establish a US production base is multifaceted. While production costs are reportedly higher in the US, Canaan views this as more than just a response to tariffs. The company acknowledges the existing 10% tariff on products manufactured in Malaysia, and the murkiness surrounding tariffs on imported components creates planning difficulties. This US expansion is, in the company’s view, a strategic investment in long-term resilience, offering potential benefits such as improved delivery cycles and faster response to local demand.

Navigating Tariffs and Building a Robust Future

Canaan‘s approach extends beyond simply hedging against trade barriers. The company is actively focused on cost optimization within the US to ensure commercial viability. This involves navigating a complex environment of customer demand, and the ever-evolving tariff regulations. The ultimate success of US production will depend on this combination of cost management, market need and a clear understanding of any regulatory shifts.

Focus on Bitcoin Mining: The Path Forward

Chairman and CEO of Canaan, Nangeng Zhang, emphasizes that doubling down on core crypto infrastructure and Bitcoin mining is the most strategic path forward for the company. This is a logical move, given the current competitive environment. While Canaan currently controls 2.1% of the Bitcoin mining ASIC market, securing a stable US production base could give them a strategic advantage. This realignment potentially allows Canaan to focus its resources and expertise where it believes the greatest opportunities lie.

Industry Trends and Regulatory Scrutiny

Canaan’s move aligns with broader trends in the Bitcoin mining industry. Recently, reports suggest that other major ASIC producers like Bitmain and MicroBT are also establishing or expanding their presence in the US. However, the industry is facing heightened regulatory scrutiny. This includes concerns about national security standards. Canaan has addressed these by ensuring devices shipped to the US are compliant with relevant local authority certifications.

Looking Ahead: Compliance and Optimization

Canaan‘s commitment to compliance underscores the increasing importance of operating within the regulatory framework. As the company potentially expands US production further, aligning with evolving US standards is a key priority. This will be an important factor as they aim to achieve commercial viability while managing costs. The US expansion will likely depend on market dynamics and Canaan‘s ability to navigate this complex landscape.